Week ahead – CPI and PMI data flood the agenda, earnings also in focus [Video]

-

US CPI and PMI data to test dovish Fed cut bets.

-

UK inflation figures may impact chances of another BoE cut in 2025.

-

Canadian and Japanese CPI numbers are also due out.

-

Eurozone flash PMIs could revive ECB rate cut expectations.

![Week ahead – CPI and PMI data flood the agenda, earnings also in focus [Video]](https://editorial.fxsstatic.com/images/i/CPI_3_XtraLarge.png)

Investors maintain dovish Fed cut bets

The dollar began the week on a strong footing, buoyed initially by US President Trump’s weekend remarks aimed at tempering concerns over a potential escalation in US-China trade tensions. However, the greenback quickly relinquished its gains after Fed Chair Jerome Powell struck a dovish tone, reinforcing investors’ expectations of aggressive rate cuts down the road.

The Fed Chief observed that the labor market remained subdued, adding that the assessment was based on private-sector data in light of the ongoing government shutdown and the resulting lack of official releases. While he suggested that sufficient information may still be available to support an informed policy decision at the upcoming meeting, he cautioned that a prolonged shutdown could further obscure the economic outlook.

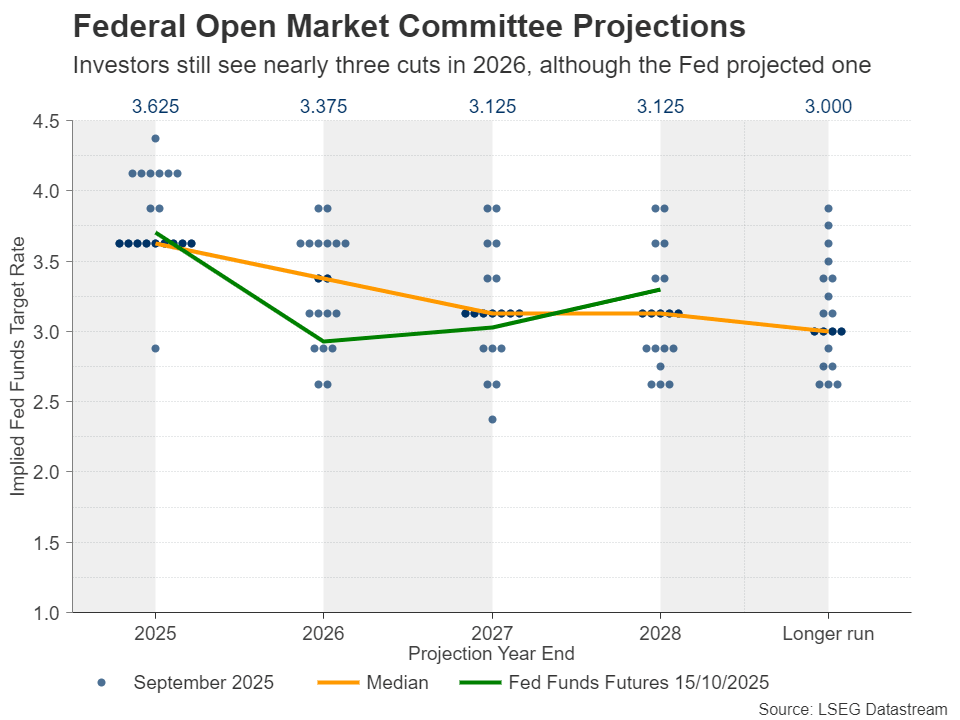

His comments allowed market participants to maintain expectations of two additional quarter-point rate cuts this year, while nearly fully factoring in another three in 2026. This stands in sharp contrast to the Fed’s latest dot plot, which indicated only a single cut next year, and underscores the potential for heightened volatility should forthcoming data tilt sentiment in either direction.

In addition to acknowledging labor market weakness, Powell noted that the economy appears to be “on a somewhat firmer trajectory than expected”, implying that they may not proceed as forcefully as markets anticipate, particularly if data continues to indicate economic resilience and the government reopens.

US CPI and PMI data enter the spotlight

With this context in mind, dollar traders may turn their attention to next Friday’s US CPI data for September – set to be released on Friday even if the government shutdown persists – alongside the S&P Global PMIs for October.

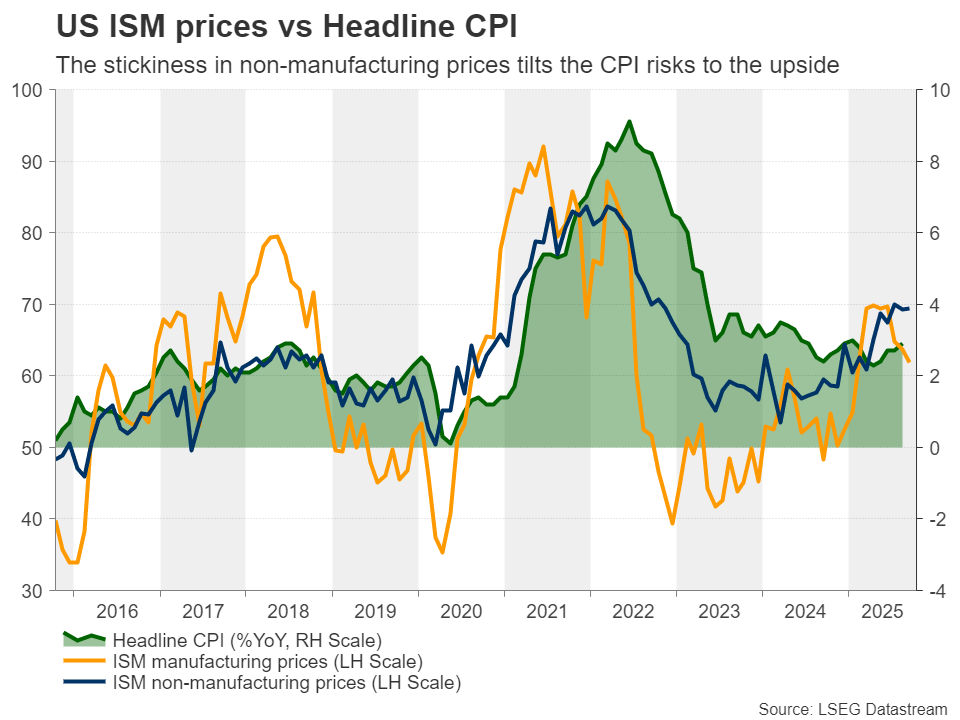

According to the ISM PMI reports for September, prices charged in the manufacturing sector continued to decelerate, but the corresponding non-manufacturing subindex saw a modest uptick. Given that non-manufacturing activity represents roughly 90% of US GDP, Friday’s inflation data may exhibit some persistence. Indeed, the Cleveland Fed CPI Nowcast model pointed to a 3% y/y inflation rate, slightly above August’s 2.9%.

Therefore, sticky inflation, coupled with PMIs supporting Powell’s view that the economy continues to fare well, may lead investors to temper their aggressive rate cut bets and scale back anticipated reductions for next year. This could prove positive for the US dollar. The opposite may be true in case inflation decelerates.

Did UK inflation accelerate as the BoE projected?

Pound traders are also facing a busy week, with September’s CPI data slated for release on Wednesday, followed by retail sales for the same month and the preliminary S&P Global PMIs on Friday.

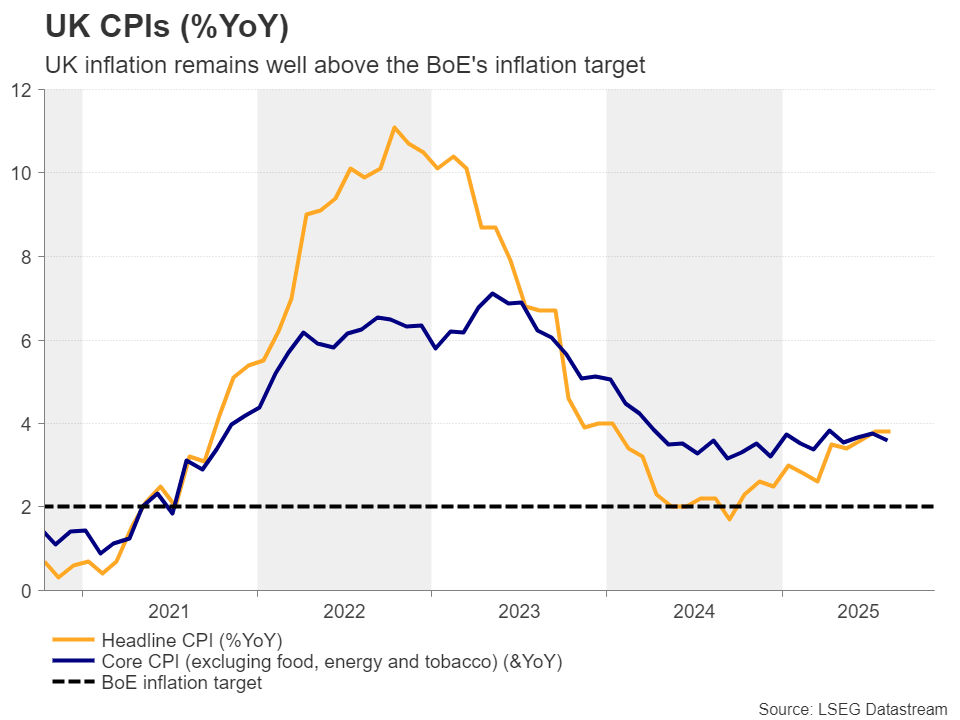

At its latest gathering, the Bank of England maintained its Bank Rate at 4% via a 7-2 vote, with the two dissenters advocating a 25bps reduction. The accompanying statement highlighted that the Bank’s monetary policy stance has become less restrictive and that a gradual and careful approach to further easing remains appropriate. Although officials acknowledged ongoing underlying disinflation, they noted that there was greater progress in easing wage pressures than prices.

Indeed, this week’s employment data revealed that average earnings excluding bonuses continued to ease, though the y/y rate remained elevated at 4.7%. The unemployment rate rose to 4.8% from 4.7%, prompting market participants to assign a nearly 50% chance of another 25bps rate cut by December. Such a policy move is nearly fully priced in for February, while one more same-sized reduction is anticipated by the end of 2026.

What may have also influenced the latest dovish tilt in market expectations were remarks by UK Chancellor Rachel Reeves, who indicated that she is considering tax increases and spending cuts in the autumn budget, scheduled for announcement on November 26.

Tighter fiscal policy creates room for a more accommodative stance, yet the BoE’s next steps will hinge largely on next week’s inflation data. The Bank itself projected that inflation is expected to increase slightly in September from 3.8% y/y in August. Should Wednesday’s CPI report confirm this, investors may scale back their rate cut bets, thereby injecting fuel into the pound’s engines. A set of encouraging retail sales and PMIs may add extra credence to the idea that policymakers should not rush into lowering borrowing costs.

Canada and Japan CPI figures to shape BoC and BoJ expectations

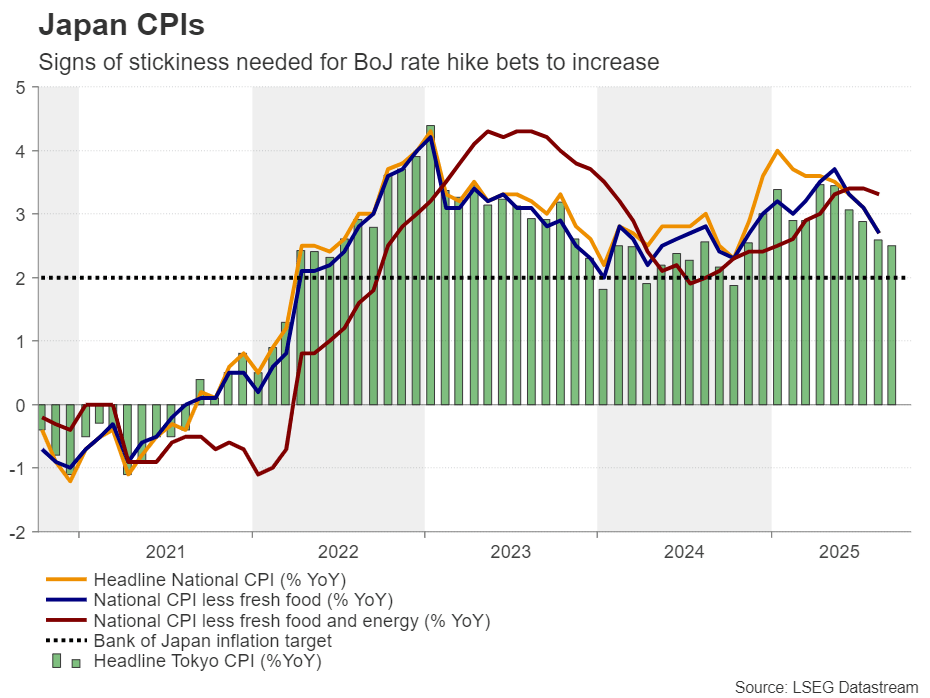

CPI figures will be released from Canada and Japan as well, on Tuesday and Friday, respectively.

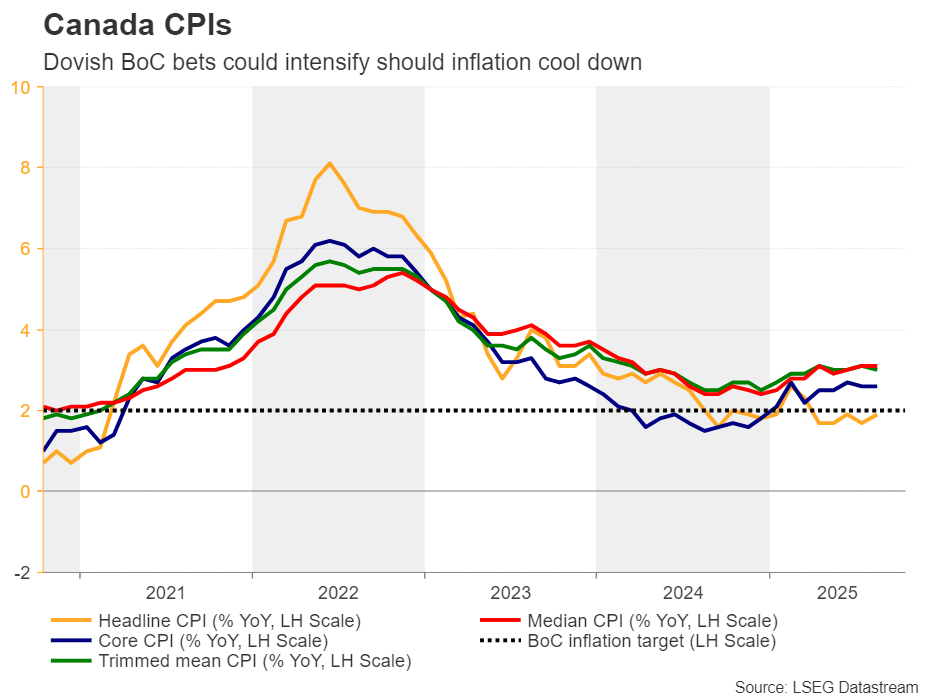

Getting the ball rolling with Canada, on September 17, the Bank of Canada lowered interest rates by 25bps – the first reduction since March – citing a weaker economy and a rising unemployment rate. The market was quick to price in at least one additional rate cut for the foreseeable future, assigning a 60% probability to a move on October 29. A slowdown in the CPIs could take that probability higher and perhaps hurt the loonie.

In Japan, the likelihood of a Bank of Japan rate hike at the turn of the year has risen again to 65% amid political deadlock. Fiscal dove Sanae Takaichi, recently elected leader of the Liberal Democratic Party (LDP), has reportedly lost support from Komeito, the coalition partner, adding uncertainty to the policy outlook.

Takaichi’s election initially raised speculation that the BoJ may delay its rate hike process, but the stalemate has led investors to restore their rate hike bets. Combined with the risk-aversion triggered by the renewed trade tensions between the US and China, these factors allowed the yen to recover decent ground. That said, for the Japanese currency to continue its upside trajectory, Friday’s inflation data may have to surprise to the upside, something that could increase the probability of a BoJ rate hike in the coming months even further.

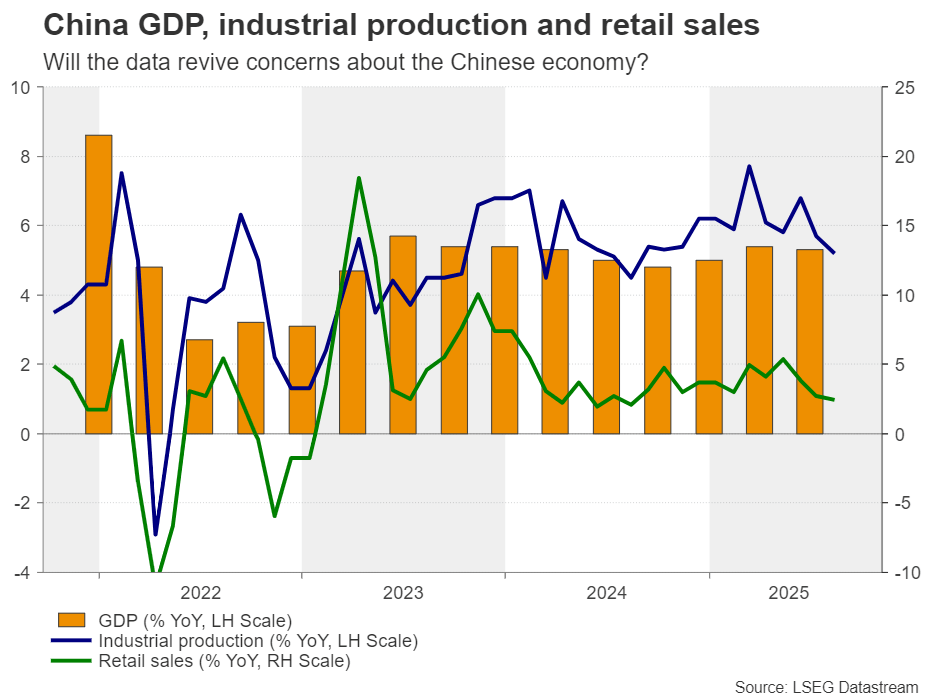

China GDP in focus amid US-China trade frictions

Speaking of China, on Monday, the world’s second largest economy will release GDP data for Q3, alongside industrial production, fixed asset investment, retail sales, and the unemployment rate, all for September.

Consumer prices fell more than expected in September and although producer prices improved, they remained in deflationary territory, highlighting weak domestic demand and trade anxiety. Another set of data suggesting that the economy is struggling could intensify calls for more stimulative measures by Chinese authorities – especially following the latest trade spat with the US – and could thereby weigh on aussie and kiwi, given that China is the main trading partner of both Australia and New Zealand.

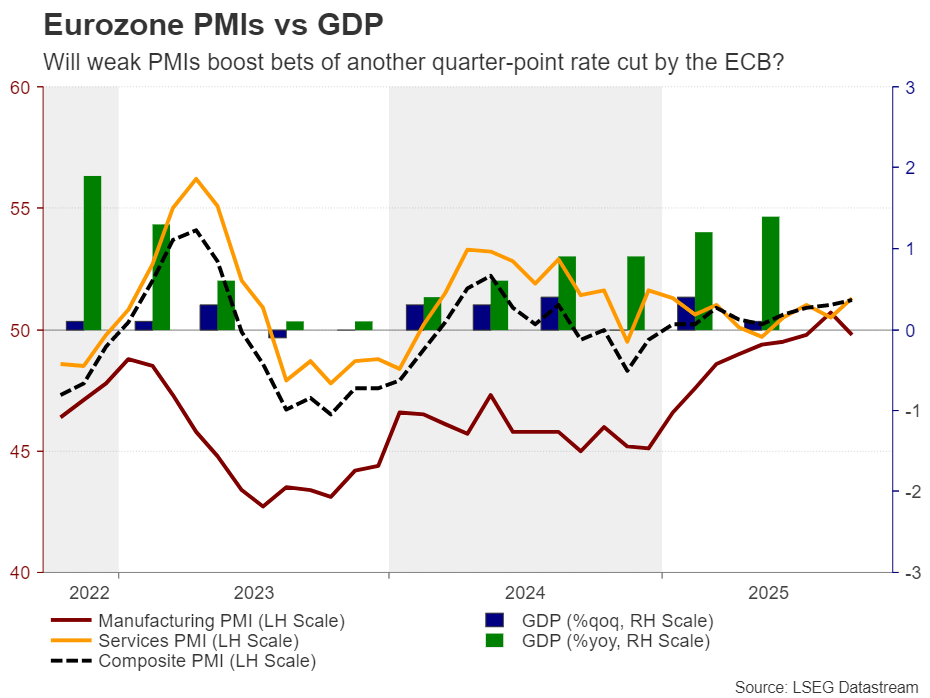

Will the EZ PMIs confirm that the ECB is done cutting rates?

In the Eurozone, the preliminary S&P Global PMIs for October may set the tone for the euro, which took a hit lately following the gridlock in French politics. However, in terms of ECB monetary policy, the market is not fully factoring in any additional rate cuts. There is nearly a 70% chance of another 25bps reduction by July 2026, which means that some investors believe the ECB is done with easing policy.

Indeed, several ECB policymakers have emphasized that there is no reason to adjust rates in the coming months. That said, Governing Council member Villeroy said this week that the Bank’s next move is likely to be a cut rather than a hike. Combined with previous remarks by Vice President de Guindos regarding the NEER euro rate, which is hovering at record highs, this suggests that any signs that a strong euro is affecting trade and the broader economy could spark speculation of a contingency cut in the foreseeable future, and thereby take euro/dollar lower. Soft PMIs could trigger the first wave of such concerns.

Earnings season continues with Netflix and Tesla results

Besides the aforementioned macro data, next week’s agenda includes earnings results from Netflix and Tesla.

Netflix will draw particular attention following Elon Mask’s call for his followers to cancel their subscriptions over controversy regarding an animated show and its creator. Nonetheless, the backlash might not be a big headache for the streaming giant, as Mask’s remarks came too late to meaningfully impact subscriber counts. What’s more, the fourth quarter of 2024 marked the last reporting of this metric before the company shifted priority to revenue over user growth.

As for Musk’s own company, the results are likely to center around vehicle deliveries and auto profit margins. The firm has already announced a record 497,099 vehicle deliveries in Q3 2025, which marks a 7% increase from the same quarter last year. Based on that, strong revenue metrics may be reported, likely providing support for the company’s stock price.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.