Week ahead – NFP in focus as US virus cases spike, recovery in doubt

As the risk rally fizzles out amid rising concerns about a second wave of virus infections in the United States, the all-important jobs report has the capacity to either calm or scare jittery markets. With very few other top tier releases on the agenda next week, it’s hard to see anything other than the virus story driving investor sentiment. Special attention will be on the escalation of Covid-19 cases in the US and whether any states begin to reverse some of the lockdown easings.

Flurry of domestic data may not budge aussie out of consolidation range

It’s going to be a packed data week in Australia but as investors evaluate how much of a threat the latest virus woes are to the prospects of a global economic recovery, the local dollar will probably remain confined to its recent sideways range.

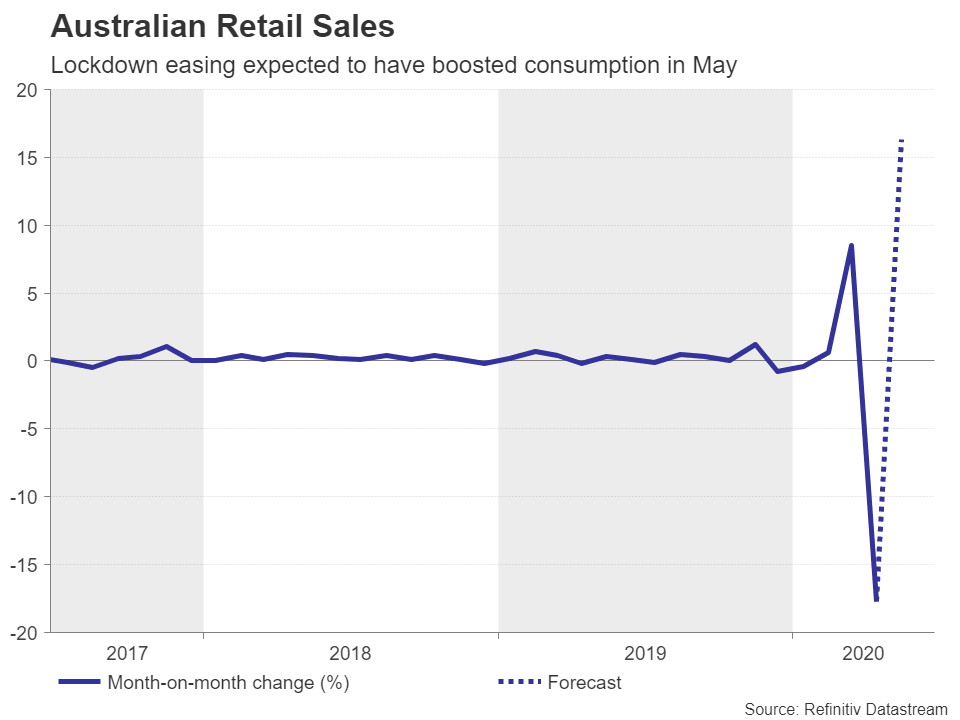

Private sector credit numbers for May will start the week on Tuesday, with the AIG manufacturing index for June and May building approvals coming up on Wednesday. But retail sales figures will likely grab the most attention, which should reveal whether the loosening of the lockdown restrictions in May led to a rebound in consumer spending.

The aussie could get a lift from a strong bounce in retail sales but traders will also be keeping an eye on PMI indicators out of China. The official manufacturing and non-manufacturing gauges for China are due on Tuesday, while the Caixin PMIs will be released on Wednesday (manufacturing) and Friday (services). The Chinese economy was possibly boosted in June from the reopening of economies around the world but unless there’s a sizeable improvement, mildly positive PMIs could end up weighing on sentiment as they would dash hopes of a quick recovery.

Across the pond, the New Zealand dollar will be getting its cues mainly from the market tone. Nevertheless, the ANZ business outlook survey out on Tuesday will be watched for clues on the RBNZ’s next move after the central bank reaffirmed its dovish stance at its policy meeting last Wednesday.

Tankan survey to spread gloom as BoJ signals pause

The Bank of Japan’s quarterly Tankan report will be the highlight in Japan next week amid few signs that the virus pain is easing in the world’s third largest economy. The flash Jibun/Markit manufacturing PMI showed the contraction in the sector worsened slightly in June, bucking the global trend of improvement. The final print is due on Wednesday, along with the Tankan survey. The Tankan indices measuring business confidence for the current quarter and the outlook for the next are anticipated to have plunged, which would point to ongoing pessimism about the economy despite the lifting of the state of emergency across the country.

Retail sales and preliminary industrial output numbers for May out on Monday and Tuesday, respectively, should shed some more light on whether the economy is on the mend or not. But as far as the Bank of Japan is concerned, it thinks it has done enough for the time being, with policymakers signalling in the June meeting summary that they will take a wait-and-see approach before deciding on any additional stimulus measures.

That can only mean the data will struggle to get much reaction from the yen, with additional gains for the safe-haven currency possible in the coming days if risk aversion is heightened further.

NFP report could make or break risk rally

The latest souring of the market mood has been positive for the US dollar too. However, with a number of growing domestic risks for the United States, it will be interesting to see to what extent the greenback will benefit from any big sell-off in risk assets. The daily cases of new virus infections across America have been edging higher over the past two weeks. And although there are no plans to shut down parts of the economy again, several states have scaled back moves to relax lockdown restrictions, while more and more authorities are making masks and other safety guidelines mandatory.

Such measures could slow the recovery process, casting doubt on the sustainability of the stock market rally. But that’s not the only thing investors need to worry about. Wall Street is starting to take note of President Trump’s fading popularity and with the election just months away, the rising prospect of a Democratic win could alone be the undoing of the incredible surge in US stocks since late March.

But as neither the worsening virus outbreak nor the election outcome are matters that will be resolved anytime soon, markets will have to make do with the June jobs report for short-term direction. The American labour market is projected to have added another 3 million jobs in June on top of May’s 2.5 million. But that would still leave the unemployment rate at a staggering 12.2%, hence, it will be important for investors to see that the jobs bounce is not losing momentum. A softer figure could undermine confidence in the recovery and spark fresh panic.

However, the dollar’s gains from any risk-off moves are likely to be contained given the darkening political and virus cloud over the US. Other data that will be significant for the greenback next week include the Chicago PMI and consumer confidence index for June on Tuesday, the ISM manufacturing PMI on Wednesday, and May factory orders on Thursday. It’s worth pointing out that the nonfarm payrolls report will also be released on Thursday as US markets will be shut on Friday for 4th of July celebrations.

The Fed will be making some headlines as well next week as Chairman Jerome Powell faces questions in Congress on Tuesday about the central bank’s pandemic response and the minutes of the June FOMC meeting are published on Wednesday.

Quiet time ahead for the euro and pound

The euro and pound will be taking a backseat next week with not a lot on the calendar to excite traders. In the euro area, the Economic Sentiment Indicator (ESI) due on Monday will be the main release to watch. The ESI is forecast to rise from 67.5 to 81.7 in June, which would reinforce expectations that the Eurozone economy is on the path to recovery.

The flash estimate for June inflation will follow on Tuesday. The headline rate is anticipated to stay unchanged at 0.1% year-on-year, avoiding a dip into deflationary territory for now. On Wednesday, the final manufacturing PMI is due, with the services one rounding up the week on Friday.

The final June PMIs will also be hitting the UK, but before that, revised estimates of first quarter GDP will be eyed on Tuesday. However, a bigger focus for the pound is likely to be what signals Bank of England policymakers send out as a number of them take to the podium next week, including Governor Andrew Bailey on Monday.

The BoE surprised markets by not sounding overly dovish at its last policy meeting but Bailey later tried to soothe nerves by suggesting it will be a long time before they can begin to raise interest rates. There’s also confusion about where the Bank stands on negative interest rates and all of this does little to restore faith in the British economy, which, aside from the pandemic, is battling ongoing Brexit uncertainty.

July looks set to be a crucial month for both the euro and pound as the EU will decide on a virus recovery fund and Brexit talks will be intensified. Until the outcomes start to emerge, however, both currencies will probably continue to drift sideways.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl