V-shape scenario for global growth on back of coronavirus

In this document, we take a closer look at what to expect from economic data in coming months following the spread of the coronavirus.

We expect a big hit to Chinese growth in Q1 and PMI should nosedive in February. However, we look for a sharp rebound of PMI in Q2. Quarter-on-quarter GDP growth could fall to around zero in Q1 but should move up again in Q2 and Q3.

The rest of the world will also feel the impact due to lower Chinese demand and supply-chain disruptions. In particular, a sharp decline in tourism is likely to affect the rest of Asia.

We see signs that global inventory levels were low going into 2020. These could become even lower due to supply disruptions. This points to a decent rebound once the cycle turns up again following an initial dive.

Our scenario assumes that the spread of the virus slows down in February and is contained by March/April. While there are early signs of a slowing spread of the disease, uncertainty relating to our predictions is very high.

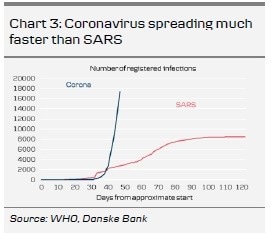

The rapid spread of the coronavirus has triggered big uncertainty over the global outlook from the beginning of 2020. The virus has proven more contagious than SARS was in 2003 and the level of infections is already far above the peak of SARS cases (see Chart 3).

While this looks dramatic, we see tentative signs that the rate of increase is slowing down. The daily increase is now below 20%, down from 50% last week. This is in line with views of scientists in China that the rate of increase should peak within a week. Uncertainty is high but we base our scenario on this view.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.