What does Yellen’s new appointment mean for American Dollar? [Video]

![What does Yellen’s new appointment mean for American Dollar? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/DollarIndex/close-up-look-of-markets-various-bills-1775965_XtraLarge.jpg)

Dollar bears love hearing that Joe Biden (if and when he takes control of the White House) will appoint Janet Yellen as the next Treasury secretary, making Yellen the first woman to hold the position.

Traders see Yellen as a "dove", meaning she should be very accommodative and a strong proponent of rates staying lower for longer. Also, since she was formerly the Fed Chair and leader for the Council of Economic Advisors she will create a strong working relationship across the financial industry. Perhaps more than anything the market fully understands how Yellen communicates and views the economy. Remember, Yellen was Vice Chair under Fed Chair Ben Bernanke, during which they navigated the economy through the 2008 financial crisis.

As Fed Chair, she maintained the Fed's ultra-low rate policy well into 2015 and presided over a period of tremendous job growth.

Keep in mind, the head of the Treasury is typically the one negotiating with Congress on behalf of the White House, so it's seen as one of the most critical roles right now.

Let's also not forget we have some serious political uncertainty still in the mix during the next 45-days. with the run-off Senate election in Georgia, and the ongoing debates and recounts surrounding the Presidential debates.

This week we are waiting for Retail sales, the Empire State and Philadelphia Fed manufacturing surveys. Negative numbers plus virus cases rise, and lockdown fears may bring dollar to new lows.

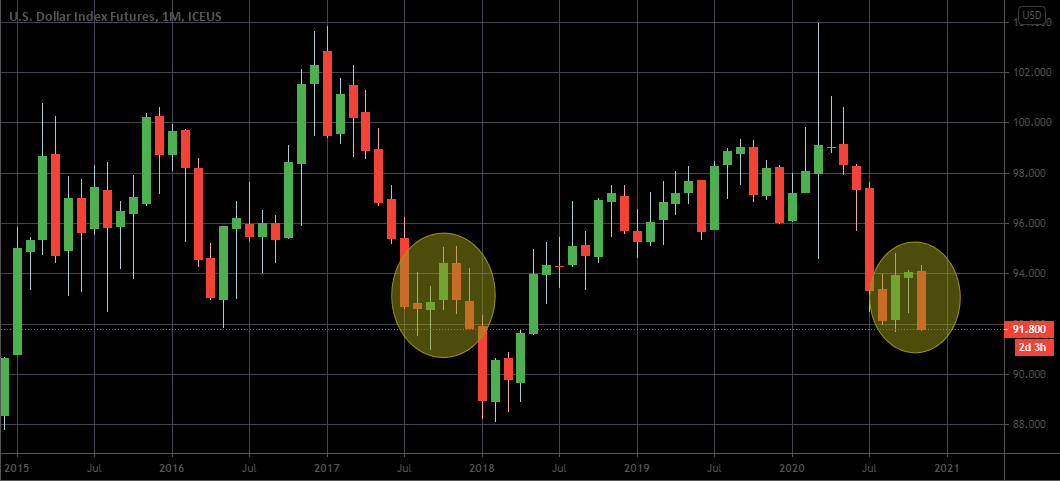

With all that in mind, I want to focus on the monthly chart of American dollar. It has a flagging pattern similar to one we saw in 2017. Taking into account all the fundamentals, there is a big chance to see another breakdown in a long-term perspective.

However, we are getting close to the end of the year and risk of potential massive profit booking is increasing. Closing of big positions may result in a rally to 96 range. I believe the 4h chart is the best option to focus on.

Author

Inna Rosputnia

Managed Accounts IR

Inna Rosputnia is a stock and futures trader, portfolio manager and financial analyst that has been in the trading industry for the last 12 years.