Week Ahead on Wall Street (SPY) (QQQ): Earnings season begins and CPI data the highlight

- Equities fall sharply on Friday as the jobs market remains strong.

- Equities still closed higher on a volatile week, while Monday, Tuesday saw massive gains.

- Oil prices spike as OPEC+ cuts supply, all eyes now on CPI data.

Another week of huge volatility for financial markets was met with a certain resignation on Friday. Early indications for the week were positive with a massive two-day rally to set things off as the Fed pivot talk once again took centre stage. This saw a massive 6%-plus, two-day rally for most of the main indices before some flatlining ahead of Friday's jobs report. The hope was for a weak number to continue the Fed pivot hopes.

However, what we got instead were more signs of a strong labour market that will need to take a few more interest rate hits before it falls to the canvass. The unemployment rate dipped to 3.5%, while the payrolls number showed gains of 263K, just below the 270K consensus. This reinforced the hawkish comments from Fed officials, which markets had ignored earlier in the week.

Bond yields once again spiked with the 2-year closing at a yield of 4.3% and the 10-year just shy of 3.9%. Fed funds futures markets priced the near certainty of another 75bps hike in November, and as a result equities sold off aggressively. Despite all the doom and gloom the S&P 500 (SPX) actually gained 1.6%. Energy was back on its throne as the biggest winner. OPEC+ announced a 2 million barrel per day oil supply cut that sent crude oil prices spiking higher midweek toward $90. This will also not help the Fed pivot hopes. Energy (XLE) rose over 13% on the week, while the continued rate hikes meant real estate (XLRE) was the worst-performing sector on the week.

We now turn our attention to the week ahead with two key events, one micro and one macro. First, it is earnings season. Investors have been nervously anticipating this one for a while now, and as ever the banking sector is first up. We do have to question how much bad earnings news is priced in given the mess we have already seen from FedEx (FDX) and Nike (NKE) to name a few. Apple (AAPL) will be the key as in a proper full-on capitulation the leaders are the last ones to topple. If we are indeed about to capitulate, then AAPL will need to move seriously lower. On the macro front, it is all about Thursday's CPI. Another hot number would lead to curtains for the stock market. The spike in oil will not have an effect this time out, so hopes are growing for a calming number. Again though, how much is priced in?

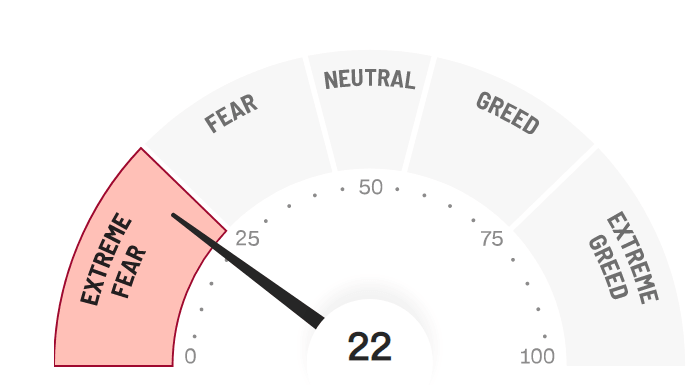

We notice the conditions for a counter-trend rally are higher than we would have expected. A number of factors support the theory. First, earnings season has arrived as mentioned. Analysts have lowered the bar with forecast downgrades, and investors largely expect a bad season. We had a similar situation in Q2, and the worst fears were not realized. Perhaps this will be more of the same. Second, positions and sentiment are again maximum bearish.

Source: CNN.com

Meanwhile, the American Association of Individual Investors Sentiment Survey is also near max bearish. Hedge funds are overly shot and could be squeezed. CTA trend-following systems are near maxed out also and will run to longs in a big way if the rally picks up. We are also close to the max period for corporate buybacks, which will soon begin to pick up again.

Share buybacks:

— Maverick Equity Research ✌️ (@Maverick_Equity) October 5, 2022

corporates buyback blackout period is about to enter peak period, removing a crucial tailwind for equities ... but

wait for the 3rd week of October, the machines turn back on (massively) positive again

Source: Barclays#SPY $QQQ #Stocks #Equities pic.twitter.com/4tevmbQvqa

Ehile the backdrop remains terrible in my view, there is more risk/reward to the upside. We need to get over the hump of Thursday's CPI first though.

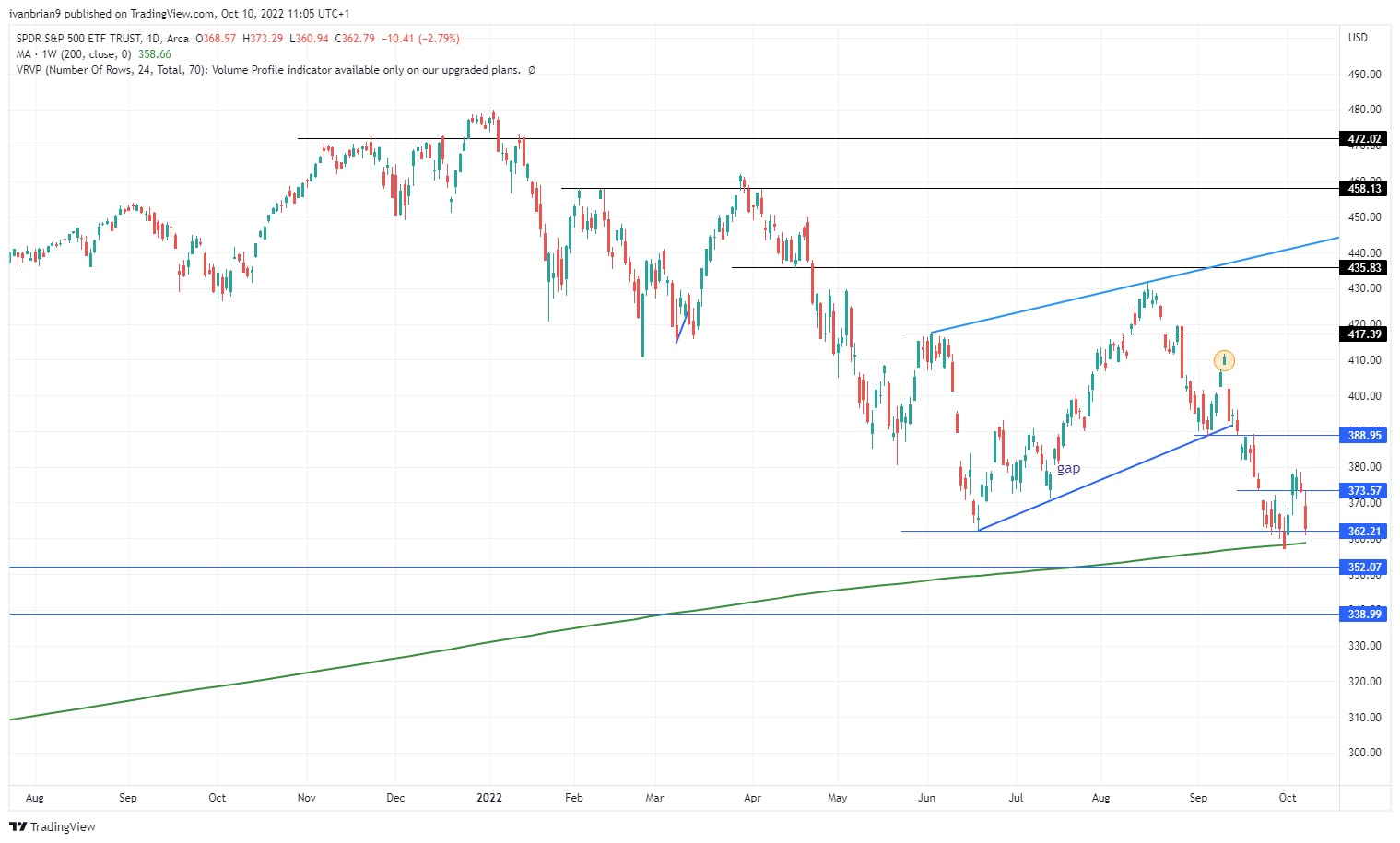

SPY forecast

Once again SPY looks to test the lows and the 200-week moving average. The pivot remains $373. Below we are likely to see more losses and a test of $352, which is the 50% retracement of the pandemic low to high.

SPY daily chart

Earnings week ahead

Finally, we are here. Earnings week begins this week, well, actually at the end of the week with the banking sector as ever leading the way. Earnings are likely to be poor, but watch the market's reaction to misses or lowered guidance for clues as to whether positioning is overly bearish. If my hunch is correct, earnings and outlook will be poor, but the reactions will not see strong enough follow through.

#earnings for the week https://t.co/lObOE0dOhZ $JPM $PEP $TSM $DAL $MS $C $UNH $BLK $WFC $DPZ $AZZ $WBA $USB $CMC $FAST $PNC $PGR $WIT $FRC $THTX $DCT $ETWO $APLD $VLNS $INFY pic.twitter.com/jB4Ygjl4n9

— Earnings Whispers (@eWhispers) October 8, 2022

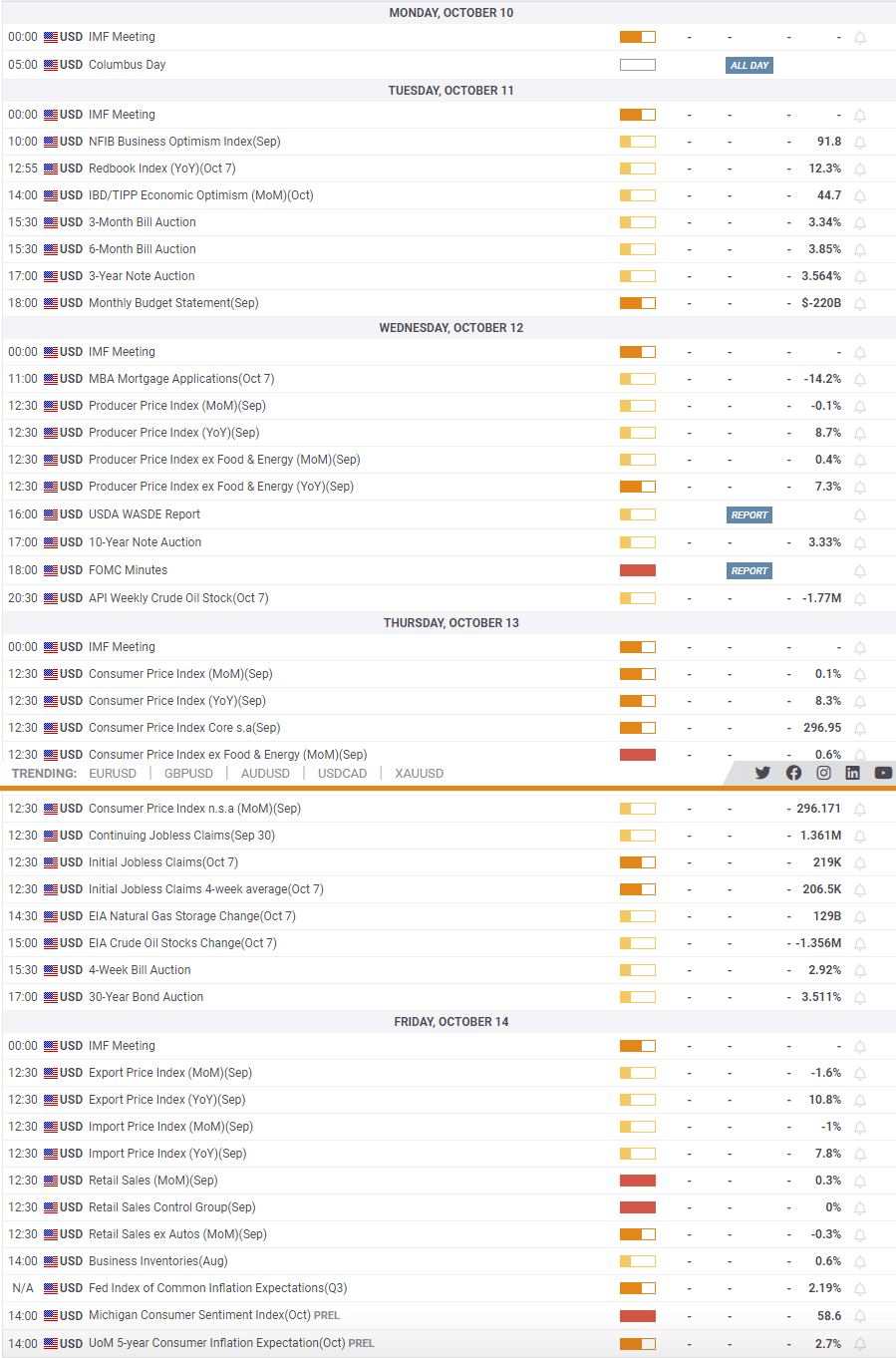

Economic releases

Really, Thursday is the big one with CPI data due. Those of you also looking at FX, the IMF meeting could be of interest as there may be more talk of the dollar hurting other economies. This may also see calls for a more doveish tilt for the Fed. We also have some interesting Treasury auctions with the 3 and 10-year versions. Two weeks ago we had some poor demand for 2 and 5-year auctions, which spiked yields again and led equities lower. These will be more important than usual.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.