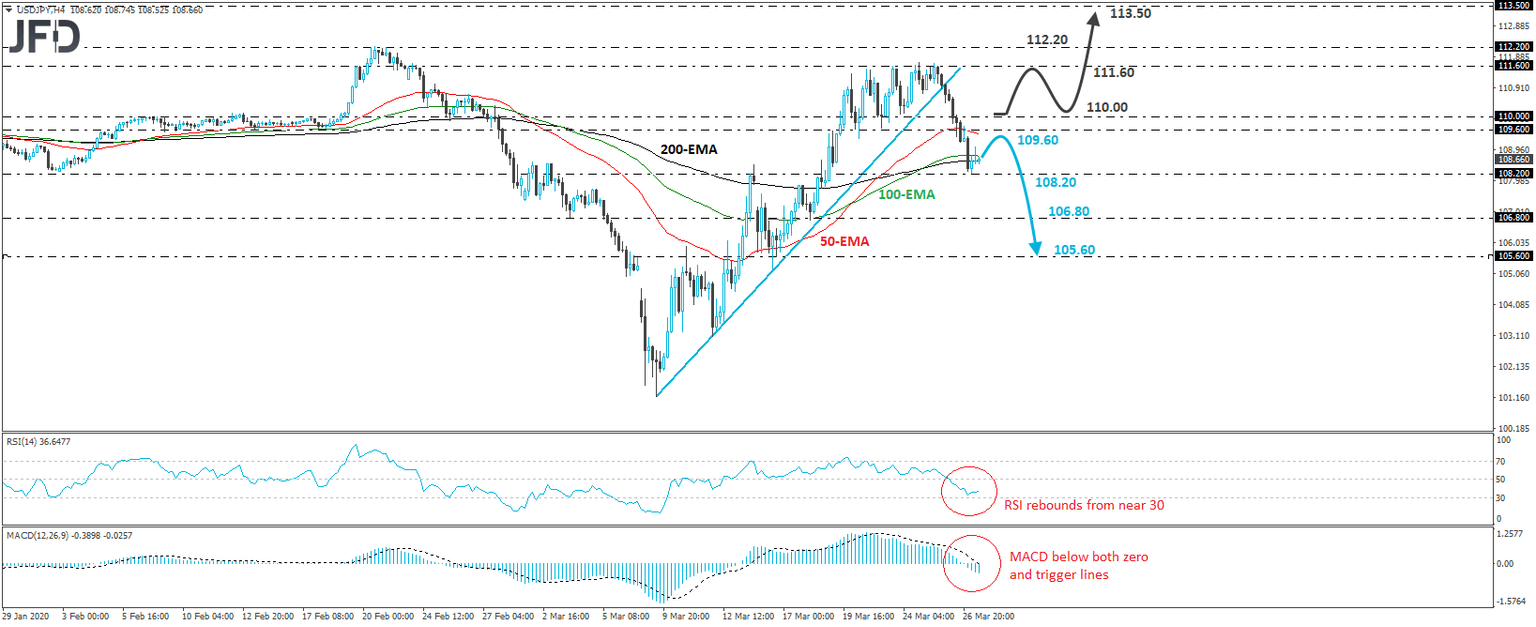

USD/JPY trades below the 110.00 barrier

USD/JPY has been in a sliding mode since Wednesday, when it once again hit resistance near the 111.60 barrier. Yesterday, the rate slid below the short-term uptrend line taken from the low of March 9th, and then, below the psychological round figure of 110.00. Thus, having all these technical signs in mind, we would consider the short-term outlook to be cautiously negative.

Today, the rate hit support near 108.20 and rebounded somewhat, which suggests that some further recovery may be on the cards before the next leg south, perhaps for a test near the 109.60 hurdle. If the bears decide to take charge from there, then we may see them aiming for the 108.20 support again, which if broken may allow declines towards the 106.80 obstacle, marked by the low of March 18th. Another break, below 106.80, may carry more bearish implications, perhaps paving the way towards the 105.60 territory.

Taking a look at our short-term oscillators, we see that the RSI rebounded from slightly above the 30 mark, while the MACD, although below both its zero and trigger lines, shows signs that it could start bottoming soon. Both indicators detect slowing downside speed, supporting the idea of some further recovery before, and if, the bears decide to shoot again.

In order to abandon the bearish case, we would like to see a strong recovery above the 110.00 psychological zone. This may encourage some bulls to drive the battle towards the 111.60 area, which provided strong resistance between March 20th and 25th, or the 112.20 barrier, defined by the highs of February 19th and 20th. That said, before we start examining the resumption of the latest short-term uptrend, we would like to see a strong break above 112.20. Such a move may extend the advance towards the 113.50 hurdle, near the peak of December 17th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD