USD/JPY Weekly Forecast: When the stars align and consumers celebrate

- Rising intermediate and long-term US Treasury rates help to propel the USD/JPY.

- American consumer spending and income data jumps in January.

- Japanese economic and consumer statistics in January remain moribund.

- Technical momentum shifting higher, moving averages forming support.

- FXStreet Forecast Poll suggests limited room for USD/JPY gains.

The USD/JPY was the standout in a week of middling dollar performance, rising in the three mid-week sessions, consolidating those gains on Friday, and finishing above 106.00 for only the third time since early October.

Once again it was US and dollar events that shaped the week's trading.

American Treasury rates at the intermediate to long side of the yield curve have increased markedly this year. The 5-year bond has gained about 40 basis points to 0.77% (2/25), the 10-year 60 points to 1.518 (2/25) and the 30-year 66 points to 2.308%. All three are at at their pandemic highs.

At the short end of the spectrum, where the Fed has concentrated its efforts to repress interest rates, the 2-year bond has added but 3 points to 0.154% (2/25).

Credit markets are pricing strengthening US and global recoveries with evidence from the US retail sector and commodity prices.

In the US consumers appear ready to celebrate the end of the pandemic.

Durable Goods Orders jumped 3.4% in January, triple the 1.1% forecast and Retail Sales soared 5.3%. Excluding the up and down around the spring lockdowns, that was the second highest monthly retail increase in a generation. American families are set to receive another $1400 in government grants on top of the $600 that helped fuel the January burst of spending. Personal Income jumped 10% in January up from 0.6% in December, reflecting the December stimulus awards.

In Japan the economic data improved, but only by being less negative. Retail Trade (sales) fell 0.5% on the month in January, better than December's -0.7%, but not much else. On the year Trade dropped 2.4% and December was revised to -0.2% from -0.3%. These are not the figures of recovery.

USD/JPY outlook

The sharp rise in real interest rates in the US (yield -inflation) has been the largest factor in the ascent of the USD/JPY this year. Even though the dollar overall has had a nondescript two months, the Dollar Index is up a paltry 0.7% since December 31, the USD/JPY has gained 3.1% since the beginning of he year.

American economic statistics in January show, pending confirmation in February and beyond, a consumer itching to resume a normal life. Interest rates reflect that expectation as do equity prices and in a broader sense, global commodity prices.

Technically, the January 27 break of the pandemic down channel is history. All three moving averages, 50, 100 and 200-day have been crossed in the USD/JPY ascent, the 200-day most recently on Wednesday. Resistance lines have been readily passed on the rise and are now active support.

There has been no indication from the US Federal Reserve that it is concerned about the increase in medium to long-term yields, even as Chairman Jerome Powell promises to keep rates low until the recovery is complete. These gains are an accurate representation of the prospects for the American economy.

Fundamental and technical view mesh, the USD/JPY is headed higher.

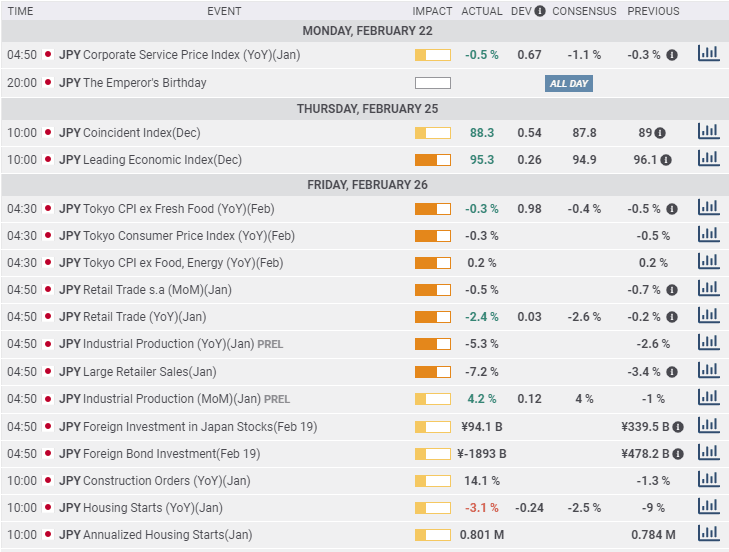

Japan statistics February 22-February 26

Tokyo consumer prices dropped a bit less than expected in February, Retail Trade (sales) was slightly less negative in January than forecast and Industrial Production was better. The improved amounts were 0.2% or smaller and the market effect nil.

Monday

The Corporate Service Price index (CSPI) from the Bank of Japan, which measures the price of services traded among companies, fell 0.5% in January, half its -1.1% estimate and close to December's -0.4%.

Thursday

The Coincident and Leading Economic Indexes fell slightly in December to 88.3 and 95.3 respectively from 89 and 96.1 in November.

Friday

Retail Trade (sales) for January sank 0.5% (MoM) and December was revised to -0.7% from -0.8% . Annual Retail Trade fell 2.4% on a -2.6% estimate. Large Retailer Sales fell 7.2% in January and December was revised to -3.4% from -3.5%. Industrial Production rose 4% in January (MoM), 4% was forecast after -1% in December. Annual production fell 5.3% and -2.6% in December. Housing Starts sank 3.1% to 801,000, -2.5% had been predicted. Starts in December were -9% and 784,000. Tokyo CPI for February: headline -0.3% January -0.5%, core 0.2% January 0.2%, ex Fresh Food -0.3%, forecast -0.4%, January -0.5%, all year-over-year.

FXStreet

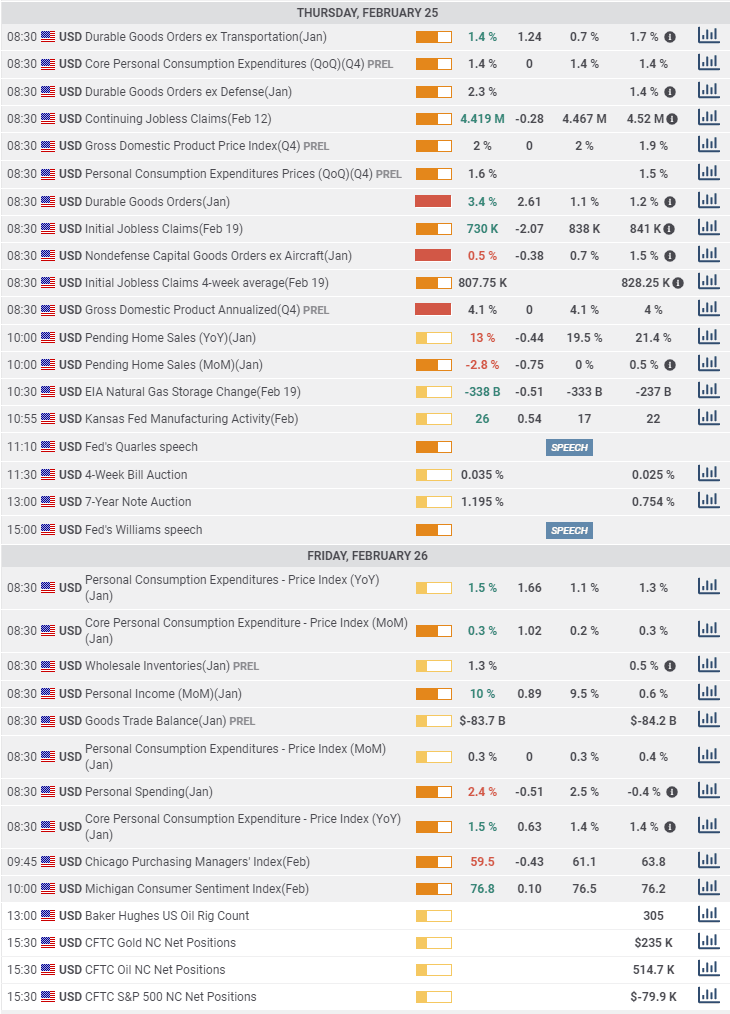

United States statistics February 22-February 26

Federal Reserve Chairman Jerome Powell's Congressional testimony on Tuesday and Wednesday reassured markets that even if all goes well and the economy sees the a growth spurt in the next few quarters that the bank expects policy will remain accommodative for some time. Durable Goods confirmed the Retail Sales surge in January, the housing market continued hot and Personal Income rose the most since April.

Monday

Dallas Fed Manufacturing Business Index for February rose sharply to 17.2 from January's 7. The forecast was 8.3.

Tuesday

Case-Schiller Home Price Index (YoY) increased 10.1% in December, just over its 9.9% forecast and November's 9.2% rate. Richmond Fed Manufacturing Index for February was 14 as expected. Conference Board Consumer Confidence at 91.3 in February was better than January's revised 88.9 reading.

Wednesday

New Home Sales rose 4.3% in January, double the 2.1% projection to 923,000 annually from 885,000.

Thursday

Durable Goods Orders in January jumped 3.4%, on a 1.1% forecast and December was revised to 1.2% from 0.2%. Durable Goods Orders ex Transportation rose 1.4% on a 0.7% prediction and December was adjusted to 1.7% from 0.7%. Nondefense Capital Goods ex Aircraft: January 0.5%, forecast 0.7%, December 1.5% from 0.6%. Initial Jobless Claims for February 19 week 730,000, estimate 838,000, prior week 841,000. Continuing Claims for February 12 week 4.419 million, prior 4.52 million. Gross Domestic Product (GDP) for the fourth quarter 4.1% as expected from 4%.

The Kansas Fed Manufacturing Activity Index for February was 26: forecast 17, January 22.

Friday

The Personal Consumption Expenditure Price Index (PCE): January 0.3% (MoM) and 1.5% (YoY), forecast 0.3% and 1.1%, December 0.4% and 1.3%. Core PCE Index: 0.3% (MoM) 1.5% (YoY), forecast 0.2% and 1.4%, December 0.3% and 1.4%. Personal Income: January 10%, forecast 9.5%, December 0.6%. Personal Spending: January 2.4%, forecast 2.5%, December -0.4%. Wholesale Inventories: January 1.3%, December 0.5% from 0.3%.

FXStreet

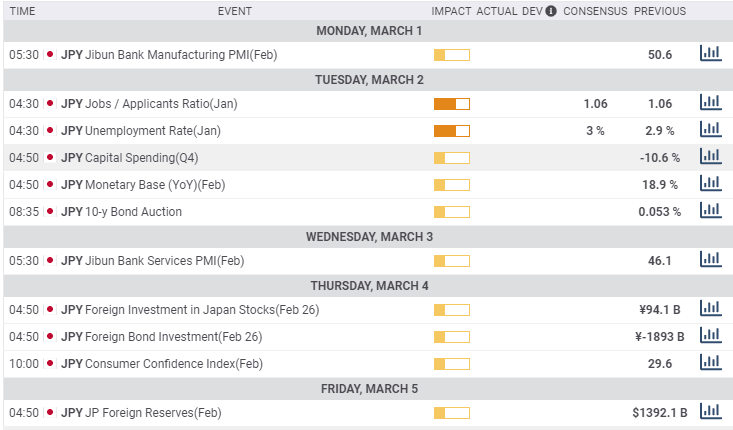

Japan statistics March 1-March 5

Consumer Confidence has reversed lower in December and January from November's pandemic high. With the global economy looking to soar will the Japanese consumer get onboard?

Monday

The Jibun Bank Manufacturing PMI revision for February: first release 50.6.

Tuesday

The Unemployment Rate for January is forecast to rise to 3% from 2.9% and the Jobs/Applicants Ratio is expected to be unchanged at 1.06%.

Wednesday's

The Jibun Bank Services PMI revision for February: first release 46.1.

Thursday

Consumer Confidence for February; January 29.6.

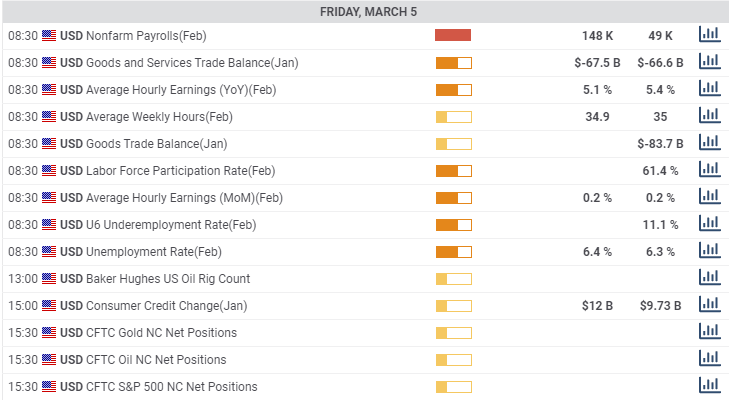

United States statistics March 1-March 5

Nonfarm Payrolls followed by the ISM Indexes for Services and Manufacturing and the Fed's Beige Book assessment for the March 16-17 meeting are center stage. Markets expect a US growth acceleration in the next few months and will be looking for its earliest signs.

Monday

ISM Manufacturing PMI for February is forecast to be 58.9 in February, little different than January's 58.7. The Price Index is expected to fall to 77 from 82.1. The Employment Index was 52.6 in January and the New Orders Index was 61.1. Construction Spending is projected to fall 0.7% in January after 1% in December.

Tuesday

Total Vehicle Sales for February: January 16.6 million annualized.

Wednesday

ADP Employment Change for February is expected to produce 168,000 positions. January was unexpectedly strong at 174,000. ISM Services PMI is predicted to be unchanged at 58.7 in January. The Employment Index was 55.2 in January, February is forecast at 51.7, New Orders at 61.8 forecast 55.4, and Prices 64.2, forecast 64.7. The Fed Beige Book anecdotal rendering of the economy for the March 16-17 FOMC meeting is out at 2:00 pm EST.

Thursday

Initial Jobless Claims for the February 26 week are predicted to rise to 755,00 from 730,000. Continuing Claims February 19 week: prior 4.419 million. Factory Orders are predicted to climb 1.9% in January from 1.1% in December.

Friday

Nonfarm Payrolls are forecast to add 148,000 new positions in February after 49,000 in January. The Unemployment Rate (U-3) is expected to rise 0.1% to 6.4%. The Underemployment Rate (U-6) was 11.1% in January. Average Hourly Earnings are projected to rise 0.2% on the month and 5.1% on the year in February from 0.2% and 5.4% in January. The Labor Force Participation Rate was 61.4% in January. Consumer Credit is anticipated to expand $12 billion in January after climbing $9.73 billion in December.

FXStreet

USD/JPY technical outlook

The USD/JPY passed the 38.2% Fibonacci of the March to January pandemic decline on Thurdsay, less than one month after the reversal and is just 40 points short of the 50% mark at 106.92. The 21-day average at 105.33 and the 200-day at 105.45 reinforce support at 105.40. The 100-day average is at 104.40.

Crossing the 200-day average on Wednesday represents the long-term shift higher in the USD/JPY and is the most significant of the three averages that moved from resistance to support in this breakout. The Relative Strength Index at 69.02 borders overbought territory but, given the steepness of the ascent is probably not yet a sell signal. The resistance at 107.00 is the most substantial as it coincides with the 50% Fibonacci but it will likely be challenged early in the coming week.

The technical momentum of the USD/JPY is higher, support is firm and backed by an array of indicators.

Resistance: 106.70; 107.00; 107.35; 107.60; 108.00

Support: 106.30; 106.00; 105.65; 105.40; 105.00; 104.60

USD/JPY Forecast Poll

This week's strong move higher in the USD/JPY has convinced the FXStreet Forecast Poll analysts that in the near term the pair is bid. The reluctance to carry that prediction further seems unusual. The change in US interest rates is not likely to be reversed unless the economy inexplicably falters. The real rate advantage accruing to the US dollar in the USD/JPY should be sufficient to carry the pair back to 108.00.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.