WTI capped by supply return as Brent holds a geopolitical premium

The crude market is entering a phase where the word “oil” is no longer enough. A meaningful divergence is emerging between U.S. linked pricing and global pricing, and the driver is not demand. It is geopolitics, sanctions mechanics and the geography of supply.

WTI and Brent are now reacting to different macro realities.

WTI is increasingly shaped by the possibility of incremental supply flowing into the U.S. system through Venezuela related channels and reshuffled custody of barrels. Brent, instead, continues to carry the premium of global risk, where Middle East instability, Iran related tension and shipping uncertainties remain active.

This is not a generic energy rally. It is a pricing split, and the spread between benchmarks is becoming a key market signal.

Venezuela adds complexity to US supply dynamics

Venezuela has reentered the crude narrative not as a normal producer, but as a geopolitical instrument. U.S. intervention and sanction enforcement actions are altering how Venezuelan barrels can be marketed, routed and monetized.

The key point is not simply whether Venezuela produces more. The near term issue is the direction of flows.

If Venezuelan crude becomes more accessible to the U.S. refining system, even indirectly, it shifts the balance of marginal supply inside North America. That does not automatically crash prices, but it caps upside pressure on WTI during periods when global risk should normally lift all crude benchmarks together.

In other words, Venezuela’s return does not need to be large in volume to matter. It only needs to change the marginal barrel.

Brent remains the benchmark that prices global stress

Brent responds to different forces. It prices what WTI often cannot fully absorb, namely geopolitical risk in the global supply chain.

Any escalation involving Iran, broader Middle East instability, or shipping disruptions across key corridors feeds directly into Brent’s premium. Even when supply is not physically interrupted, the market must price optionality and tail risk.

This is why Brent can stay firm even while WTI looks heavy.

The market is not pricing shortages. It is pricing uncertainty about control, routes and timing.

That uncertainty does not hit WTI equally because WTI is increasingly anchored to U.S. balance conditions, where supply can be buffered more efficiently through domestic output and logistics.

The spread becomes the real story

In early 2026 the most informative signal may not be WTI alone or Brent alone, but the relationship between the two.

When Brent outperforms WTI, it usually indicates that global stress dominates local fundamentals.

When WTI catches up, it usually indicates either demand strength or broad risk on supply.

Today the market sits in the first regime. Brent holds a premium because the global system feels fragile, while WTI absorbs the possibility of supply normalization and reintegration.

That is why the oil market is not moving as one block. It is fragmenting by geography.

Technical structure confirms the premium is holding but momentum is cooling

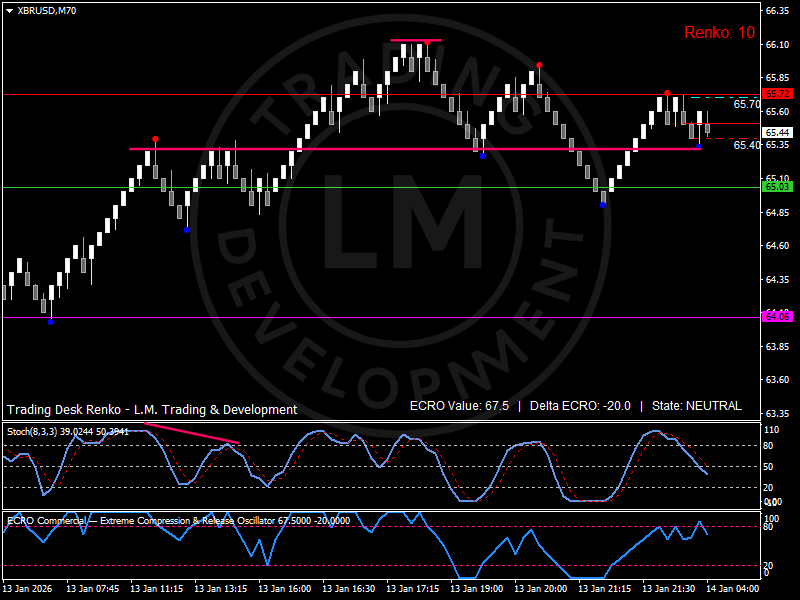

The Renko structure of XBRUSD captures the market’s current posture with clarity.

Brent continues to defend the 65.40 zone, which acts as a central structural pivot across multiple rotations. Price has rebounded repeatedly from this level, suggesting the market still treats it as value, not as a breakdown threshold.

At the same time, the 65.70 area stands out as a resistance ceiling where upside attempts repeatedly slow. This creates the shape of a controlled range, not exhaustion, where buyers remain active but require new catalysts to push higher.

The lower support structure remains near 64.05, a deeper floor that would signal a meaningful reduction in geopolitical premium if broken decisively. As long as this base holds, the market is not unwinding risk. It is simply digesting it.

Momentum indicators support this interpretation. The oscillator sequence shows cooling momentum after the last rebound, consistent with stabilization rather than reversal. This is what a geopolitical premium often looks like in price action, supported structurally but not accelerating without fresh events.

Why this regime matters for traders

This divergence matters because it changes how oil should be traded.

If an investor treats crude as a single instrument, the signals become confusing. Headlines that should push prices higher may not move WTI much, because supply dynamics dilute the reaction. Meanwhile Brent may remain supported, because global risk does not disappear even when barrels are available.

This creates a market where trading oil requires understanding which benchmark is pricing which factor.

WTI is increasingly a function of U.S. supply balance and flow custody. Brent is a function of global risk, route security and geopolitical escalation potential.

That structural split defines the early 2026 environment.

Outlook: Brent may stay firmer than WTI unless risk fades

Looking ahead, the base case is continued two track pricing.

If Venezuelan supply routes become smoother, WTI upside remains capped. If the market perceives that U.S. custody over barrels reduces uncertainty, the effect becomes even stronger.

Brent, however, is unlikely to fully unwind its premium unless the market sees clear de escalation in the Middle East risk complex, a reduction in sanction enforcement uncertainty, and smoother global shipping conditions.

In practical terms, that means Brent could remain stable inside a bullish structure while WTI remains more reactive and more capped.

The next decisive move would likely require either a global escalation, pushing Brent above 65.70 and toward higher zones, or a genuine collapse of risk premium, which would pull Brent toward the 64.05 region.

Until then, oil remains a split market.

Conclusion

Oil is no longer moving as a single commodity responding to inflation narratives or growth expectations. It is fragmenting into benchmarks that price different realities.

WTI reflects the evolving nature of U.S. supply dynamics and the possibility of incremental barrels returning through Venezuela linked mechanisms. Brent reflects global geopolitical premium, shipping risk and the market’s need to price uncertainty even without direct supply disruption.

This is why the spread has become the signal. Oil is not just about demand and barrels. It is about custody, routes and geopolitical control.

As 2026 begins, the crude market is pricing a world where supply is abundant, but access and stability are not guaranteed.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.