Week Ahead: ECB and BoC to test taper waters, US CPI in spotlight too [Video]

![Week Ahead: ECB and BoC to test taper waters, US CPI in spotlight too [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/ECB/european-central-bank-building-in-frankfurt-am-main-56326962_XtraLarge.jpg)

The European Central Bank will pretend it is not thinking about tapering when it meets next week, while the Bank of Canada will take a step back to assess its recent decision to get the ball rolling on its QE exit process. As the two central banks set the stage for the FOMC meeting in the following week, the May CPI print out of America will catch the attention of the US dollar. In an otherwise quietish week, sterling will be hoping for a boost from the barrage of April production data that’s due in the UK.

Stronger euro brings out the dove in the ECB

The ECB had long pencilled in the June meeting as the right time to review the pandemic emergency purchase programme (PEPP). But although investors initially interpreted this as a sign that policymakers will reduce the pace of purchases, those expectations have now receded. So what will be the purpose of the review if no decision on tapering is on the cards on Thursday? The Bank will probably want to get its message across that it has no plans to end the PEPP programme early and that the Eurozone economy still needs plenty of accommodative policy even as ECB staff revise up the region’s growth forecasts.

Maintaining a dovish tone while sounding optimistic about the bloc’s recovery prospects will be difficult for Christine Lagarde when she briefs reporters. The PMIs for May were exceptionally strong, not just for manufacturing but for services as well, as virus curbs are further loosened. Moreover, the quickening vaccine rollout should hopefully ensure that the decisions to lift the lockdowns are not reversed in a few weeks’ or months’ time.

Faster growth, not to mention higher inflation (Eurozone CPI hit 2% in May) would normally be grounds for a hawkish turn, but Lagarde can always rely on the one thing that unites the doves and the hawks – a strong exchange rate. The euro is up around 4% from its end-of-March lows and Eurozone government bond yields have also risen substantially in the last couple of months. This has likely put the brakes on any thoughts of prematurely withdrawing some of the pandemic stimulus.

However, the ECB won’t be able to avoid the taper topic for long and unless policymakers give any hints as to what will happen after March 2022 when PEPP ends, any dovish talk on Thursday might only be a temporary setback for the euro.

On the data front, revised Eurozone GDP estimates are due on Wednesday, while a batch of stats out of Germany will be watched too, including industrial orders (Monday), industrial output (Tuesday) and the ZEW economic sentiment index (Tuesday).

Bank of Canada on hold for now

While the ECB meeting has a tinge of unpredictability to it and markets could overreact to the slightest change in language by either Lagarde or in the statement, the Bank of Canada’s policy decision on Wednesday is unlikely to cause much of a stir. The BoC became the first of the big central banks to get onto the stimulus exit path in April as the Canadian economy is recovering faster than expected, helped by vaccinations and a booming housing market.

Having reduced its weekly purchases of bonds twice in six months, the Bank is almost certain to stay on hold in June and although further tapering is not being forecasted before the autumn, an upbeat tone in the statement should be enough to sustain the Canadian dollar’s bullish bias until then.

US inflation to continue its alarming ascent

The consumer price index for May is the sole highlight of the US calendar. When the April CPI was published, the 10-year Treasury yield surged by almost 10 basis points as annual inflation shot up by a much bigger-than-expected 4.2%. Treasury yields have since drifted lower, so has the dollar. But another positive surprise could set off a fresh bond selloff, lifting both yields and the dollar as a number of Fed policymakers have hinted in recent days that it may be time to think about tapering.

The 12-month CPI rate is forecast to rise to 4.6% and the core rate to edge up to 3.4%.

However, ahead of Thursday’s CPI release, there could be some unexpected turbulence arising from the JOLTS job openings number on Tuesday. The April data might attract a bit more attention than usual because of the unexplainable miss in the nonfarm payrolls estimate of the same month. If job openings were strong in April, it would confirm suspicions that the generous unemployment benefits were keeping Americans at home rather than to seek work. That would be good news in the sense that the labour shortages being cited by businesses will be temporary, but it would also indicate that the jobs market is far healthier than what the NFP figures imply, reviving the case for an early taper.

Finally, the University of Michigan’s preliminary consumer sentiment reading for June will round up the week on Friday, potentially adding more upside for the dollar.

Reopening boost for UK GDP in April

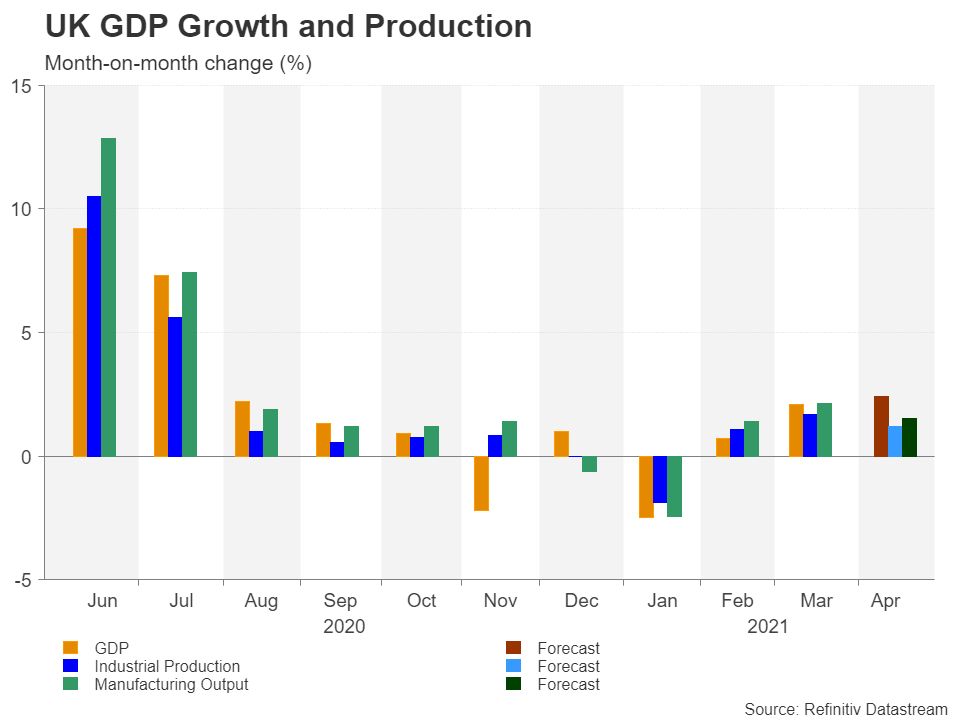

The $1.42 level is proving to be an impenetrable barrier for the pound, but will next week’s barrage of growth indicators be of much use in aiding it clear this hurdle? Probably not. The monthly prints on GDP, industrial output and trade are on the UK agenda on Friday. Given that non-essential retailers across England reopened their doors to the public in April, economic output is anticipated to have soared during the month. The PMIs suggest manufacturers also had a strong month.

Hence, there could be a bit of a lift from the data for sterling, though it’s the dollar that will likely be in the driving seat for cable. The US currency appears to be resisting further declines and is potentially reversing upwards, hence, reclaiming the $1.42 handle might have to wait a bit longer.

Elsewhere, it’s going to be a fairly uneventful week and so many traders might take to the sidelines early ahead of the June 15-16 FOMC meeting. Still there are some notable releases that could affect sentiment. Trade figures for May are due in China on Tuesday and will be followed by consumer and producer inflation numbers on Wednesday, and in Japan, revised Q1 GDP estimates are out on Tuesday, with corporate goods prices coming up on Thursday.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl