Week ahead – US inflation data and RBA decision enter the limelight [Video]

-

US CPI and PPI data awaited amid dovish Fed bets.

-

RBA ready to cut rates as Australian inflation slows.

-

UK jobs and GDP data to shake the pound after BoE.

-

Japan’s GDP also on tap as BoJ hike bets ease again.

![Week ahead – US inflation data and RBA decision enter the limelight [Video]](https://editorial.fxsstatic.com/images/i/RBA_1_XtraLarge.png)

How will the wounded Dollar respond to US inflation data?

The US dollar had a rough time this week, extending the decline triggered by last Friday’s NFP report. The soft report, combined with the weakness revealed in the ISM non-manufacturing PMI for July and the reciprocal tariffs that kicked in on August 7, may have revived recession fears.

Although heavy trade duties are posing upside risks to inflation, they are also raising worries about the health of the world’s largest economy, and this is evident by the fact that investors have adopted a more dovish stance on US interest rates. They are now nearly fully pricing in a 25bps rate cut for September, while the total worth of reductions by the end of the year has risen to 60 bps.

With all that in mind, next week, dollar traders are likely to lock their gaze on the CPI and PPI data for July, due out on Tuesday and Thursday, respectively, as well as on Friday’s retail sales figures for the same month and the preliminary University of Michigan (UoM) consumer sentiment survey for August, which includes the 1- and 5-year inflation expectations subindices.

Although manufacturing prices slowed according to the ISM survey, the non-manufacturing prices subcomponent revealed a strong acceleration. Given that the manufacturing sector accounts for only 10% of US GDP, this implies that the risks surrounding the CPI and PPI data may be titled to the upside. Hotter-than-expected inflation, even before the reciprocal tariffs enter the equation, could prompt traders to remove some basis points worth of rate cut bets from the table.

However, should Friday’s retail sales reveal that the economy is struggling more than expected, expectations for a September cut and another one by the end of the year are unlikely to be altered, which could keep any CPI-related dollar gains limited and short-lived. What’s more, Trump remains willing to increase levies on more nations, like China. Thus, should things fall out of orbit, more sell-America episodes in the not-too-distant future could be possible.

Will the RBA appear more dovish amid slowing inflation?

Apart from the US data, there is also a central bank decision on next week’s agenda. On Tuesday, the Reserve Bank of Australia (RBA) is widely anticipated to reduce interest rates by 25bps, while another 60bps worth of reductions are factored in by June 2026.

Back in July, the Board kept interest rates on hold, but the decision was not easy. There was a strong division, with some members arguing that a rate cut was appropriate. However, the case to remain sidelined proved stronger, with the minutes revealing the argument was that a third reduction within the space of four meetings would not be consistent with their cautious and gradual strategy.

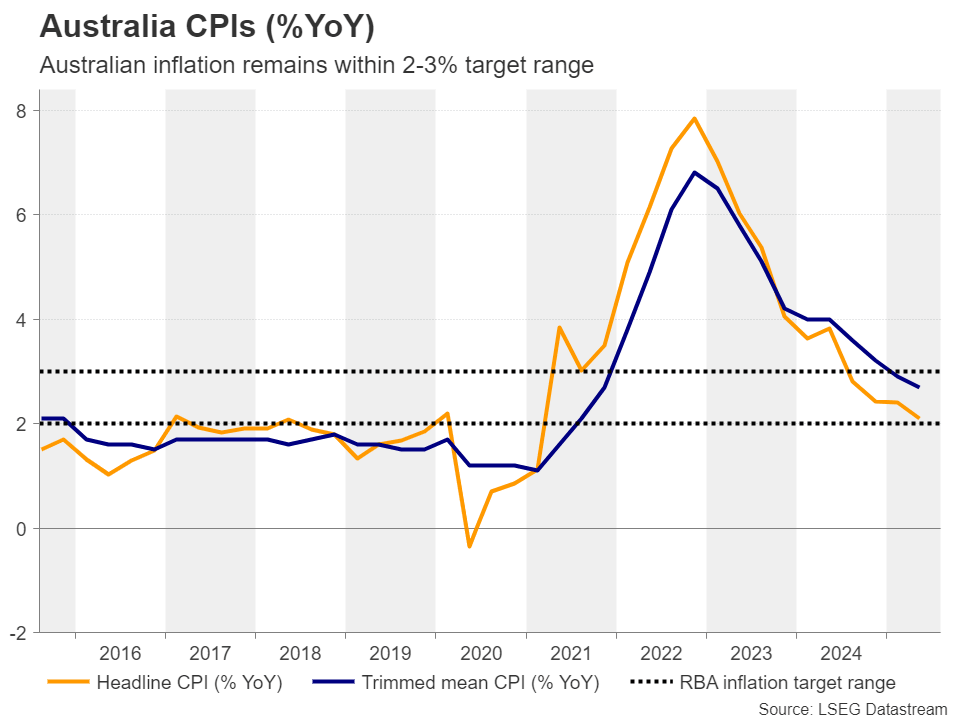

Since then, the quarterly CPI data revealed that headline inflation slowed to 2.1% y/y in Q2 from 2.4%, just a tick above the lower bound of the RBA’s 2-3% target range. The trimmed mean rate also slipped to 2.7% y/y from 2.9%.

With inflation in the target range and cooling, policymakers are likely to feel more confident to press the rate-cut button this time and thus, given that such an action is fully priced in, aussie traders are likely to quickly turn their attention to the accompanying statement and the new macroeconomic projections.

They may be eager to find out whether the September decision would also be “live” or whether a November follow-up reduction will be telegraphed. Currently, economists believe that November may be a more appropriate time to take the cash rate back to around neutral levels. Therefore, if this is the RBA’s message, the aussie’s outlook is unlikely to be shaken.

For that to happen, Wednesday’s wage price index for Q3 and the employment report for July on Thursday, may have to disappoint to a degree where traders start speculating about a September rate cut, despite the Bank signaling otherwise.

Chinese data may also be of interest for aussie traders, as China is Australia’s main trading partner. On Friday, the world’s second largest economy releases retail sales, industrial production, unemployment rate, and fixed asset investment data, all for the month of July.

After hawkish BoE cut, Pound traders lock gaze on UK data

After a tumultuous BoE decision this Thursday, pound traders will remain on the edge of their seats next week, in anticipation of the UK employment report for June and the preliminary GDP data for Q2, which will be accompanied by the industrial production and trade numbers for June.

After a second round of voting, the BoE decided to cut interest rates by 25bps via a 5-4-0 vote. Economists were expecting only two dissenters and not four. In its new macroeconomic projections, the Bank revised its inflation forecasts higher, while at the press conference, Governor Bailey said that it is important that they don’t cut the bank rate too quickly or too much.

The outcome gives September pause vibes and thus, should next week’s data come in on the bright side, that view will be solidified as pound traders may further scale back their rate cut bets. Currently, they are fully pricing in the next quarter-point reduction for February 2026.

Will Japan’s GDP data push hike bets further back?

Elsewhere, Japan’s GDP for Q2 is also coming out. The probability of a BoJ rate hike by the end of the year fell again to just above 50% after Trump threatened to impose higher tariffs on Japanese imports, even after the two allies signed a deal. Ergo, if the data comes in weak, more investors may be convinced that the next rate increase will most likely happen in 2026, which could add more selling pressure on the Japanese yen.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.