Week Ahead on Wall Street (SPX QQQ): AMC social and traded volume soars but jobs report boosts all

- AMC dominates the week as the stock surges despite two share sales and a potential 2022 issue.

- Oil surges as OPEC+ opt for the tried and tested approach.

- Friday's employment report the perfect tonic for equity markets.

AMC week dominated headlines as the stock took over the airwaves of mainstream and social media. The saga had many layers but boils down to the theme of disenchantment that surfaced in the original GameStop saga. Retail traders are determined and take glee in imposing significant losses on hedge funds and other shorters. Wall Street has always been associated with an us versus them mentality and the advent of handheld trading apps has meant unprecedented access to financial markets for the general population. Add in a hugely accommodative Fed policy and the government giving cash stipends to trade with and the results look more understandable. Seasoned watchers have been shocked over the relative valuations of the underlying meme stocks GameStop (GME) and AMC but that is to miss the point. These retail traders represent the mass of public opinion which has been disenfranchised with Wall Street for some time and can possibly be traced back to the Occupy Wall Street phenomenon. Or to be more political, the growing inequality definitely has some causative effects. Whatever the reasons the results are obvious with wild swings now the norm in a handful of stocks. AMC has cleverly tapped into the zeitgeist and used it to its advantage, raising huge amounts of cash to stave off bankruptcy. AMC CEO Adam Aron appears to be in tune with his new investors, appearing on a popular youtube channel for a Q&A on Thursday. In terms of keeping AMC afloat, he has done a stellar job and if he had not tapped the market for funds it is doubtful that AMC would have made it this far. The company also has warned investors in its latest SEC filing about the high valuation not representing any change in the underlying business, a fact largely ignored by retail investors.

Moving on from AMC the employment report on Friday was exactly what bulls would have scripted in their dreams. Just slightly on the disappointing side but not by so much as to dampen the growth tailwinds. Yet just weak enough to keep any talk of tapering or rate hikes firmly off the table and kick that can further down the road. The Fed was also delighted with the outcome as tapering is going to provide a serious policy challenge. At the time of writing the S&P 500 is poised to make record highs with one hour of trading left in the week. The Nasdaq has a bit more work to do but should get there early next week.

Oil had a productive week with the OPEC+ meeting keeping the bulls happy and Iranian supply off the discussion table. Bitcoin and Elon Musk are headed to the divorce courts if his cryptic tweet of a broken heart emoji and a bitcoin hashtag is anything to go by. Four years of economics at university and a near 25 years in investment banking and I'm reduced to analyzing broken heart emojis, I must have missed that chapter in Econ 101. However, it did knock the price back to $37,000 just when $40,000 was beginning to look interesting. The dollar was under some pressure early in the week but by Friday had been boosted by a little pre jobs report uptick in yields. Russia talking of dumping its dollar assets didn't help and the yield heavy employment report saw the dollar shed a swift fifty pips versus the Euro and end the week nearing 1.22 again.

The latest Refinitiv Lipper Alpha flow data shows equity ETF's (Exchange Traded Funds) registering a modest outflow last week with some interesting sub-sector performance. Growth and Momentum ETF's saw outflows with Growth and Value losing $5.6 billion and momentum (MTUM) dropping $1.6 billion. The Nasdaq ETF (QQQ) also saw outflows while the S&P 500 (SPY) and Russell 2000 (IWN) saw net inflows. Despite Growth and Value ETF's losing flows, they still are the largest net recipients so far in 2021 with $83 billion of net inflows. International Equity ETFs performed well last week as investors perhaps see the major US indices as stretched.

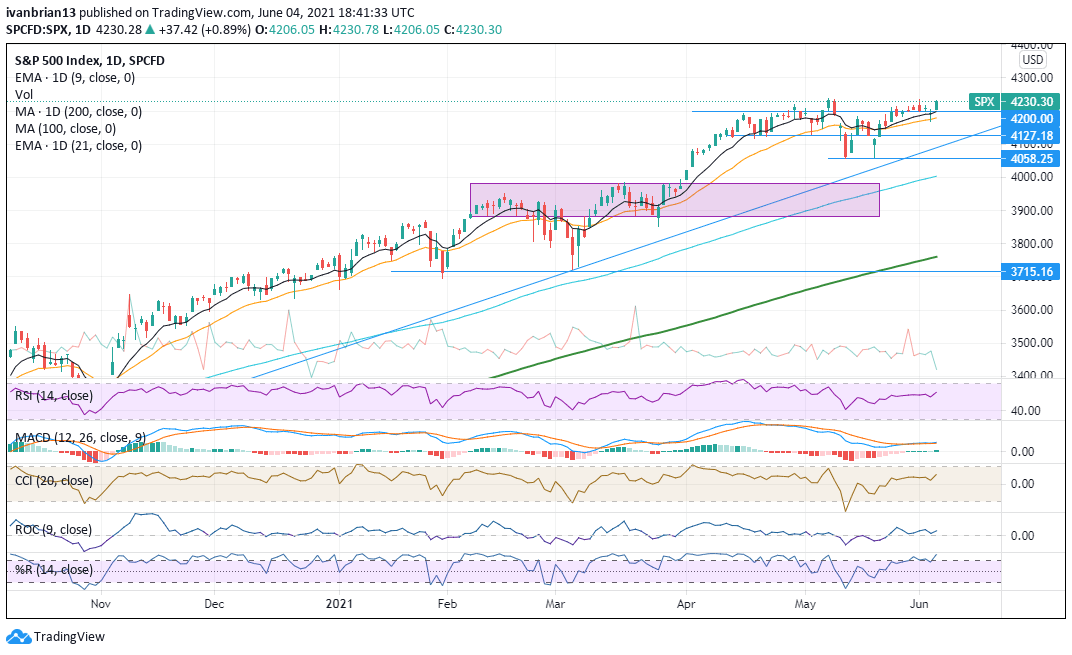

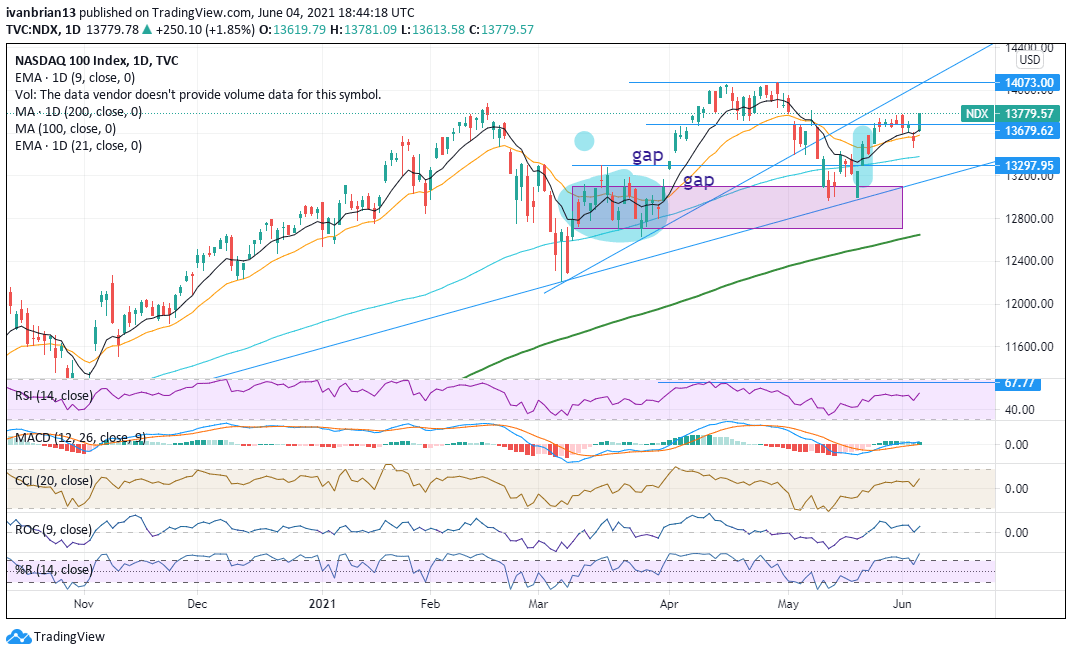

Nasdaq and S&P 500 technical levels

The employment report was exactly the kicker needed and the S&P 500 traded nicely along with the levels we had previously identified. The 9-day moving average held the trend perfectly as the week progressed and Thursday's slight wobble stalled at the 21-day moving average. The market had been signaling good things as the week progressed with advancing issues outnumbering decliners despite the flat or lower S&P 500. Friday's employment report gave the S&P 500 the kicker it needed.

The Nasdaq has a bit more work to do and is at a small resistance 13,814, the high from May 07. This candle led to a sharp fall on May 08 and the Nasdaq has not retraced until now. A break of this level should help to retrace and test new record highs.

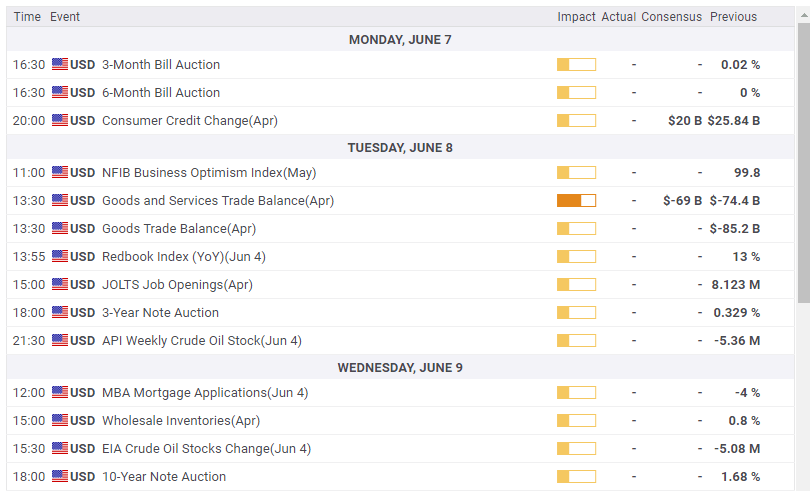

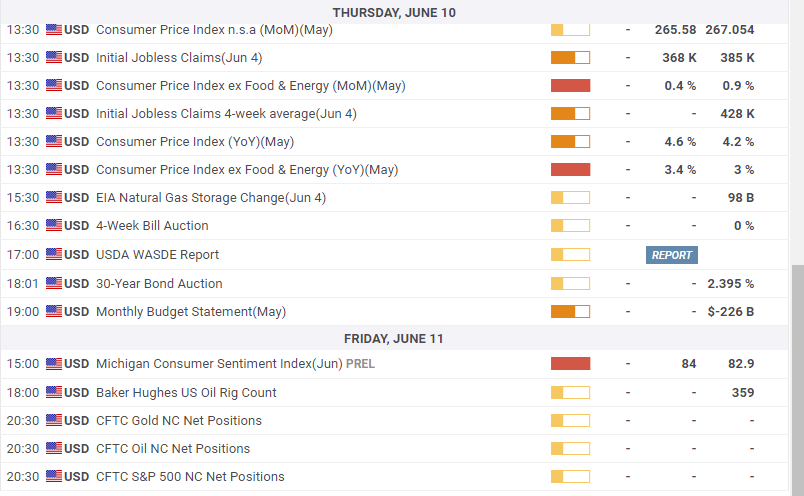

Wall Street week ahead

Some earnings laggards still going with one notable name that should grab some headlines, GameStop (GME) on Wednesday. The number itself will be overshadowed by the outlook and possible diversification into NTF's and other rumoured areas.

The economic data releases will not stir much trader enthusiasm until Thursday's Consumer Price Index. Worries over inflation have received but they have not gone away you know! Thursday may rekindle the nightmare or put it firmly to bed.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.