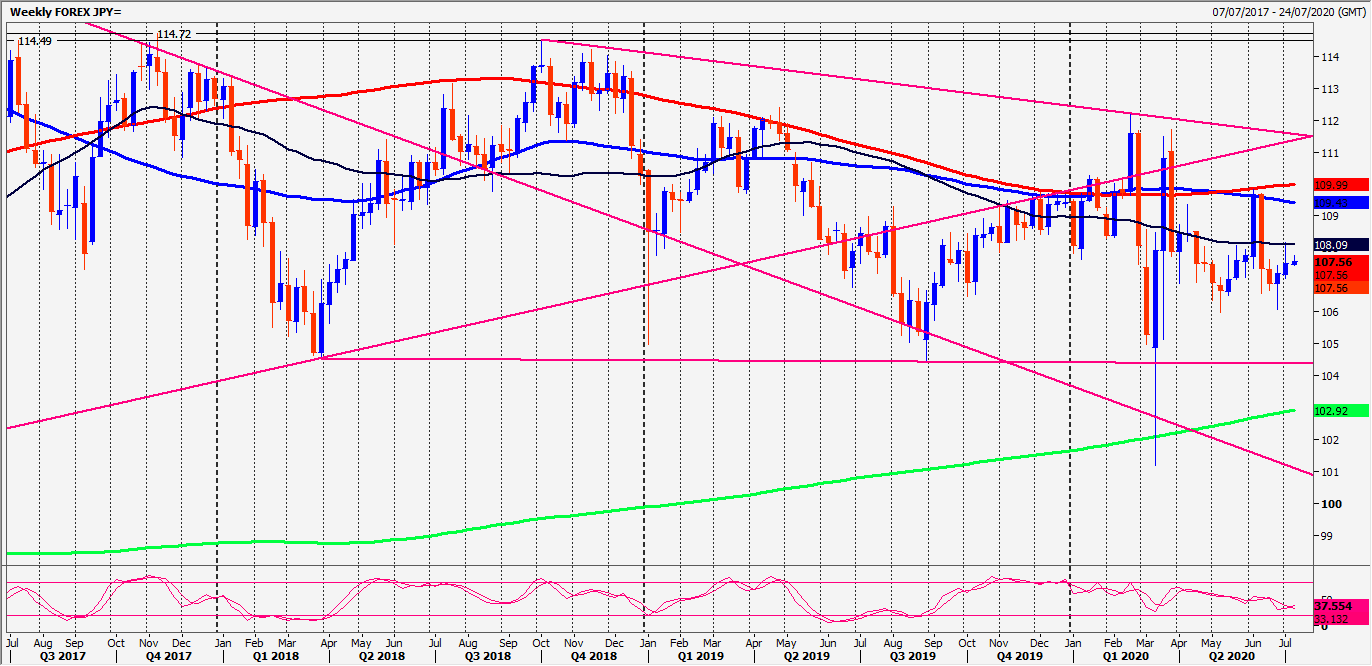

USD/JPY: Selling opportunity at 108.35 above 108.15

USD/JPY _ EUR/JPY

USDJPY longs at first support at 107.40/30 worked perfectly. We bottomed exactly here & held 3 pips from the 107.75 target last week.

EURJPY appears to be establishing a sideways trend, in line with many financial markets. We held in between minor resistance at 121.20/30 & 121.50/60 & bottomed exactly at the buying opportunity at 120.70/50.

Daily Analysis

USDJPY first support at 107.40/30 holding perfectly to target 107.75, perhaps as far as 107.90/108.00. A break above 108.15 meets a selling opportunity at 108.35/45 with stops above 108.65.

Longs at 107.40/30 stop below 107.15. A break lower targets 107.10/00 & 106.80/75, perhaps as far as 106.50/40 with minor support at the May low at 106.00/105.95 for profit taking on any remaining shorts.

EURJPY first support at 120.70/50. A break below 120.25 meets strong support at 119.70/60. Try longs with stops below 119.40.

A bounce targets 121.10, perhaps as far as 121.50/60. Expect strong resistance at 121.90/122.10 & again at 122.70/80.

Trends

Weekly outlook is neutral.

Daily outlook is neutral.

Short Term outlook is neutral.

Author

Jason Sen

DayTradeIdeas.co.uk