Why is gold not gaining on stagflation fears?

Gold has been touted as an inflation hedge and as a stagflationary play, so why are prices not soaring right now? You could be forgiven for asking this question as high inflation and slowing growth prints have been increasing over the last few weeks. On Monday, Chinese activity showed signs of slowing with industrial production well down at -2.9% vs 0.4% expected. In the US, Goldman Sachs lowered the US GDP growth forecast to 1.6% from 2.2%. The Bank of England signalled that the UK’s GDP would be negative in 2023, but inflation could peak at 10% this year.

So, why is gold not surging higher?

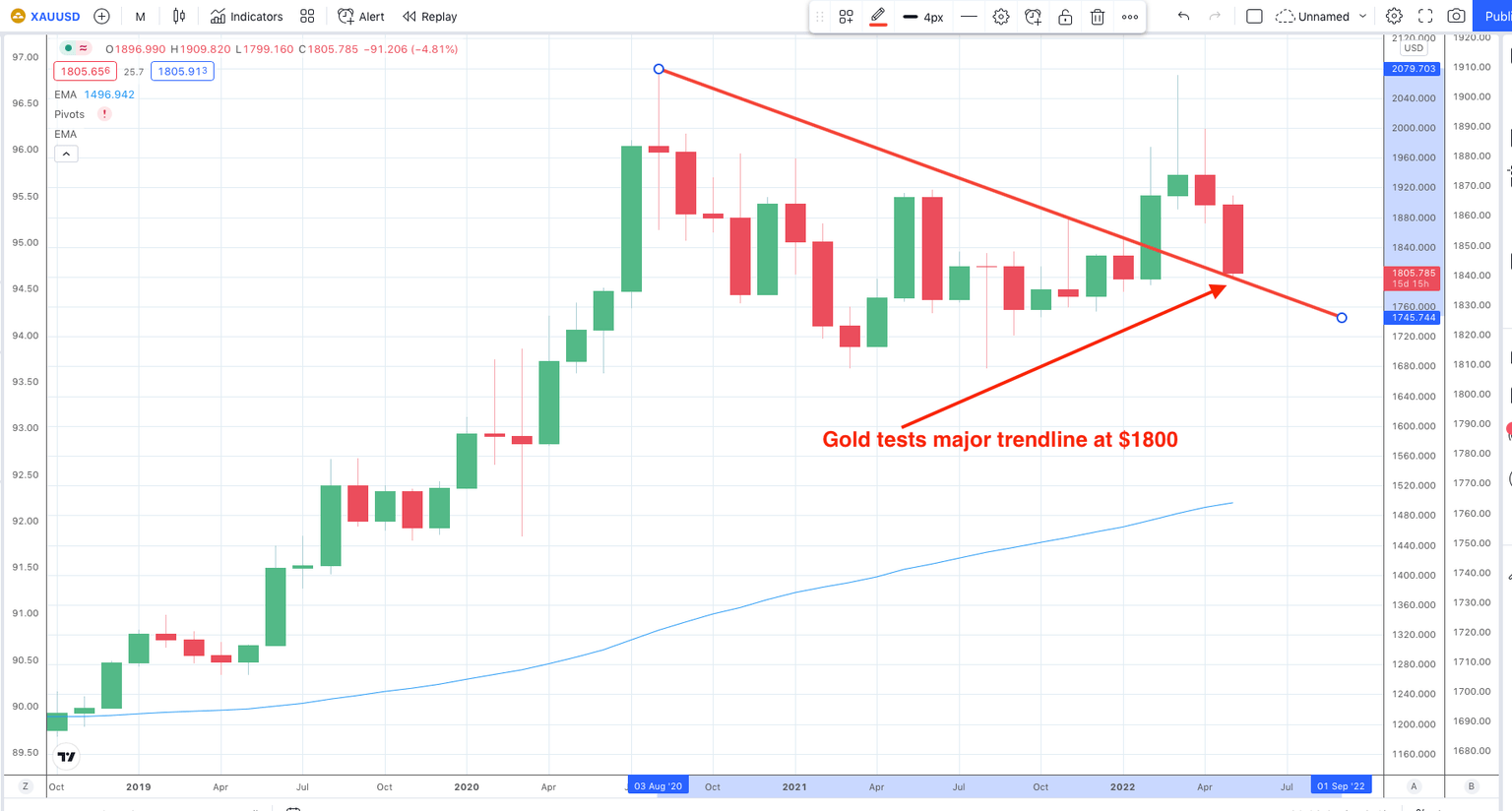

Gold is testing the major trend line lower marked on the monthly chart above around the $1800 region.

The reason for gold remaining pressured lower is due to the interplay between real yields and the USD. Now, many traders know that strength in the USD is a headwind for gold. This provides part of the reason for gold weakness. The USD index moved above 104 on both Fed’s monetary policy and signs of slowing global growth

Real yields are still elevated

Real yields are simply the US bond yield minus inflation expectations. So, if the nominal bond yield is 5%, but inflation is 6% then the real yields is -1%. When real yields fall, that lifts gold prices. So, real yields have pulled back a little, but they are still relatively elevated.

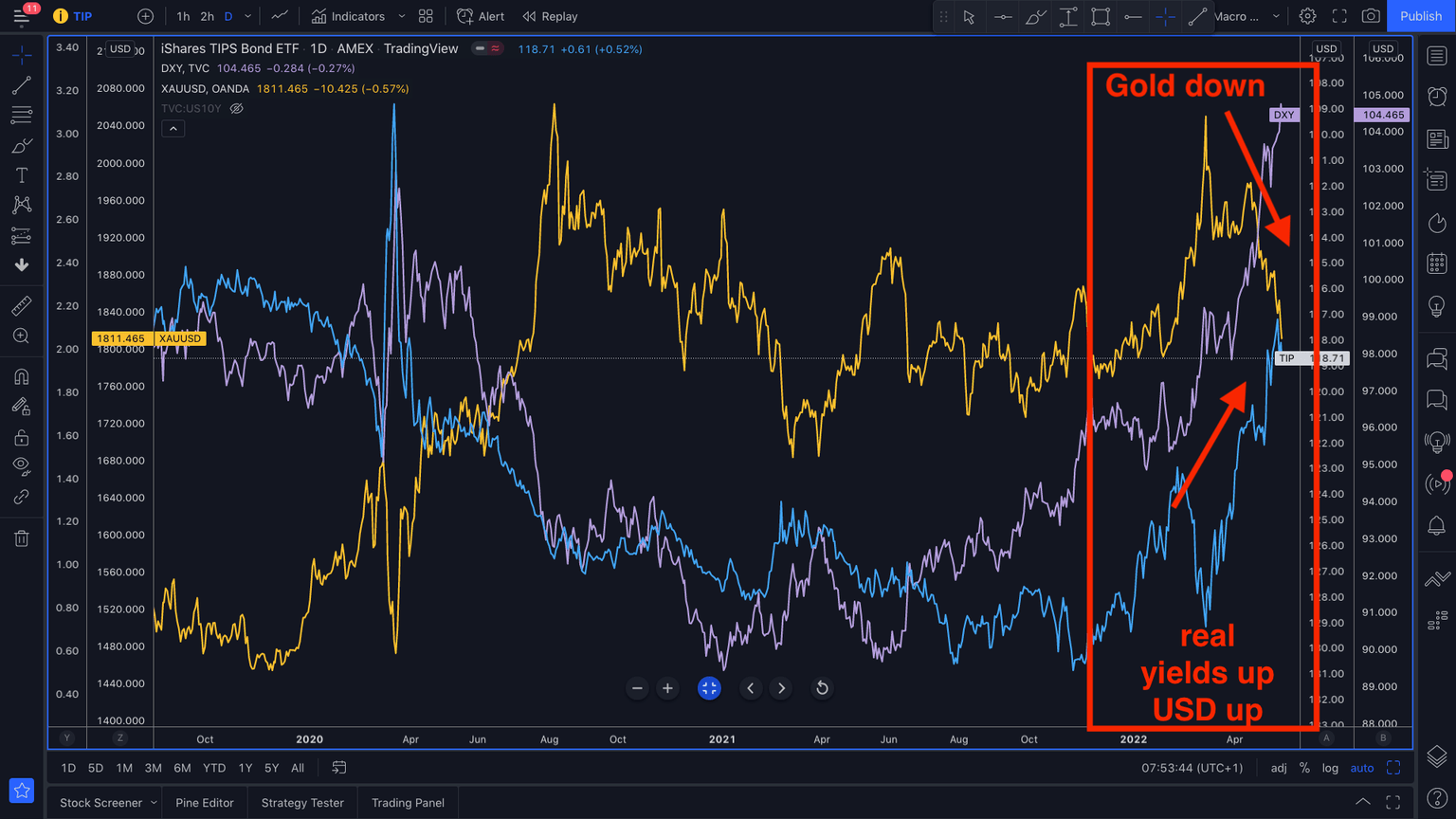

So, a strong USD and relatively elevated real yields are keeping gold prices pressured. Look at the chart below (Gold is in yellow, TIPS is in blue, and DXY is in Purple).

The secret sauce for gold upside

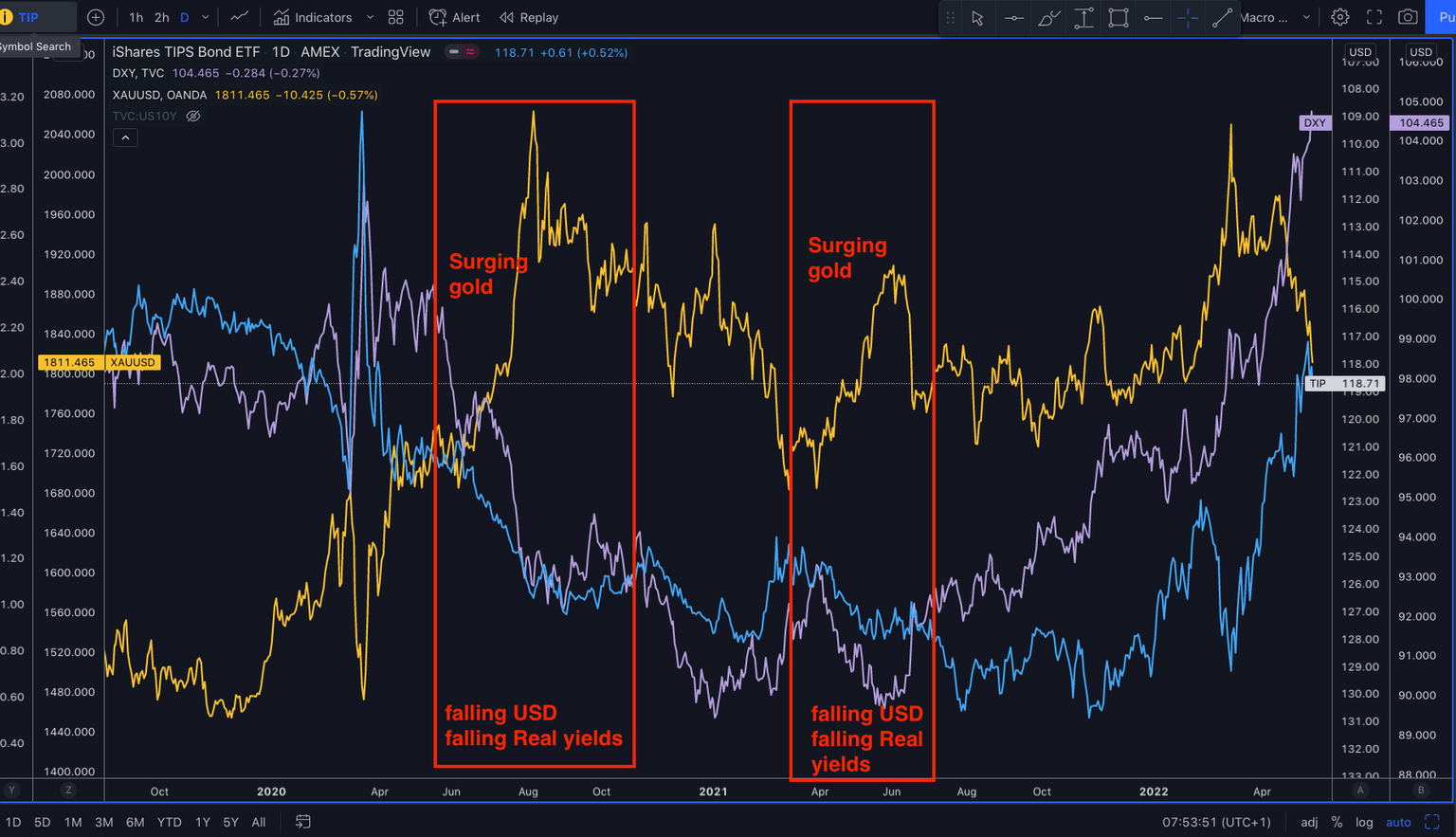

What gold buyers are looking for is the environment where real yields and the USD are both falling. When this happens, gold tends to gain extremely quickly! Look at the chart below where falling really yields and a falling USD sends gold surging higher. Please note that on this chart I use a TIPS ETF as a proxy for real yields as real yields are only updated once a day.

So the ‘secret sauce’ for trading gold is this at the moment:

-

Rising real yields, and rising USD = gold pressured.

-

Falling real yields, and falling USD = gold upside.

As long as this dynamic remains gold traders should pay attention to it.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.