USD/JPY: the shackles are still on [Video]

![USD/JPY: the shackles are still on [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/yen-japones-billetes-de-banco_XtraLarge.jpg)

USD/JPY

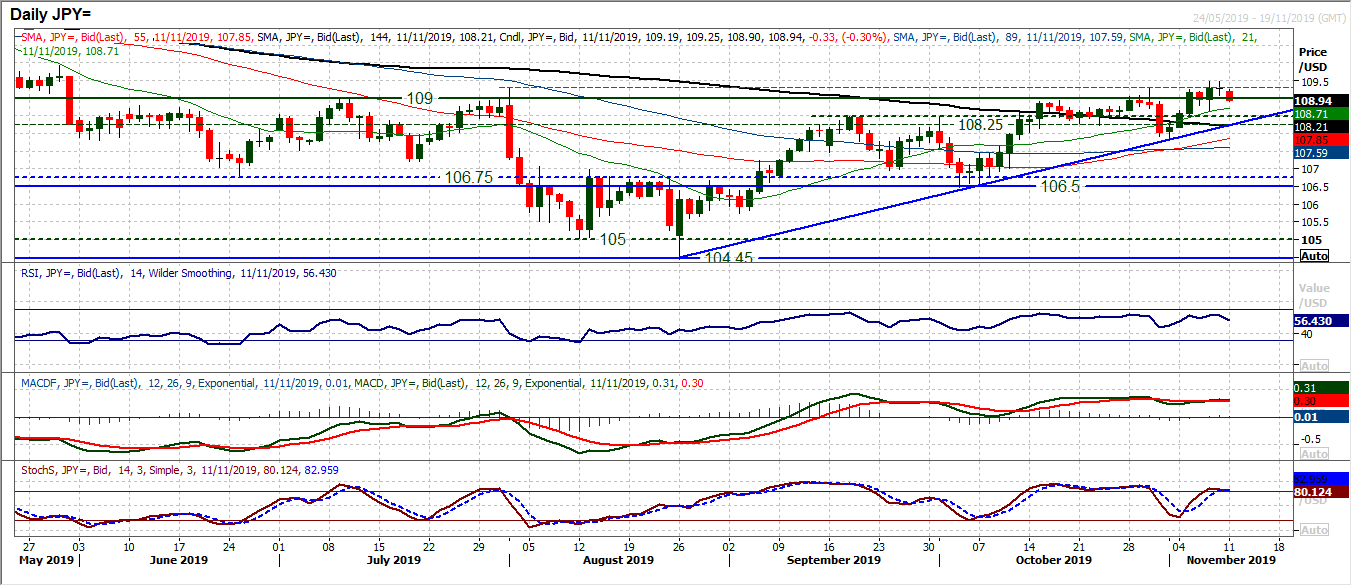

The dollar has spent the past week improving amidst slippage on the yen, in a move that is gradually breaking clear of resistance on Dollar/Yen. However, the shackles are still on, so can the decisive breakout be seen? It is a move that still needs to be viewed with cautious optimism for now. Whilst 109.00 has been cleared on a few occasions now, the market is yet to pull clear of 109.30 with any conviction. Momentum indicators have been building an improved outlook but once more, the RSI is failing around 60 whilst MACD lines are only tentatively higher. There is a sense that the intraday corrective moves are still a chance to buy, so the reaction to this morning’s slip back will be a gauge of the appetite in the market. Thursday’s higher low at 108.65 is subsequently a key marker for the bulls now to build from. Hold 108.65 and the bulls remain in control. The hourly chart does though, once more, reflect a slightly underwhelming positive bias on momentum. The last couple of highs at 109.50 are resistance that are preventing 109.90 and on towards 110.65.

Author

Richard Perry

Independent Analyst