USD/JPY tracks yield spreads as Fed cut bets weigh on Dollar

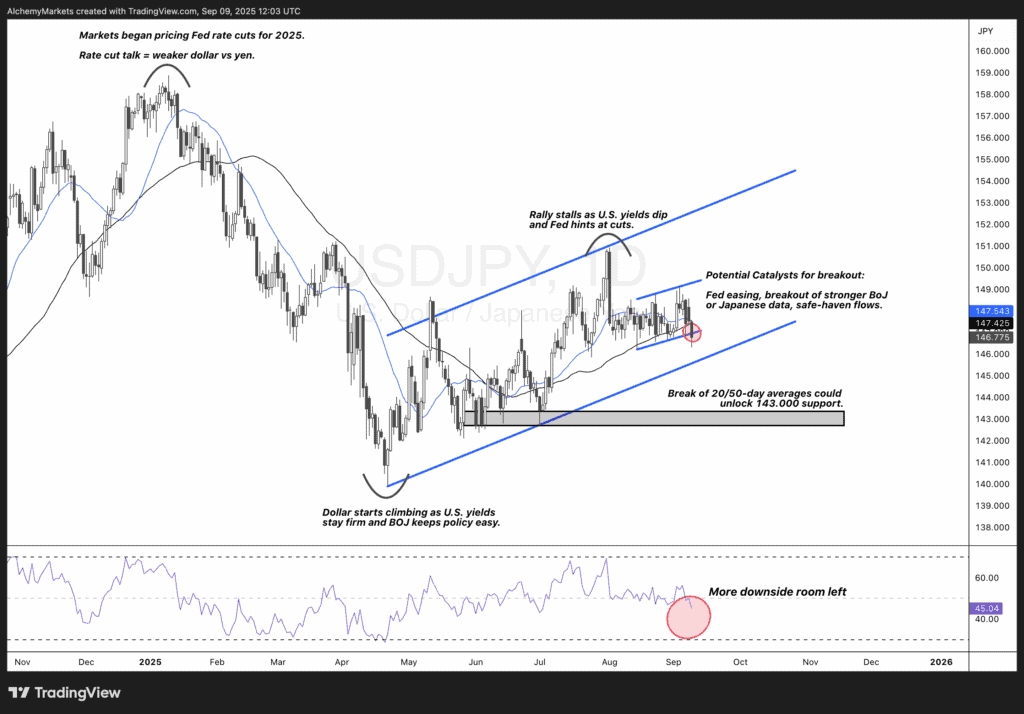

USD/JPY has been driven by shifting rate expectations through 2025. The pair sold off early in the year as markets began pricing in Federal Reserve rate cuts, weakening the dollar against the yen. Into the summer, the tide turned as U.S. yields held firm and the Bank of Japan (BOJ) maintained its easy policy stance, pushing USDJPY higher.

By August, however, momentum stalled again as Treasury yields dipped and the Fed hinted at easing—leaving the pair stuck in a consolidation channel.

The yield spread connection

One of the cleanest macro drivers for USDJPY is the U.S.–Japan 10-year yield spread. When U.S. yields rise faster than Japan’s, the spread widens, and USDJPY tends to follow higher. Conversely, when the spread narrows, the dollar loses its relative advantage, often resulting in yen strength.

Currently, the spread has been grinding lower, now near 2.48%, down from peaks above 4%. This narrowing has coincided with USDJPY’s recent pullback.

Technical picture

Looking at the price action:

- USDJPY remains in a consolidation channel after stalling out near 151.

- The pair now sits at a crossroads, with the 20/50-day moving averages acting as near-term support.

- A clean break below these averages could unlock downside toward 143.00, a key support zone.

- On the upside, renewed U.S. yield strength, a BOJ policy surprise, or safe-haven flows into the dollar could drive a fresh breakout.

Recent catalyst: Weak US jobs data

The latest move lower has been fueled by disappointing U.S. jobs data, which reinforced expectations of Fed rate cuts. Markets now view a September cut as almost certain, further narrowing the yield gap with Japan and weighing on the dollar.

Key takeaways

- USDJPY is tracking yield spreads closely—a narrowing gap spells trouble for the dollar.

- Technical risk skews lower if the pair breaks below its moving averages, exposing 143.00 support.

- Upside scenarios require a rebound in U.S. yields or renewed risk-off flows into the dollar.

For traders, the setup is clear: watch the yield spread, Fed cut expectations, and the 20/50-day moving averages for the next decisive move.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.