With intensifying Russia-Ukraine tensions, cybersecurity industry poses a unique opportunity

In February, shares of cybersecurity software companies soared as tensions between Russia and Ukraine worsened. Fortinet (FTNT), Zscaler (ZS), Palo Alto Networks (PANW), and CrowdStrike Holdings (CRWD) were among the top performers. The group is likely to continue outperforming as analysts forecast more spending on security-related services with businesses and governments preparing for cyber warfare. The First Trust NASDAQ Cybersecurity ETF has gained 10.6% since February 23, the day before the Russian invasion, while the ETFMG Prime Cyber Security ETF has gained 9.5%.

With firms preparing for potential cyberattacks, investors have recently expressed a growing interest in the cybersecurity industry. In terms of cyber capabilities, the United States is thought to be the most powerful country in the world, and it continues to advance. In 2021, U.S. President Joe Biden's proposed budget included $9.8 billion for all civilian cybersecurity operations, with roughly half of that going to protecting and improving federal IT systems and networks. Florida Governor DeSantis also announced $20 million in funding on March 2, 2022, to build and improve cybersecurity and IT training opportunities. Cybersecurity stocks are likely to continue to outperform other software categories, with investors betting on increased demand for these products due to concerns over cyberattacks in Ukraine spilling over to other nations, as well as the government's efforts to strengthen IT systems and networks.

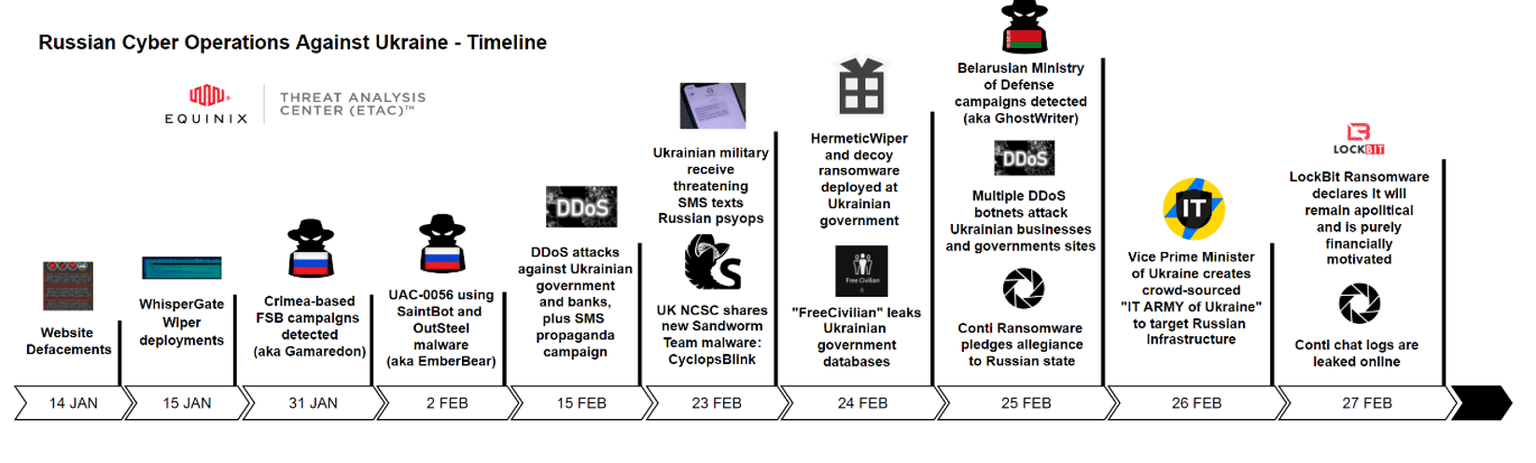

The Ukrainian crisis has erupted into a major conflict, and global corporations, particularly those in critical infrastructure groups, should brace themselves for increased risks. The U.S. Cybersecurity and Infrastructure Security Agency (CISA), the FBI, and the Department of Homeland Security issued a warning last month about the risk of Russian cyberattacks spreading to U.S. networks. A cyber-attack on multiple Ukrainian governments and bank websites was claimed to have occurred a week before the war began. Over the first 48 hours following the invasion, suspected Russian-sourced cyber-attacks increased by more than 800%. The European Central Bank (ECB) has also warned European financial institutions of the risk of Russian cyberattacks due to sanctions.

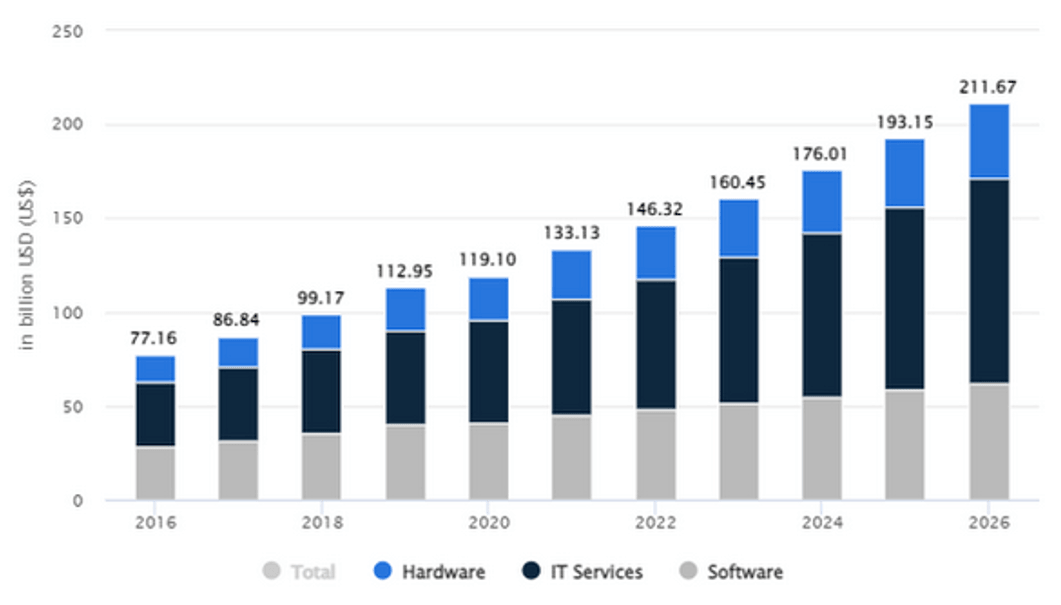

As more devices and computers become connected to the Internet, the requirement for cybersecurity will only increase. The cybersecurity sector consists of both software and technology that provides services to secure electronic data from theft, damage, or misuse. Due to remote work, the booming crypto industry, and third-party breaches, security will remain the top spending priority in 2022. According to Gartner, global cybersecurity spending increased 13% to $172 billion in 2021, up from 8% growth in 2020. Gartner predicts an 11% increase in cybersecurity investment in both 2022 and 2023, with firms investing $77 billion in security outsourcing in 2022.

The use of AI and machine learning will also drive market growth because AI is critical in the development of advanced, automated security systems and autonomous threat detection software. This technology allows analysis of large amounts of data at a much faster rate, which benefits both large companies dealing with massive amounts of data and small and mid-sized businesses with limited resources. The revenue in the cybersecurity market is expected to reach $146.3 billion in 2022, thanks to the rising demand for intelligent security software solutions, data protection, and cost-effective data management services.

The trend will benefit major players in this sector such as Palo Alto Networks (PANW), CrowdStrike (CRWD), and Fortinet (FTNT). Meanwhile, HUB Security (HUB: Tel Aviv), an Israeli computing solutions provider, is reinventing cyber security with quantum-powered confidential computing. Hub was founded in 2017 by veterans of the 8200 and 81 elite intelligence units of the Israeli Defense Forces. Hub Security specializes in cybersecurity solutions and is known for its holistic software data-in-use encryption solutions. Its hardware and anti-tampering solutions are key to both government and private sector companies. The company has secured multiple prestigious clients, including the Pentagon, HSBC Holdings (HSBC, Financial) and Boeing (BA, Financial). The Tel Aviv-based company is currently only traded in Israel, but it announced a special purpose acquisition company (SPAC) deal to become listed on the Nasdaq in early 2022, which was an expected next step following Hub's growth in revenues and notoriety during the previous year. Existing Hub shareholders expect that their position in the company, once restructured, will be greater than 75%. Leadership at Hub claims that the deal will help the company gain the necessary transparency and credibility to be considered in the Fortune 500 arena. Recent worldwide developments and the announcement of the SPAC deal have had a positive effect on the company’s share value, and the current consensus is that Hub stock is a "buy" or "strong-buy" given how undervalued it is and the likely hood of this valuation going up if the SPAC deal is completed.

Businesses will spend more on new and advanced technologies as cybercrime and possible threats evolve. Cybersecurity is more crucial than ever in terms of securing resources across several networks, as well as data protection and recovery. It is vital for businesses, particularly critical infrastructure suppliers, and its significance is growing as the Russia-Ukraine war escalates. The cybersecurity sector, therefore, seems well-positioned to deliver handsome returns to investors in the coming years.

Author

Ronald Kaufman

Independent Analyst

Ronald Kaufman a writer and blogger active in the fields of foodtech, pharma, cyber, biotech and more. Ronald writes for leading publications about a number of topics.