USD trades softer as markets adjust to Fed rhetoric

EUR/USD Finds Support Off The Trend Line

The euro currency is paring losses following the Fed meeting.

Prices fell to a five-week low before recovering. This coincides with the trend line from which the common currency is reversing losses.

Further continuation to the upside could see the 1.1900 level being challenged once again.

With the trend turning flat above 1.1715, we expect this sideways pattern to hold.

A strong close above 1.1900 will be needed to confirm the upside.

This needs to be followed through with the breakout above 1.2000 for any further signs of the uptrend resuming.

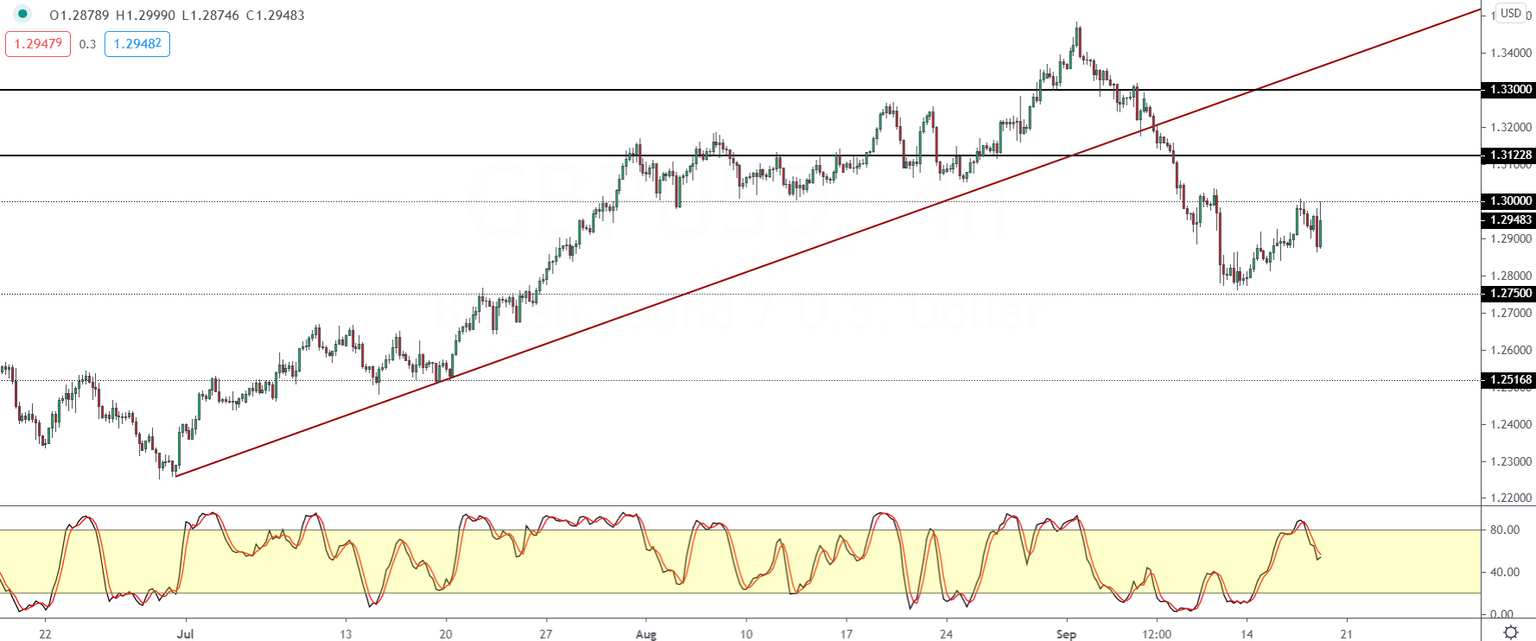

GBP/USD Trades Mixed On BoE Meeting Outcome

The British pound sterling is trading mixed, albeit price action is attempting to pull back from the intraday lows.

The declines were offset by the BoE meeting where officials hinted that they were open to negative rates.

This saw GBPUSD declining after failing to breakout above the 1.3000 handle.

However, as prices touched intraday lows of 1.2865, a strong reversal has made up some of the loses.

The Stochastics oscillator is likely to push higher as well, suggesting upside momentum building up.

Watch for a breakout above 1.3000 which will see further gains to 1.3122 level next.

WTI Crude Oil Back Near Familiar Resistance

Oil prices made up for the losses set off last week. After breaking past the 38.83 level which did not offer much resistance, price action pulled higher.

Late in the US trading session, oil prices briefly tested the 41.00 level before pulling back modestly.

But given the bullish momentum, a breakout above the 41.00 level is likely.

This will put the upside toward the 42.00 price level next.

The close above 38.83 also diminishes the downside bias in oil markets. That is unless we see a break down below 38.83 once again.

Gold Prices Somewhat Weaker After Fed Meeting

The precious metal is on track to close in the red on Thursday. However, the pace of declines is limited following the initial reaction.

Gold prices closed with modest gains on Wednesday, only to reverse those gains on Thursday.

The bearish candlestick pattern could signal a continuation to the downside. However, with the price level near 1900 holding strong for the moment, gold prices might see some consolidation.

To the upside, the 1967 region is proving hard to break. As a result, the sideways range could continue in the near term.

But giving some weight to the upside is the Stochastics which is currently reversing off the oversold levels.

Watch for gold prices to break out above 1967 for any further gains to come.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.