Week ahead – Dollar shines ahead of Nonfarm Payrolls [Video]

-

Dollar cruises higher, nonfarm payrolls on Friday will be crucial for this rally.

![Week ahead – Dollar shines ahead of Nonfarm Payrolls [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/money-9377516_XtraLarge.jpg)

-

Early indicators point to another solid month for the US labor market.

-

Central bank decisions in Australia and New Zealand will also be in focus.

Dollar goes on a rampage

The US dollar rally has gone into overdrive lately. Empowered by a stunning rise in US yields, solid economic fundamentals, and safe haven flows, the dollar has charged higher to record 11 consecutive weeks of gains against the euro.

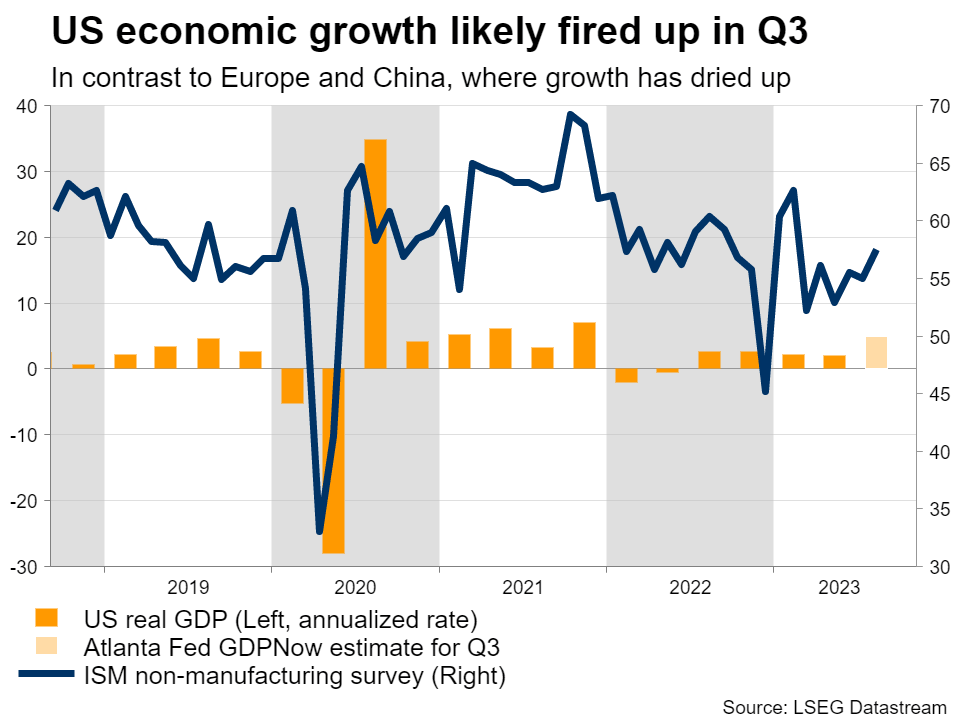

In a nutshell, the United States appears much more resilient than any other region. Incoming data releases continue to reaffirm the strength of the US economy, while in contrast, Europe is suffering a sharp slowdown in economic growth and China is still dealing with the implosion of its property sector.

This differential in economic growth is increasingly pushing investors towards the United States, and the impressive rally in US yields lately has made the dollar even more attractive from an interest rate perspective.

Hence, the dollar offers the ‘full package’ at the moment - the highest real rates among the major economies, the strongest economic growth, and safe haven qualities thanks to its reserve currency status. Meanwhile, there’s a lack of attractive alternatives in the FX arena, as every other major currency is dealing with its own problems.

Next week’s data releases will either add more fuel to this rally or trigger a correction, with the main event being the US employment report on Friday. Forecasts suggest nonfarm payrolls rose by 150k in September, less than the previous month but still a decent number overall.

Meanwhile, the unemployment rate is projected to have ticked back down to 3.7%, while wage growth is expected to have picked up some steam in monthly terms. If the forecasts are met, this would be yet another dataset reinforcing the Fed’s message that interest rates could remain higher for longer.

As for any surprises, most early indicators point to another solid month for the US labor market. Applications for unemployment benefits fell sharply in September, so there were no signs of any mass worker layoffs. Similarly, business surveys from S&P Global signaled a reacceleration in employment growth.

Speaking of business surveys, the ISM manufacturing index is due on Monday, ahead of the non-manufacturing PMI on Wednesday. In the political scene, the government will shut down this weekend unless a funding deal is reached in Congress. That said, markets usually ignore these shutdowns, as investors view them as political theater. For markets to care, it would need to be a prolonged shutdown that dampens economic growth.

RBA and RBNZ decisions

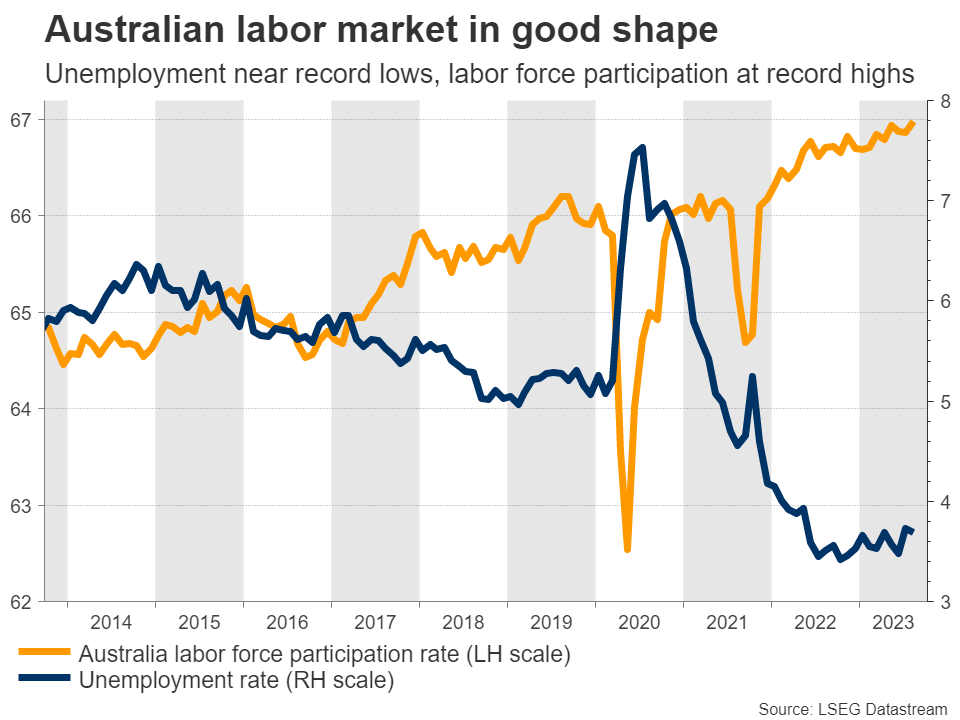

Crossing into Australia, the Reserve Bank will conclude its meeting early on Tuesday, the first one under the new Governor, Michelle Bullock. Even though data releases have been rather strong lately, with the labor market enjoying a substantial recovery in August and inflation reaccelerating, markets assign less than a 10% probability to a rate increase.

That’s mostly because the latest signals from the central bank itself show a preference for keeping rates unchanged. The latest RBA minutes preached patience, as rates have already risen quickly and the full impact of all this tightening has not been felt yet.

A decision to keep rates unchanged would argue for a negative reaction in the Australian dollar, but nothing dramatic, as this is the market’s baseline scenario already.

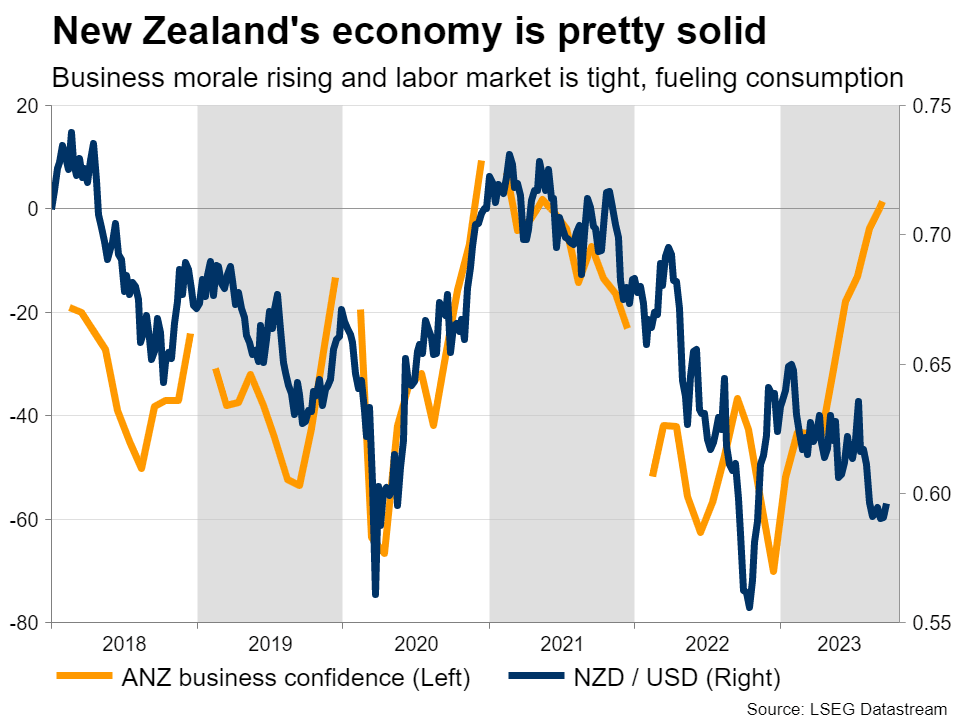

In neighboring New Zealand, the central bank will announce its own decision on Wednesday. The market-implied probability for a rate increase is also around 10%, but it might still be an exciting event as the economy has outperformed expectations lately. Hence, the question is whether the RBNZ will set the stage for another rate hike in November.

Inflation seems to be gaining momentum again. Even though inflation cooled a little in the second quarter, the jobs market remained very tight, with record levels of labor force participation and an explosion in population growth helping to boost demand. In addition, the depreciation of the New Zealand dollar in recent months coupled with the sharp rise in oil prices will also help to refuel inflation.

Against this backdrop, the RBNZ will likely keep rates unchanged, but perhaps signal that a rate increase in November is a real possibility. Markets assign a 60% chance to that scenario, and if this probability moves any higher in the aftermath, it could lift the currency somewhat.

That said, there’s an election in two weeks, so the risk is that the RBNZ does not deliver any clear signals, to avoid interfering. Either way, the general outlook for the kiwi dollar seems grim, even if the currency spikes higher after the RBNZ. The slowdown in global growth and the deterioration in risk sentiment will likely keep a lid on any rallies.

Chinese data releases will be in focus too. China is the largest trading partner of both Australia and New Zealand, so these currencies are very sensitive to developments in China, where the latest business surveys will be released over the weekend.

Elsewhere, Japan’s Tankan business survey for Q3 will hit the markets on Monday, while in Canada, the employment report for September will see the light on Friday.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service