Week ahead – No festive cheer for the markets after hawkish Fed

-

US and Japanese data in focus as markets wind down for Christmas.

-

Gold and stocks bruised by Fed, but can the US dollar extend its gains?

-

Risk of volatility amid thin trading and Treasury auctions.

Sticky inflation is the Dollar’s friend

There can be no doubt that 2024 was the year of the US dollar, as the tables turned from 2023 when sticky inflation gripped Europe and elsewhere, while the Fed boasted progress in its inflation battle. But it was other central banks that took the lead in cutting rates in 2024, with stalling progress on taming inflation delaying the Fed’s easing cycle.

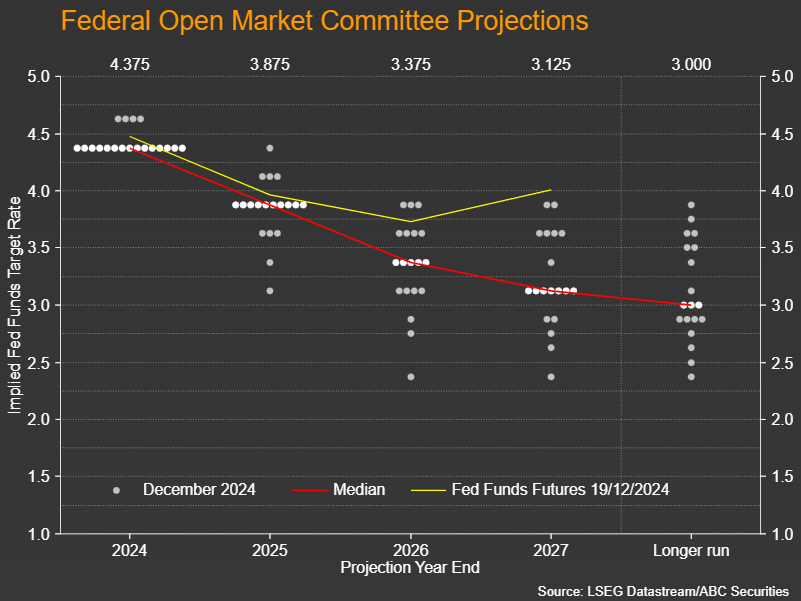

Having just concluded its last policy decision of 2024, optimism is in short supply at the Fed. FOMC members are predicting just two 25-basis-point rate cuts in 2025, leading market participants to price in fewer reductions for the Fed than any other major central bank over the next 12 months, apart from the Bank of Japan, which is hiking rates.

However, whilst this isn’t a totally unexpected development, especially after Trump’s shock landslide victory at the US presidential election, markets have nevertheless been taken aback by the Fed’s hawkishness. Chair Powell strongly hinted in his post-meeting press conference that Fed officials are already thinking about what impact Trump’s policies may have on the economy and on inflation.

Holiday mood sours on rate uncertainty

This reality check for the markets has dampened the mood ahead of the Christmas break, leaving investors on edge, as rate cuts could turn to rate hikes if the incoming Trump administration doesn’t water down its election pledges on taxes, tariffs and migration.

For now, it’s clear that king dollar isn’t about to lose its crown, although low volumes during the holiday period could spark some undue volatility, particularly against the yen, as the bulk of economic releases in the coming week will be from Japan and the United States.

A light US agenda

Starting with the US, the Conference Board’s consumer confidence gauge is likely to attract some attention on Monday. The index has been rising for the past two months, while one of its sub-gauges – the ‘jobs hard to get’ index – has been falling during the same period. The latter has a close positive correlation with the official unemployment rate, so a further decline in this measure in December would be indicative of a pickup in jobs growth and could further boost the greenback.

On Tuesday, durable goods orders and new home sales for November are due. Durable goods orders are forecast to have declined by 0.4% m/m following a 0.3% gain in October. Investors, though, tend to favour the narrower metric of nondefense capital goods orders excluding aircraft, which is less volatile and is used in GDP calculations.

Will the yen steal Christmas?

In Japan, it will be business as usual, and although there aren’t many top-tier releases, the data are likely to be watched as they come hot on the heels of the Bank of Japan’s December policy decision. Investors will also be on alert for any possible verbal or actual intervention in the FX market by the BoJ, as the yen’s freefall doesn’t seem to be ending.

The Bank signalled at its meeting that it will likely wait at least until March before hiking rates again when it will have a better view of how wage pressures are evolving after the spring pay negotiations have concluded.

In the meantime, inflation in Japan continues to hover above the BoJ’s 2.0% target. The Tokyo CPI estimates for December, which are published well in advance of the nationwide figures, are out on Friday. In November, Tokyo’s core rate edged up to 2.2% y/y. A further acceleration in December would reinforce expectations of a rate increase in March, lifting the yen.

Other data on Friday will include the jobless rate, retail sales and the preliminary reading for industrial output for November. Ahead of all that, producer prices for services might spur some moves on Wednesday when trading is expected to be extremely thin, while the minutes of the BoJ’s October meeting will be eyed on Tuesday for any additional clues on policymakers’ thinking.

Pound and loonie in need of some support

Elsewhere, both the Bank of Canada and Reserve Bank of Australia will also be publishing the minutes of their latest policy meetings on Monday and Tuesday, respectively. In Canada, monthly GDP readings for October will be another focal point for the Canadian dollar on Monday.

The loonie has plummeted to more than four-and-a-half year lows against the US dollar this month and is looking oversold, hence, it’s vulnerable to a correction.

In the UK, there might be a small boost to the pound on Monday if Q3 GDP growth is revised higher in the second estimate.

Rising yields come back to haunt the markets

On the whole, if there is any market turbulence during the festive period, it’s more likely to hit the equity and bond markets. The Fed’s hawkish stance hasn’t gone down well on Wall Street and a deepening of the selloff is possible as Treasury yields continue to climb. The US Treasury Department is planning on auctioning two-, five- and seven-year notes on Monday, Tuesday and Thursday, respectively, which could add to the upside pressure on yields if demand is low.

Gold has also taken a tumble over the past week amid the jump in yields and the dollar. It will be difficult for the precious metal to reclaim the $2,600 level with the 10-year Treasury yield above 4.50%, and a re-test of the $2,530 support region seems likely.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl