What’s really going on with Australian inflation

A sharp drop in November inflation is encouraging thoughts of RBA easing by May, with more rate reductions by the end of the year. We think this is unlikely. Indeed, it is easier to make the case for further hikes.

Where we are right now

The November inflation release showed a further decline in the headline inflation rate to 4.3% YoY, a sharp drop from the 4.9% rate achieved in October and also a little lower than the consensus estimate of 4.4%. On the day, there was some weakness in the AUD as the market took the numbers as corroboration for their fairly entrenched view that the Reserve Bank of Australia has finished hiking rates and was well on the way to easing.

But we're not totally convinced. And we're going to outline why the inflation data isn't as good as it may look at first glance. In doing so, we will at least raise some doubt about the view that rates have peaked. We think they may have, but a residual upside risk still exists, which could also help support the Aussie dollar.

So, what happened in November?

We prefer to start any analysis of inflation from the perspective of the CPI index, how it's changing month-on-month, and only then what this means to the annual year-on-year inflation rate. That means that fluctuations in the price level a year ago are given a fair chance to affect the inflation rate but have little or no bearing on what the price level is doing now, and we can focus more on monthly fluctuations and their trend run-rate (in practice, the annualised 3m and 6m rates). That also gives us more of a forward look at what we may expect in the coming months.

The month-on-month rate for CPI in November came in at 0.33%. If that were repeated for 12 months, it would deliver just over 4% inflation. Fortunately, the trend is not quite so high. The 3m annualised rate is only 2.3%, but this incorporates the 0.33% MoM decline in October, which will drop out of the trend once January data is available and so will probably push higher again. The 6m annualised figure, which dilutes single-month spikes and dips more than the 3m trend, is still running at 4.2% - way above the Reserve Bank of Australia's 2-3% target.

Australian annualised CPI

%, 3m and 6m.

Source: CEIC and ING

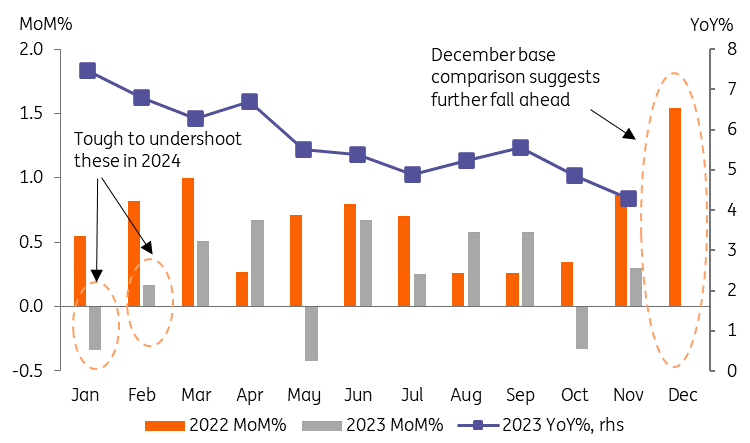

Base effects to deliver a further big inflation drop for December's numbers

To just creep under the RBA’s upper target band, the month-on-month change needs to average 0.24%. So, roughly speaking, for every monthly increase of 0.2%, you can have just under one of 0.3%. Any more than this, then over twelve months, you are going to overshoot the RBA’s target. In the last six months, there have been only two occasions when CPI has risen less than 0.3%. That was July’s 0.25% increase and, more recently, the -0.33% decrease in October – driven by a one-off drop in gasoline prices and some volatility in holiday costs.

The good news is that for at least one more month, base effects (the impact of last year’s price movements on the year-on-year comparison) mean that the inflation rate could decline further in the near term.

Last December, Australia’s CPI index experienced a huge spike of 1.5% MoM, briefly taking the inflation rate to 8.4% YoY. This was caused by an unlikely coincidence of factors which we don’t expect to be repeated. Firstly, cold weather and flooding wiped out many seasonal crops, pushing up food prices. As a result of the flooding, some coal mines were inoperative, which took some coal-fired electricity generation offline. Because too much natural gas had been exported, there was not enough to offset this loss with gas-fired plants. Energy prices spiked. All of this, coupled with a post-lockdown surge in demand for travel and hotels in the prime holiday season, resulted in a 27% MoM increase in holiday prices and an 11% increase in recreation prices overall.

Monthly CPI progression and base effects

Source: ING and CEIC

Base effects give way to run-rates

It doesn’t look as if the weather is as unseasonably cold or wet as it was last year, although there has been flooding in Queensland. Hopefully, last year's energy crisis will not be repeated this December. Recreation prices reflecting travel and hotel costs will likely move higher, as they do most Decembers, but pre-Covid, monthly recreation prices typically rose between 5-7% MoM, not the 11.0% MoM increase recorded last year. So, on the assumption that more normal increases occur this year, then we should see the CPI index increase by no more than 1% in December, and possibly much less, meaning that the rate of inflation will fall from 4.3% to 3.7% for a 1% outcome, to maybe as low as 3.3% on a 0.6% MoM outcome. And that really would put the RBA’s inflation target into play.

But the good news may then be interrupted for a while because last year’s price spikes were followed by abnormally large unwinding. But with less of a surge in prices at the end of 2023, the unwinding in early 2024 is also likely to be commensurately less.

While last year’s January print was -0.3%MoM, this year may be a more modest -0.1 to +0.1% outcome, and the February 2023 0.2% MoM outcome could be closer to 0.3-0.4. If so, then that would take the inflation rate back up by 0.3-0.6pp, returning to around 4% YoY.

After that, there are no particularly egregious base effects to worry about until May, when the 2023 0.4% MoM decrease could result in a further upward lurch, reversing whatever decline stems from the December comparison. What will determine where inflation ends up by the end of the year will be much more driven by the run-rate of monthly outcomes than base effects. As we noted before, right now, this is not looking convincingly low enough to bring inflation in on target, at least not by the end of 2024.

The macroeconomy is still looking pretty good

For this to happen, it would be more encouraging if the macroeconomy were slowing. Certainly, the GDP figures have been coming down, but these don’t tell the whole story. Employment data remains fairly robust. Most months, the increase in the labour force is greater than the rise in unemployment, which is keeping a lid on the unemployment rate, which at 3.9% is still fairly low. Retail sales have dropped back to about 2%YoY but look pretty stable and are certainly not screaming recession or household distress. And with house prices still rising, the single largest source of household wealth is looking strong despite the RBA’s tightening.

Market pricing just looks wrong

In terms of market pricing, futures markets are pricing in a 50% chance of a cut in May, and by August, the first hike is fully priced in, with a further 25bp cut fully priced in by December.

This looks totally wrong to us. For one thing, and unlike the Fed, the RBA has been quite tentative about its increase in the cash rate. At 4.35%, the cash rate is probably a bit restrictive, but not much. The real rate (ex-actual inflation) is about zero. A properly restrictive rate would be higher. On the same basis, the Fed’s real policy rate is more than +200bp. Consequently, even the arguments for some finessing of the policy rate to a more neutral setting aren’t terribly convincing. At least not until and unless inflation drops much more than it will have likely done by May.

The possibility for a May cut doesn’t even coincide with the very narrow window of low inflation that will appear when the December inflation data are released at the very end of January and just ahead of the RBA’s February meeting.

Market pricing

Implied cash rates.

Source: Refinitiv

It's easier to make a case for hikes

In contrast, we have only one rate cut pencilled in for 4Q24, and even that feels a bit speculative currently, as there is a good chance that inflation won’t have reached the RBA’s target by then. That's especially true should the current tensions in the Red Sea spill over into higher prices of energy and, indeed, all goods that are normally routed through this stretch of water.

It is probably easier to make a case for further RBA rate hikes because if monthly inflation averages 0.3% over the second half of the year, not the 0.2% we have optimistically assumed, then inflation will still be around 4% by the end of 2024.

Read the original analysis: What’s really going on with Australian inflation

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.