Week ahead: Fed, BoE, and BoJ claims spotlight

The financial markets will be exceptionally busy this week, with the US Federal Reserve (Fed) taking centre stage. The Bank of England (BoE) and the Bank of Japan (BoJ) will also claim a portion of the spotlight.

On the data front, a handful of inflation metrics from Australia, the eurozone, and Switzerland are on the docket. Stateside also welcomes a slew of labour data, including the US Employment Situation Report.

FOMC: September on the table?

The US Federal Open Market Committee (FOMC) announces its latest rate decision on Wednesday at 6:00 pm GMT. According to market pricing, a rate reduction at this week’s meeting is unlikely, leaving the Fed funds target rate on hold for an eighth consecutive meeting at 5.25%-5.50%, the highest level in 23 years. However, markets are now pricing in nearly three rate cuts this year. September is fully priced in to cut by 25 basis points, followed by a potential rate reduction at November’s meeting and perhaps another discount in December. From the last Fed meeting, nonetheless, Fed officials pared back rate-cut expectations from three cuts to one this year, with Fed members seeking more confidence in data before easing policy.

While an interest rate adjustment is doubtful this week, the Fed may be more communicative regarding a possible rate reduction at September’s meeting, which aligns with market forecasts. This will be key for many market participants. A lack of communication from the Fed may encourage a dollar (USD) bid; equally, signals of an impending rate cut could direct the greenback southbound against its major peers.

In terms of the latest US economic data, the soft-landing narrative appears within reach: Consumer Price Index (CPI) inflation is slowing – easing to +3.0% in June at the headline level and core inflation cooling to +3.3% year on year – the labour market is loosening, and economic activity was higher than expected in Q2.

Bank of England: A close call

The BoE claims some of the limelight on Thursday at 11:00 am GMT. Heading into the event, markets are about even whether the BoE steps up and reduces the Bank Rate or opts for an eighth straight meeting on hold at 5.25% (16-year high).

Following June’s finely balanced policy meeting – a 7-2 vote in favour of a hold – economists estimate a 5-4 vote in favour of a cut this week. External member Swati Dhingra and Deputy Governor Dave Ramsden voted to cut rates at the last two meetings, and given there is a division among the ranks at the BoE – minutes of the previous meeting showed ‘MPC members judged today’s decision as ‘finely balanced’ – a meaningful vote shift could materialise. However, the BoE’s Chief Economist Huw Pill echoed a hawkish tone earlier this month, underlining that services inflation and wage growth show ‘uncomfortable strength’. Jonathan Haskel, an external Monetary Policy Committee (MPC) member, also emphasised a higher-for-longer stance on concerns that a ‘tight and impaired’ labour market will underpin inflation. This will be his last meeting in August as he steps down after six years.

Regarding UK economic data, June’s CPI inflation print remained at the BoE’s inflation target of +2.0%, matching May’s release and defying economists’ estimates of +1.9%. However, services inflation remains an issue despite headline inflation sitting at target; year on year, services inflation rose +5.7% in June, equalling May’s release and was slightly higher than the +5.6% markets anticipated.

In the labour market, unemployment remained at 4.4% from March to May 2024, its highest rate since September 2021 and points to a softening jobs market. Nevertheless, wage growth in the UK remains elevated and a problem for the BoE.

Gross Domestic Product (GDP) growth also expanded by +0.4% between April and May, bettering Bloomberg’s median estimate of +0.2% and up from a month of no growth in April. This reflects the economic recovery in the UK following stagnation over the last few years and positions the UK economy for solid growth in Q2.

With wages and services inflation still proving sticky and BoE officials’ mixed signals, the BoE rate decision could essentially ‘swing either way this week’.

Bank of Japan rate hike?

The BoJ holds a policy meeting on Wednesday at approximately 3:00 am GMT, with expectations of a possible policy shift. According to the swaps market, there is about a 65% chance of a rate hike at this meeting (15 basis points priced in). But given the Japanese yen’s (JPY) recent appreciation, specifically last week (up +2.3% versus the USD), officials may decide to hold back on policy tightening. You will recall that the central bank raised its Policy Rate in March for the first time in 17 years by 10 basis points.

The BoJ will also announce plans to reduce its government bond (JGBs) holdings. The central bank currently purchases about 6 trillion yen of bonds per month; the challenge is trimming these purchases without destabilising the market. Consensus suggests that the central bank will gradually reduce its monthly purchases of JGBs to 3 trillion yen.

Furthermore, investors will receive the central bank’s outlook report, released quarterly. This report provides the BoJ’s view (forecasts) on key metrics, such as inflation and growth.

US employment situation report

Another key risk event this week is Friday’s jobs report for July out of the US at 12:30 pm GMT. Early forecasts suggest that employment growth slowed to 175,000 in July from June’s reading of 206,000 (the estimate range is currently between 210,000 and 70,000). The unemployment rate is expected to have remained unchanged at 4.1% (the highest rate since late 2021), with average earnings anticipated to have cooled to 3.7% (from 3.9%) year on year.

Should we see further signs of a cooling jobs market, this could trigger a dovish rate repricing and weigh on the USD. Any broad upside surprise in data, however, may underpin a USD bid and prompt investors to pare back rate-cut bets.

The jobs data will be widely watched this week as investors look to determine the future rate path for the Fed. Focus will also be on Tuesday’s US JOLTs Job Openings data, Wednesday’s ADP non-farm employment change, and Thursday’s weekly jobless filings.

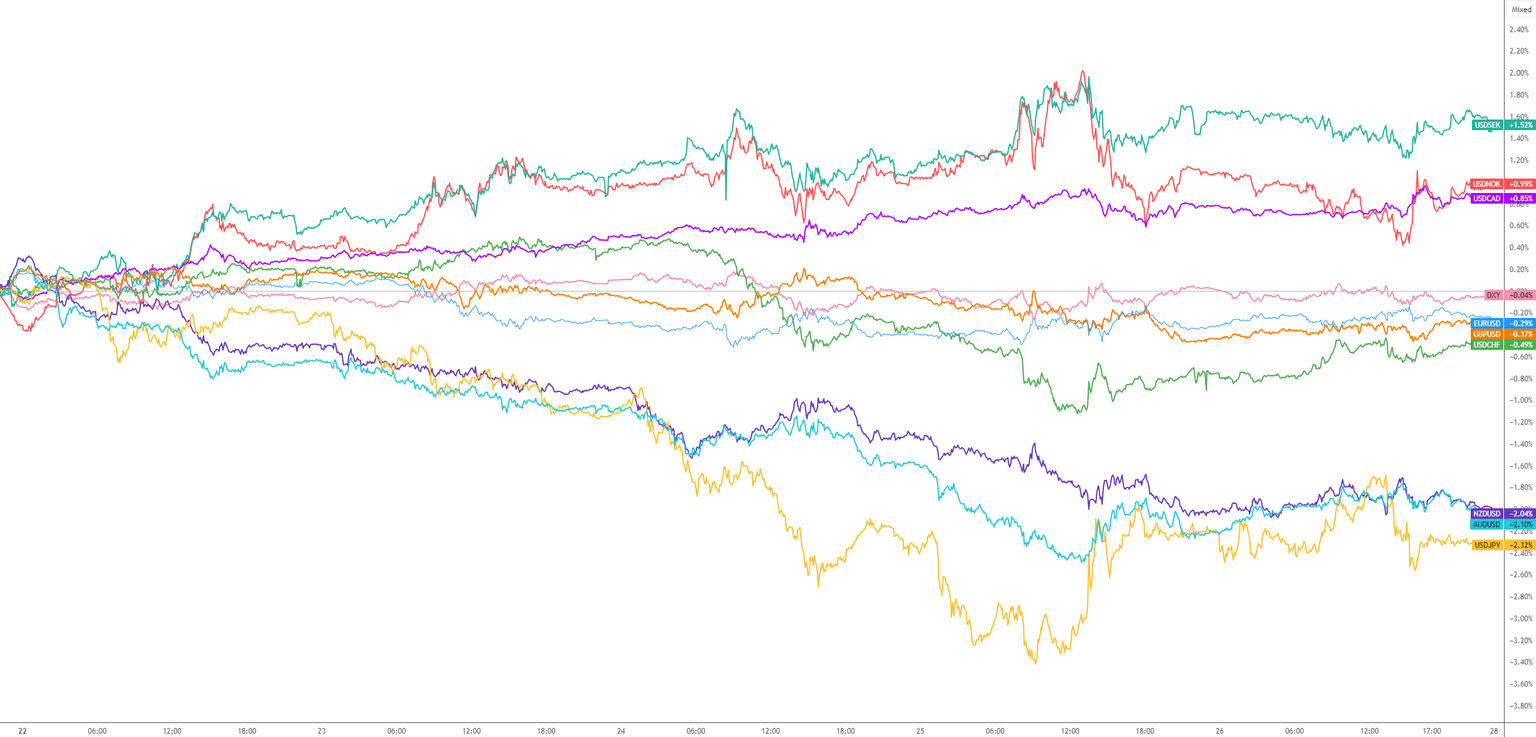

G10 FX (five-day change):

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,