Will Japanese authorities intervene to stop the Yen’s bleeding?

- Takaichi’s dovish stance pushes yen off the cliff.

- December BoJ hike probability drops to 25%.

- FM Katayama says they are “alarmed” over yen’s fall.

- Intervention may fail to break dollar/yen uptrend.

Yen skydives as Takaichi emerges victorious

The yen has been the most wounded currency among the major ones since October 4, the day Sanae Takaichi was elected as the Liberal Democratic Party’s new leader, and subsequently Japan’s new prime minister.

Takaichi was known for her dovish fiscal and monetary policy views, with her plans and rhetoric after her election reinforcing market unease. She repeatedly called for the Bank of Japan to take into account wage growth when conducting monetary policy and not just cost-driven inflation, while she pledged to proceed with a different fiscal approach than the existing one that has been targeting a budget surplus each year. Her new plans include evaluating the nation’s fiscal health over a multi-year horizon to allow for more spending.

BoJ rate hike bets pushed back into summer 2026

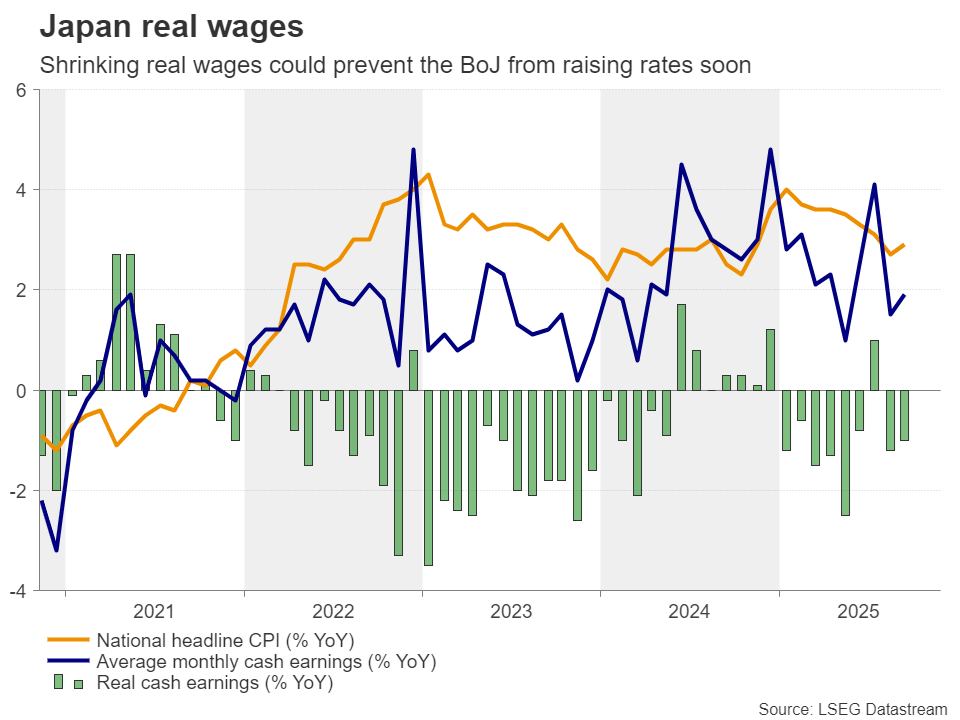

Taking all that into account, investors pushed back their BoJ rate hike bets and from assigning a strong likelihood of a 25bps rate hike in December, they are now giving only a 25% chance. A quarter-point increase is fully priced in June, after the conclusion of the spring wage negotiations.

Although the BoJ remained willing to continue raising interest rates at its latest gathering, and although inflation remains sticky – with the Tokyo CPIs pointing to acceleration in October – investors are not convinced that a hike could be looming. After all, recent data revealed that the Japanese economy contracted 0.4% q/q in Q3, driving the annual rate to -1.8%, while real wages shrank for the second consecutive month in September.

Yen’s fall triggers intervention warnings

All this backstory leaves the yen vulnerable to further decline, but an uptrend continuation in dollar/yen may not be the safest bet currently as the quick devaluation of the Japanese currency has raised eyebrows, with Japan’s new finance minister Satsuki Katayama being very vocal lately in expressing concerns about the yen’s price movements. “As we have recently been seeing one-sided, rapid moves in the foreign exchange market, we have been alarmed,” Katayama noted after dollar/yen surpassed the 155.00 zone.

Although Japanese officials have repeatedly noted that they are monitoring the pace of the declines and not a specific exchange rate level, history has shown that warnings intensify when dollar/yen approaches levels that are considered psychological, and actions have been taken around such levels.

But why are steep yen declines unwanted? A weaker yen could eventually benefit the nation’s exports, but it could lead to higher import costs and thereby fuel already sticky inflation. This could upset even more households and retailers.

Will intervention have the desired effect?

The last time Japanese authorities intervened was back in July last year, when dollar/yen climbed above 160.00. The intervention happened on July 11, and 20 days later, the BoJ raised borrowing costs by 25bps, helping the yen gain nearly 15% by September 16. However, with the BoJ not expected to raise interest rates anytime soon, the story may be different this time around.

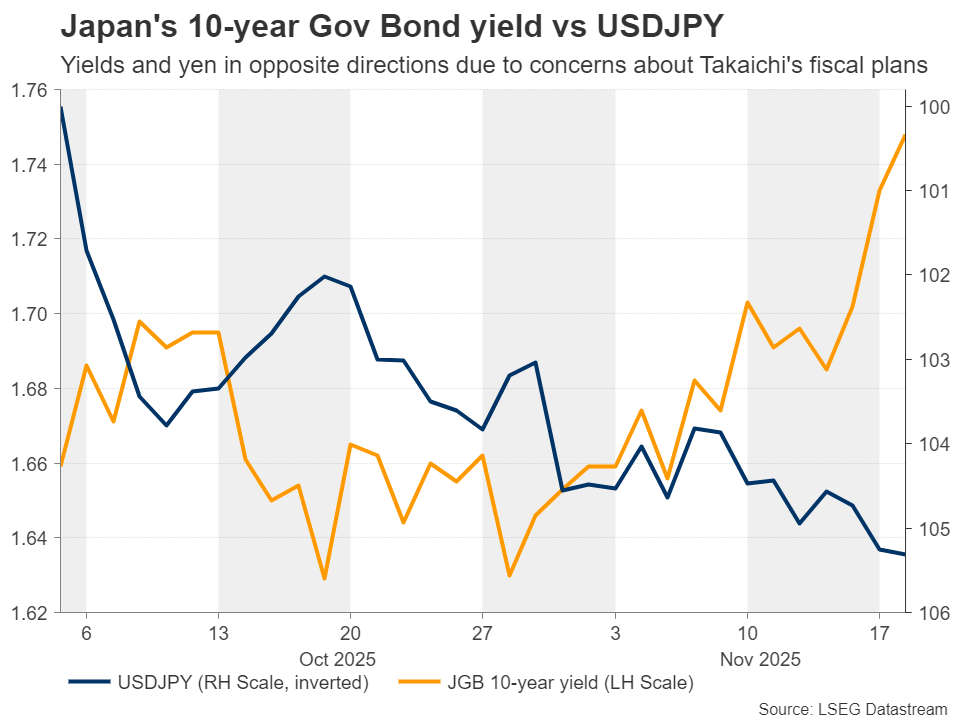

Even if intervention happens and the yen instantly strengthens, it may be a matter of time before it reverses course and resumes its downtrend. Japan’s government bond yields have been surging lately on concerns regarding massive fiscal spending under Takaichi’s leadership, which means financial conditions are tightening and thereby complicate the BoJ’s decision to raise interest rates in the foreseeable future. On top of that, the waning probability of a December rate cut by the Fed is also a positive driving force for dollar/yen.

Dollar/yen defies warnings and climbs higher

From a technical standpoint, dollar/yen has been on a steep upward trajectory since September, with the bulls staying strong and surpassing the 155.00 zone at the beginning of this week, despite the concerns expressed by Japanese officials about the decline in the yen.

It seems that buyers are willing to stay in the driver’s seat and perhaps aim for the high of January 23 at around 156.80. A break above that zone could aim for the peak of January 10 at 158.90. Even if authorities jump into the action to propel the yen higher, the pair may trigger buy orders from above the 153.25 zone and continue its prevailing uptrend.

For the outlook to start looking bearish, a decisive dip below 151.55 may be needed. The price will then be below the 50-day exponential moving average (EMA) and the bears may initially target the 200-day EMA at around 149.35. If there are no buyers to be found around there, the fall may extend towards the key zone of 146.60, which acted as a floor between August and October.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.