USD/JPY Price Forecast: Seems vulnerable ahead of BoJ/Fed policy meetings this week

- USD/JPY scales higher for the second straight day, though it lacks bullish conviction.

- A positive risk tone undermines the safe-haven JPY and lends support to the major.

- The divergent BoJ-Fed policy expectations hold back bulls from placing fresh bets.

The USD/JPY pair attracts buyers for the second straight day on Monday, though it struggles to capitalize on the momentum beyond the 149.00 round-figure mark. Investors cheered the latest stimulus measures announced by China over the weekend. In fact, China’s State Council outlined a special action plan on Sunday aimed at stimulating domestic consumption and introduced measures to increase household incomes. Adding to this, data released earlier today showed that China's Industrial Production rose more than expected in the first two months of 2025, while Retail Sales grew as anticipated, and the Fixed Asset Investment also surpassed consensus estimates. This further boosts investors' confidence, which undermines the safe-haven Japanese Yen (JPY) and acts as a tailwind for the currency pair.

However, heightened concerns over US trade tariffs and their impact on the global economy keep a lid on the optimism. Apart from this, hawkish Bank of Japan (BoJ) expectations hold back the JPY bears from placing fresh bets and contribute to capping the USD/JPY pair. The results of Japan's annual spring labor negotiations, which concluded on Friday, showed that companies met the demand for substantial wage hikes for the third consecutive year to help workers cope with inflation and address labour shortages. This, in turn, is expected to boost consumer spending and contribute to rising inflation, which gives the BoJ a fresh reason to keep raising interest rates. This, along with the underlying bearish sentiment surrounding the US Dollar (USD), turns out to be another factor acting as a headwind for the currency pair.

The recent us macro data pointed to signs of a cooling labor market and easing inflation. Adding to this, concerns about a tariff-drive US economic slowdown might force the Federal Reserve (Fed) to resume its rate policy easing cycle soon. In fact, traders are now pricing in the possibility of 25 basis points Fed rate cuts each at the June, July, and October policy meetings. The bets were reaffirmed by the University of Michigan Surveys on Friday, which showed that the Consumer Sentiment Index plunged to a nearly 2-1/2-year low in March. This keeps the USD Index (DXY), which tracks the Greenback against a basket of currencies, near a multi-month low touched last week and caps the USD/JPY pair. Traders also seem reluctant to place aggressive bets and opt to move to the sidelines ahead of this week's key central bank event risks.

The BoJ and the Fed are scheduled to announce their policy decisions on Wednesday. The outcome will play a key role in determining the next leg of a directional move for the USD/JPY pair. In the meantime, traders on Monday will take cues from the release of the US monthly Retail Sales and the Empire State Manufacturing Index, due later during the early North American session for short-term impetuses. Nevertheless, the divergent BoJ-Fed policy expectations suggest that the path of least resistance for the USD/JPY pair is to the downside. Hence, any subsequent move up might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

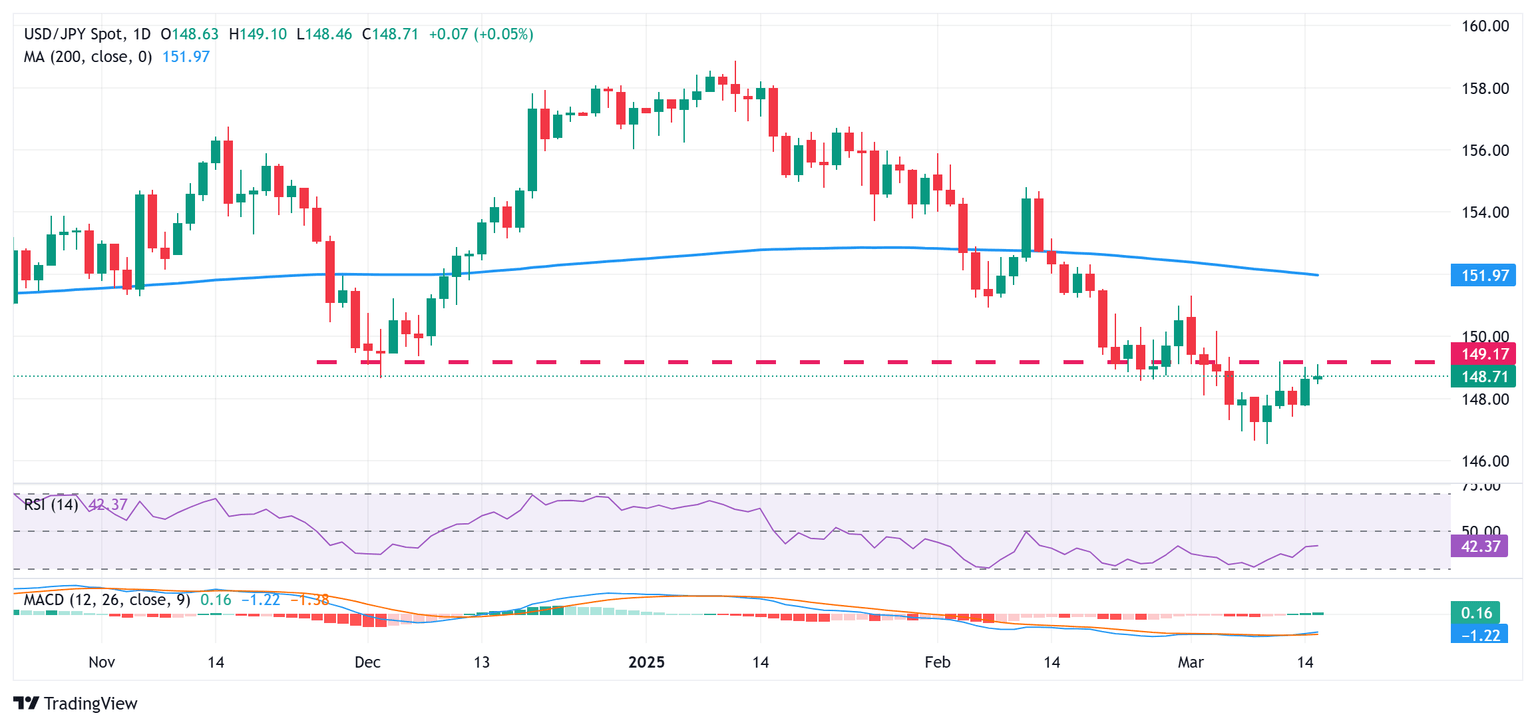

USD/JPY daily chart

Technical Outlook

From a technical perspective, oscillators on the daily chart – though they have been recovering from lower levels – are holding in negative territory. Hence, it will be prudent to wait for a sustained strength beyond last week’s swing high, around the 149.20 region, before positioning for further gains. The subsequent move-up should allow the USD/JPY pair to reclaim the 150.00 psychological mark and climb further towards the 150.65-150.70 zone. The momentum could eventually lift spot prices beyond the 151.00 mark, towards the monthly peak, around the 151.30 region.

On the flip side, the 148.25 area now seems to protect the immediate downside ahead of the 148.00 mark. Some follow-through selling below the 147.75-147.70 horizontal zone could make the USD/JPY pair vulnerable to accelerate the fall towards the 147.00 mark before eventually dropping to the 146.55-146.50 region, or the lowest level since October touched last week. A convincing break below the latter will be seen as a fresh trigger for bears and pave the way for further losses.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.