USD/CAD rebounds off 3-month low, looks oversold [Video]

![USD/CAD rebounds off 3-month low, looks oversold [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/canadian-currency-4020670_XtraLarge.jpg)

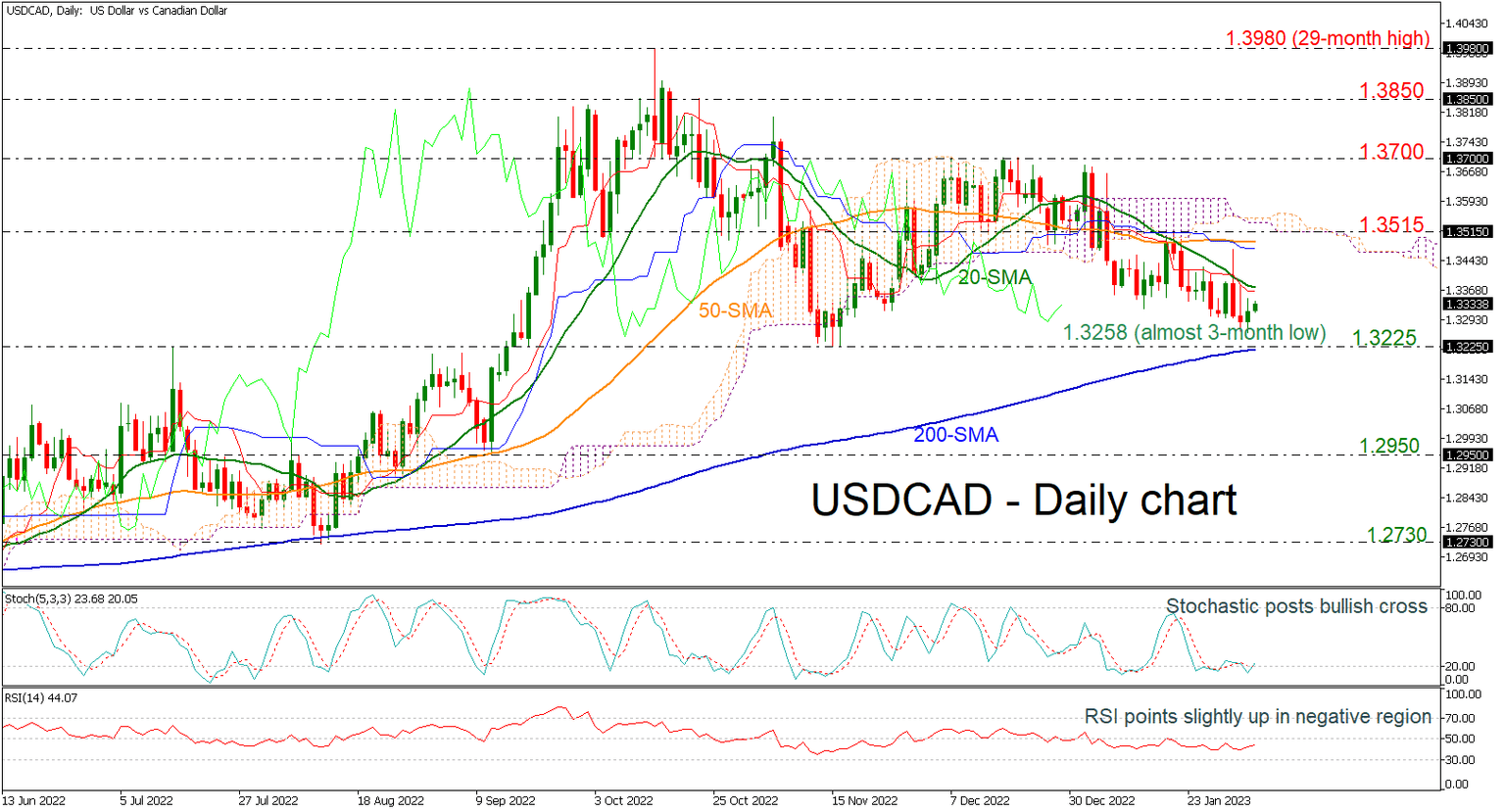

USDCAD has declined considerably after touching the 1.3700 round number, losing more than 3%. During Thursday’s trading session, it posted an almost three-month low of 1.3260, while it is currently not far above that nadir.

The negatively aligned Tenkan- and Kijun-sen lines serve as a testament to the negative short-term momentum that is in place. The Chikou Span, though, is signaling a potentially oversold market; a near-term reversal should thus not be ruled out. The RSI is heading north in the negative region, while the stochastic oscillator posted a bullish crossover within its %K and %D lines in the oversold territory.

Immediate support to further declines may be taking place around the 1.3225 figure, which overlaps with the 200-day simple moving average (SMA). Below that, the 1.2950 barrier could provide additional support in case of steeper losses.

A move to the upside may meet resistance around the 20-day SMA at 1.3375 before challenging the 50-day SMA at 1.3490 and the 1.3515 barrier. The region around the 1.3700 handle could act as an additional level in case of stronger bullish movement.

The short-term picture is looking predominantly bearish at the moment, with price action taking place below the 20- and 50-day SMAs, as well as below the Ichimoku cloud. Any moves beneath the 200-day SMA could switch the longer-term outlook to negative as well.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.