Week Ahead – Fed decision to fuel volatility in nervous market [Video]

![Week Ahead – Fed decision to fuel volatility in nervous market [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/Volatility/think-differently-black-board-gm489905586-74926503_XtraLarge.jpg)

With cracks appearing in the US banking system, markets think there’s a chance the Fed won’t raise rates next week. But considering that the Fed has already taken measures to ease financial stress and that inflation is still raging, the most likely outcome is a rate increase accompanied by high rate projections, which could boost the dollar. The Bank of England and the Swiss National Bank meet as well.

Fed dilemma

It’s going to be a difficult meeting for Fed officials on Wednesday, who will have to decide whether the priority is to safeguard the stability of the US financial system or fight inflation at all costs.

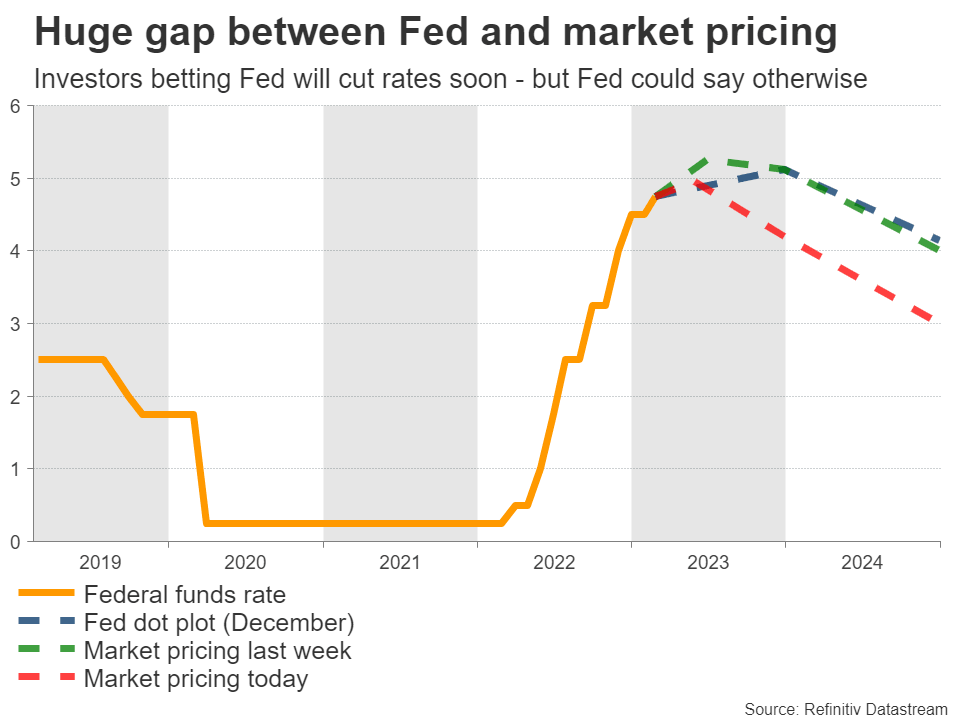

Traders are betting that the episode in the banking sector will force the Fed to stop its tightening cycle soon, perhaps even at this meeting. The implied probability of a quarter-point rate increase next week stands at 80%, with a 20% chance that the Fed does nothing at all. Beyond that, markets are pricing in rate cuts for the summer.

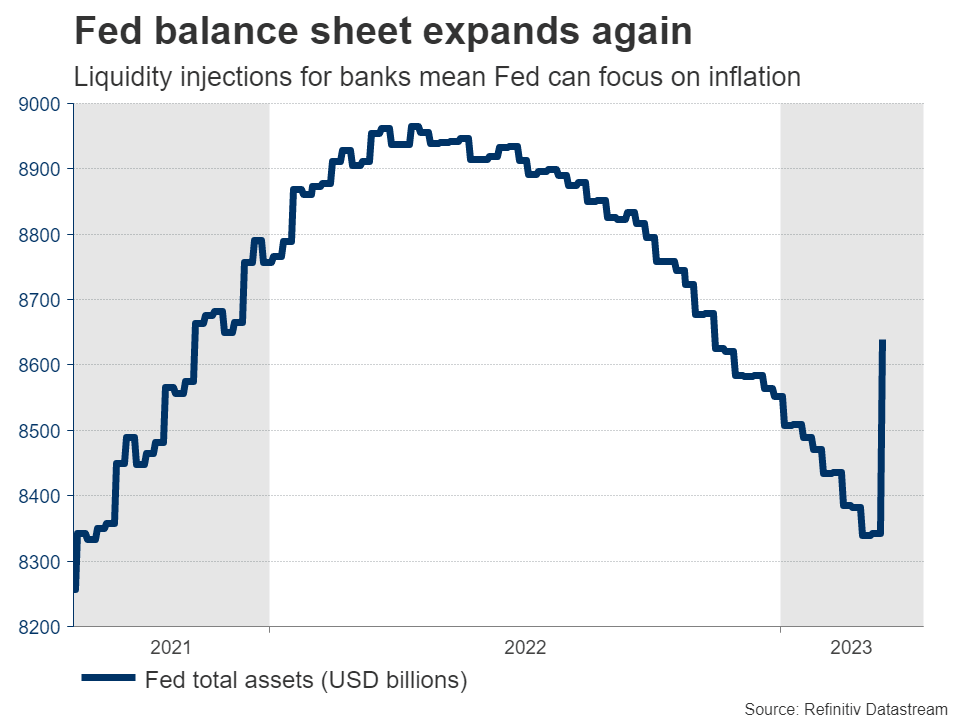

Admittedly, this speculation seems overblown. The broader banking system and especially the big US players are well capitalized, so there isn’t much threat of a Lehman-style meltdown. Most of the stress is in smaller regional banks, which the Fed has already rushed to support by rolling out an emergency lending program.

Instead, the real enemy is still inflation. Fed officials have stressed that the metric they care most about is services inflation excluding shelter, which printed 6.9% last month. That’s too hot, and coupled with the strength in employment indicators, it doesn’t allow policymakers any room to stop tightening.

It was only last week that the Fed Chairman warned rates might be raised higher than what his central bank projected in December. Back then, Fed officials expected rates to end the year at 5.1%, but current market pricing sees them at only 4.2% by year-end. That’s a huge gap, and if those projections are maintained or raised further next week, it would probably ‘shock’ markets.

In other words, investors believe that if there is a rate increase next week, it will be the final one this cycle. But the Fed might say otherwise. It has already taken measures to shore up the banking system, and inflation is far too high to stop raising rates.

If the Fed indeed sticks to its guns, that could spark a strong repricing in the markets, propelling US yields higher and boosting the dollar in the process. In contrast, the main casualty might be the Japanese yen, so dollar/yen could experience a particularly violent reaction.

BoE meeting a coin toss

The United Kingdom has remained out of the spotlight lately, as investors are more nervous about banks in the US and Eurozone. In fact, most UK news has been positive lately, both politically and economically.

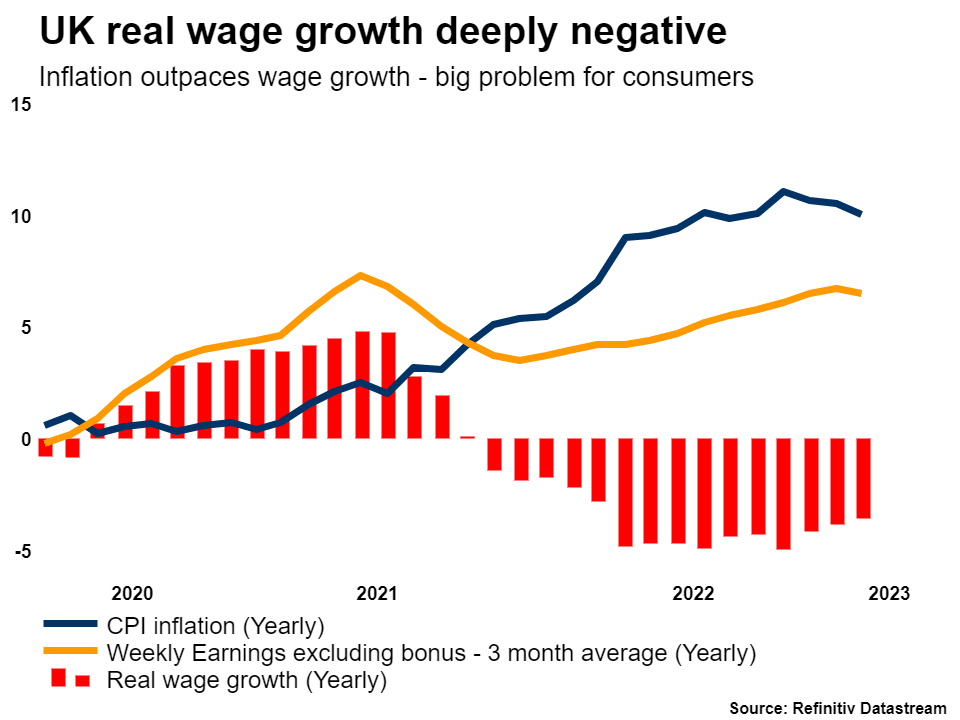

After several months of business surveys warning about a UK recession, the latest batch painted a brighter picture, revealing a recovery in new business orders that is positive news for future growth. Of course, the economy is not out of the woods. Inflation is still running at double-digits, as electricity prices have surged dramatically and post-Brexit worker shortages have exacerbated the issue.

Investors will receive an inflation update on Wednesday, ahead of the latest business surveys that will be released Friday alongside retail sales. But the main event will be on Thursday, when the Bank of England announces its decision.

Markets see this rate decision as a coin toss, pricing in 50-50 chances for a quarter-point rate increase or no action. This pricing seems fair, as the British economy is not in great shape and central bank officials have been hesitant to raise rates overall. Since the data flow has been stronger lately, the odds likely favor a rate hike, but it’s a close call.

As for sterling, the outlook seems cautiously negative. The UK economy might be stabilizing but is still fragile, its inflation problem is bigger than other nations, and the BoE is near the end of its tightening campaign. Combined with the pound’s sensitivity to the global investment mood at a time of turbulence in the markets, it’s tough to be optimistic.

Switzerland’s banking troubles

Switzerland has been at the epicenter of the recent banking panic, amid fears about the solvency of Credit Suisse. Nerves calmed after the Swiss National Bank pledged $54bn in emergency funding to the troubled bank, but the stress hasn’t disappeared as there is still elevated demand for derivatives that protect against a Credit Suisse default.

Despite this turmoil, investors still expect the SNB to raise rates by a quarter of a percent on Thursday. The rate increase is already fully priced in, so the market reaction will depend mostly on the economic commentary and any signals about future actions.

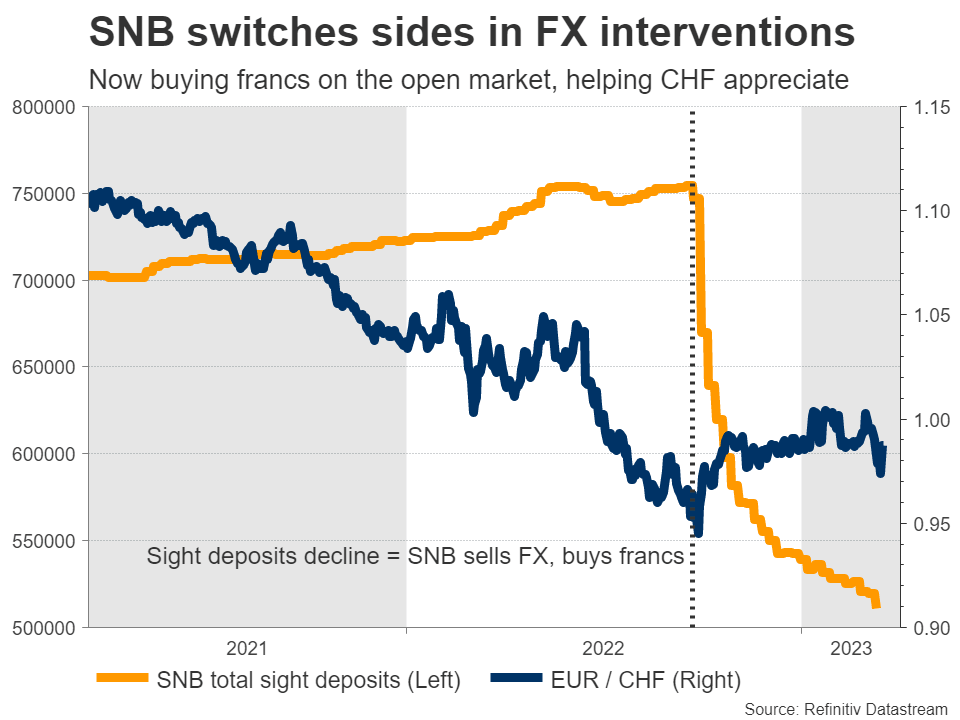

Bank troubles aside, the outlook for the Swiss franc looks positive. The SNB is still intervening in the FX market but it has switched sides in recent quarters - it is now buying francs on the open market to help the currency appreciate. Coupled with ongoing rate hikes and resurfacing concerns about the world economy, the environment is favorable for the safe-haven franc.

The wild card is Credit Suisse, but judging by the forceful policy response, it is likely that it will be protected.

Finally on the data front, the spotlight will fall on the Eurozone, where the latest PMI business surveys will be released Friday. Over in Canada, inflation and retail sales stats will be released Tuesday ahead of the minutes of the latest Bank of Canada meeting on Wednesday.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service