Why the ECB looks set to trim interest rates again and what does that mean

The European Central Bank (ECB) is widely expected to cut interest rates on Thursday for the fourth time this year. This is a significant achievement as it suggests that the ECB, which sets monetary policy in the Eurozone, is accelerating its path towards lower interest rates after an unprecedented increase.

Lower interest rates directly affect families and businesses in the Eurozone, a group of 20 countries in Europe that share the Euro (EUR) as a currency and one of the largest economic areas in the world.

The interest is the price to pay when borrowing money: bank loans, mortgages,...the amount of interest in all these ultimately depends on the level of the benchmark interest rates set by the ECB.

The ECB decides the level of interest rates independently, meaning that its decisions aren’t subject to approval by the European Commission or Parliament. Setting interest rates is one of the ECB’s most powerful tools: high rates can make borrowing money more expensive, while lower rates can make it cheaper and easier to get a loan approved.

What does an ECB rate cut mean and why is it important?

The interest rate is essentially what the bank charges for lending you money. While the ECB doesn’t directly set the interest rates charged by the bank, the level of its benchmark rates does influence them.

So, cutting interest rates lowers the cost of borrowing and thus encourages households and businesses to take on more debt. It also reduces the incentives to save money as banks are also likely to give less interest on the savings accounts they offer.

As previously said, the ECB is expected to deliver an interest rate cut for the fourth time this year after keeping rates at high levels for nine months.

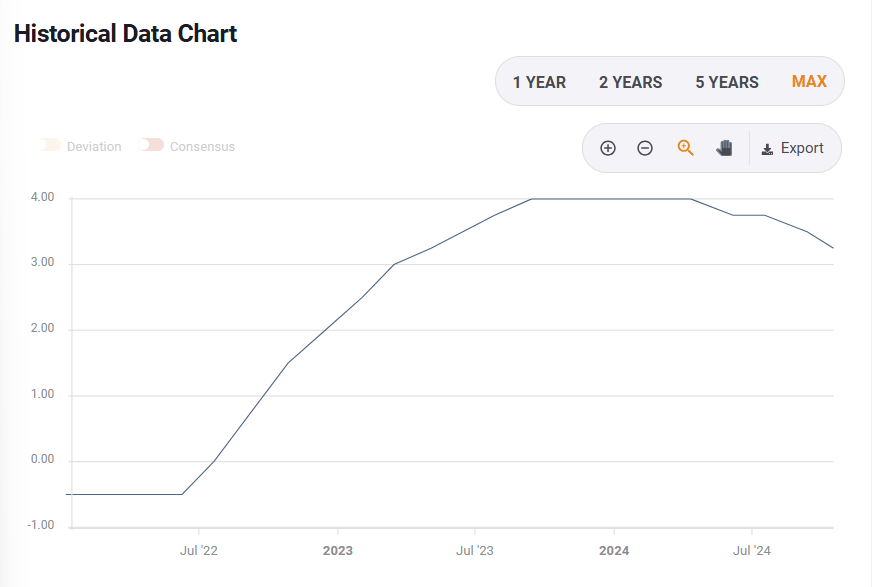

Evolution of the ECB deposit facility rate since 2022. Source: FXStreet.

Will the ECB cut interest rates on Thursday, and why?

Yes, or at least that is what the majority of economists think. The ECB already cut rates in June, September and October.

Inflation – or by how much prices are rising – is a key driver for the ECB’s actions. The central bank’s only mandate is to keep inflation under control close to its 2% target.

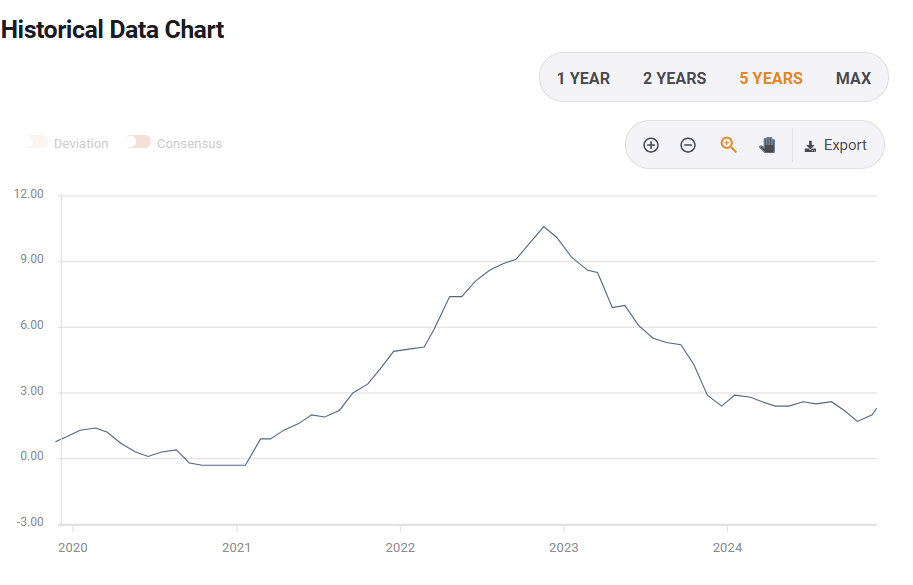

The sharp increase in interest rates from mid-2022 to mid-2023 was the response to fight the quick rise in prices that happened during the reopening of the Covid-19 pandemic and the surge in energy costs after Russia invaded Ukraine.

Having peaked at 10.6% in October 2022, inflation in the Eurozone stood at 2.3% in November, up from 2% in October but close to the ECB’s target. The recent uptick in inflation was widely expected by economists and it is considered a short-term blip rather than a genuine pickup in price pressures.

Evolution of inflation rate in the Eurozone since 2020. Source: FXStreet.

Another factor tilting the ECB towards another interest rate cut is increasing evidence that the economy in the Eurozone is getting more and more vulnerable to a downturn.

Recent survey data suggests that the Eurozone economy contracted in November, hinting at a potential downturn in the fourth quarter overall. A weakening demand environment, concerns over tariffs amid the changing United States (US) administration, and political uncertainty in France and Germany are weighing on the economic outlook.

"The medium-term economic outlook is uncertain and dominated by downside risks," ECB President Christine Lagarde said in a parliamentary hearing on December 4, Reuters reports. "Geopolitical risks are elevated, with growing threats to international trade," she added.

By cutting rates, the ECB can give a much-needed push to the Eurozone’s economy.

Lower rates can encourage thousands of people to take a mortgage or a loan to buy big-ticket items and pay less interest for it (and thus be able to spend this money somewhere else). The same applies to businesses, which can get cheaper funds to invest in expansion. This is why lower rates tend to help the economy grow.

By how much the ECB is expected to cut rates?

Most economists expect a cut of 25 basis points, or a quarter-percentage point.

The ECB has three key rates, and it tends to change them by the same magnitude.

The deposit facility rate, which is the key measure, is currently at 3.25% and it is expected to be lowered to 3%.

However, some economists say that a larger interest-rate cut of 50 basis points can’t be ruled out due to the rapidly deteriorating economic outlook.

"A 50 bp rate cut decision would nicely tie into the October motive of rate cuts as risk management and a strong signal that the ECB is seriously trying to get ahead of the curve," ING Global head of Macro Carsten Brzeski said in a note. "It would be a security move to preempt any potential risks for the eurozone economy coming from the next US administration's potential economic policy choices and political woes in France and Germany," added.

Will the ECB continue to cut rates further ahead?

Yes, or that’s what the majority of economists think.

ECB officials haven’t pre-committed to continue to lower interest rates, but the fact that inflation in the Eurozone seems under control and the recent deterioration of the economy make analysts believe that lower rates are coming.

“Our base case is also for 25 bps rate reductions at the next several meetings,” said economists at US bank Wells Fargo. Still, they also note the possibility of a larger, 50-basis-point cut “sometime during the early part of 2025” given the dimming economic outlook for the Eurozone.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

FXStreet Team

FXStreet