Weekly FX chartbook: US presidential debate is the big market unknown

Key points

-

USD: Focus on politics could bring safe-haven bid, first US presidential debate on tap.

-

EUR: France election jitters and downbeat PMIs adding to pressures.

-

JPY: Intervention threat has heightened, but weakness could extend first.

-

GBP: Room to stay resilient.

-

AUD: CPI may help extend gains on the crosses.

US election risks could take a step up

The biggest unknown for the markets this week will be on the politics rather than economic updates. Market has been jittery about the French elections for some time now, while being complacent about the UK elections on July 4.

This week, all eyes will be on the first US presidential debate scheduled for June 27 (9pm EDT), which is expected to set the tone for the campaign ahead. President Joe Biden and former president Donald Trump will meet in a TV studio. The setup is unique and seems to favor Biden, as there will be no partisan audience and candidate microphones will be muted when they are not speaking to prevent interruptions.

However, the debate is exclusively being held by commercial TV networks, and will not be overseen by the Commission on Presidential Debates (CPD), a longstanding independent and non-partisan body that traditionally governs debate rules. This unconventional arrangement could lead to more conflict-generating responses.

Key focus areas for the markets will be Biden’s health and Trump’s policies on tax and tariffs. Since any unexpected developments could break the deadlocked race, significant missteps by either candidate could have substantial consequences.

Setting up for the first round of French elections

As France heads into the first round of legislative elections on June 30, the political landscape is tense following a surprising result in the recent European Parliament elections. The far-right National Rally, led by Jordan Bardella, secured 31.5% of the vote, significantly outperforming President Macron’s Renaissance party, which garnered only 15.2%. Macron's response was to dissolve parliament and call for snap elections, aiming to regain control and prevent the far-right from gaining more influence.

Polls indicate a fragmented voter base, with the National Rally poised to increase its parliamentary seats but unlikely to secure an outright majority. Macron's strategy hinges on rallying mainstream voters to prevent the far-right from consolidating power.

A strong showing by the National Rally could heighten investor concerns about political stability and policy continuity in France, potentially leading to increased volatility in European markets. Conversely, a solid performance by Macron’s party or other mainstream groups might reassure markets and support a more stable investment environment. A hung parliament is currently seen as the base case.

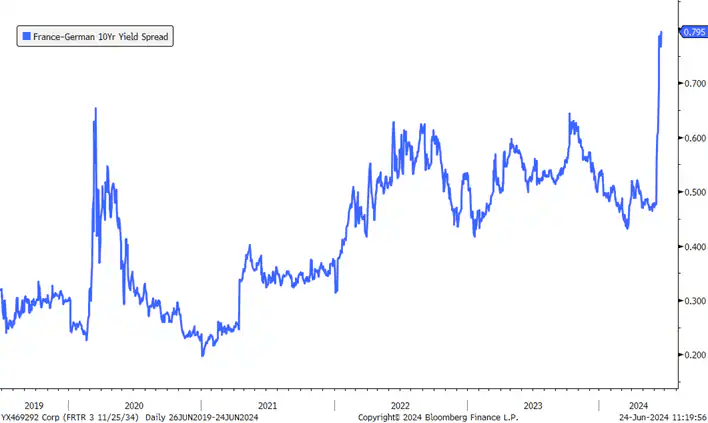

Key metric to watch will be the France-German 10-year yield spread that has widened to about 80bps as shown in the chart below. Any further widening of this spread could weigh on Euro and other European assets. However, as we noted in this article, as much as election risks can be real, political uncertainty can offer strategic entry points for long-term investors.

Source: Bloomberg

Inflation focus – US, Canada, Australia and Japan

This week, inflation data releases from the US, Canada, and Australia will be pivotal for currency traders.

US core PCE, the Fed’s preferred inflation gauge, is released on Friday. May CPI and PPI suggest that disinflation may be back after being questioned in Q1. Market expectations are muted, and hence the biggest risk will be any upside surprise.

But before we get to the PCE release on Friday, markets will assess Canada’s CPI on Tuesday, Australia’s on Wednesday and Japan’s Tokyo CPI also on Friday. Australia and Canada prints are likely to come in higher, but won’t be swaying central banks at this point. The Bank of Canada’s July rate decision remains a coin toss, while the Reserve Bank of Australia is unlikely to cut this year. Central bank policy divergence remains a key theme for FX markets, and that could make pairs like AUDCAD or AUDCHF interesting. AUDJPY has also broken to record highs, and AUDNZD may need a break above the 50-day moving average at 1.0883 to bring upside back in focus. Key risk for AUD stems from US presidential debate turning in favor of Trump and tariff policies coming back in focus.

The upside in Japan’s Tokyo CPI for June is unlikely to be enough to alter Bank of Japan’s normalization bets, and yen’s carry attractiveness vs. intervention risks remain on the radar.

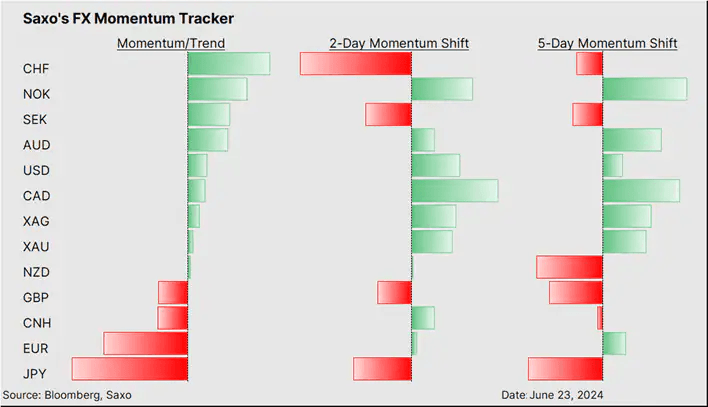

Central bank divergence theme was key in FX markets with Norges Bank's and RBA's hawkish stance making NOK and AUD the outperformers last week, while JPY and CHF remained the underperformers.

Our FX Scorecard shows positive momentum of CHF may be at risk of turning weaker, while NOK and USD could sustain.

Forex COT to the week of June 18 saw a small buildup in dollar longs after bottoming two weeks earlier but overall very little positioning shifts.

Read the original analysis: Weekly FX chartbook: US presidential debate is the big market unknown

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.