What will traders be watching this week?

Monday, December 06:

Factory Orders from Germany for the Month of October is the first significant piece of data for the week. The market is expecting a 0.5% decline MoM, in factory orders. The EUR may come under pressure when this data reaches the market, especially when investors consider it in tandem with a recent German IFO Business Survey, indicating diminishing business confidence in the region and further noted “Supply chain bottlenecks are putting companies under real pressure, there is no sign of a let-up.”

Tuesday, December 07:

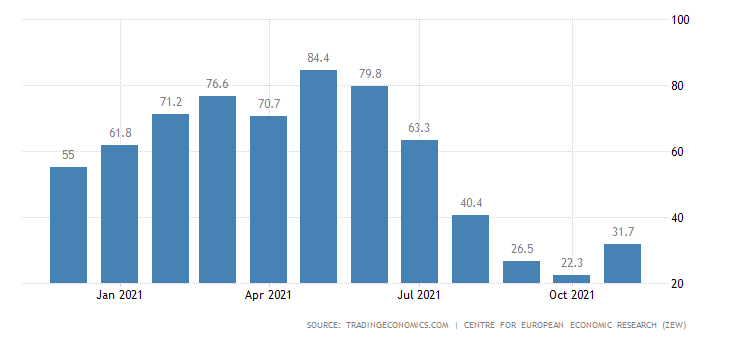

Possibly adding to downward EUR pressure is the German ZEW Economic Sentiment Index DEC, due Tuesday. The index measures the level of optimism held by analysts concerning economic developments stretching out over the next six months. The ZEW index is anticipated to post a decline of ~5 points to 25.3, from November’s reading of 31.7.

Wednesday, December 08:

Quiet Wednesday.

Thursday, December 09:

The Bank of Canada’s (BoC) Interest Rate Decision and Rate Statement are released very early Thursday. It will be interesting to see if the BoC will action its bullish rhetoric sooner than next year. However, with oil prices currently under pressure, a hike by the Bank is looking unlikely before April. Importantly, Deputy Governor of the BoC, Toni Gravelle, will speak to the organisation’s Economic Progress Report the following day.

China’s Consumer Price Index (CPI) YoY data to November is due early Thursday afternoon. Last month, China’s CPI accelerated sharply from 0.7% to 1.5% as producers passed on rising costs. Producer costs have risen 13.5% since October 2020, the fastest pace in 26 years. As such, analysts are again expecting a steeper incline for November CPI data. Market forecasts have China CPI hitting 2.5%.

Friday, December 10:

Mexican Inflation Rate data YoY to November will be posted just after the clock ticks over to Friday. Mexican inflation is anticipated to record its fourth month of increases and possibly pass the 7.00% threshold. The Central Bank of Mexico, while believing inflation to be transitory, might respond with another rate hike when it convenes the following week to dampen inflation expectations leading to persistent inflation. The Mexican Peso spent much of last week strengthening against the USD, so the market may have priced this in already.

Saturday, December 11:

The US gets the last word this week. Its Inflation Rate YoY to November is anticipated to follow Mexico’s, creeping up to ~7.00%, from 6.2% the previous month. This forecast proving true could strengthen the Federal Reserve’s resolve to speed up its bond-buying taper and possible move forward the schedule of interest rate hikes.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.