USD/JPY Price Forecast: Fresh multi-month low and counting ahead of US NFP report

- USD/JPY drifts lower for the third successive day and is pressured by a combination of factors.

- BoJ rate hike bets and rising trade tensions continue to drive flows towards the safe-haven JPY.

- The prevalent USD selling bias contributes to the decline ahead of the crucial US NFP release.

The USD/JPY pair remains under some selling pressure for the third straight day and touches a fresh low since early October, around the 147.30 area during the first half of the European session on Friday. The Japanese Yen (JPY) continues to be underpinned by the growing acceptance that the Bank of Japan (BoJ) will hike interest rates further. In fact, BoJ Deputy Governor Shinichi Uchida said earlier this week that the central bank was likely to raise interest rates at a pace in line with dominant views among financial markets and economists. This, along with a global sell-off in bonds, lifts the benchmark 10-year Japanese government bond (JGB) yield to its highest level last seen during the 2008 financial crisis. The resultant narrowing of the rate differential between Japan and other countries underpins the lower-yielding JPY.

Apart from this, the risk-off mood turns out to be another factor that benefits the safe-haven JPY. US President Donald Trump's U-turn on the recently imposed tariffs on Mexico and Canada fuels uncertainty about their impact on the global economy. Trump on Thursday exempted goods from both Canada and Mexico that comply with the US–Mexico–Canada Agreement for a month from the steep 25% tariffs that he had imposed earlier this week. Moreover, Chinese trade data fell short of expectations and added to market jitters. Data from the customs authority showed that China's exports rose 2.3%in the January to February period, marking the slowest growth since April last year and undershooting expectations. Moreover, China's imports registered the sharpest decline since July 2023 amid a lackluster domestic demand.

This, along with the prevalent US Dollar (USD) selling bias, exerts additional downward pressure on the USD/JPY pair and supports prospects for further losses. Investors remain worried that Trump's trade tariffs could slow the US economic growth in the long run, fueling speculations that the Federal Reserve (Fed) will cut interest rates several times in 2025. Philadelphia Fed President Patrick Harker acknowledged that the economy appears to be growing, with still low unemployment, though flagged growing threats to economic growth and risks to the inflation outlook. Separately, Atlanta Fed President Raphael Bostic noted that the US economy is in incredible flux and it’s hard to know where things will land.

Meanwhile, Fed Governing Board Member Christopher Waller said he leans strongly against a rate cut at the March meeting, although he reckons cuts later in the year remain on track if inflation pressures continue to abate. This, however, does little to provide any respite to the USD, which remains depressed near a four-month low touched on Thursday. Traders, however, might refrain from placing fresh USD bearish bets and opt to wait for the release of the US monthly employment details. The popularly known Nonfarm Payrolls (NFP) is expected to show that the US economy added 160K new jobs in February and the Unemployment Rate held steady at 4%. This will influence the near-term USD price dynamics and provide some meaningful impetus to the USD/JPY pair, which remains on track to register heavy weekly losses.

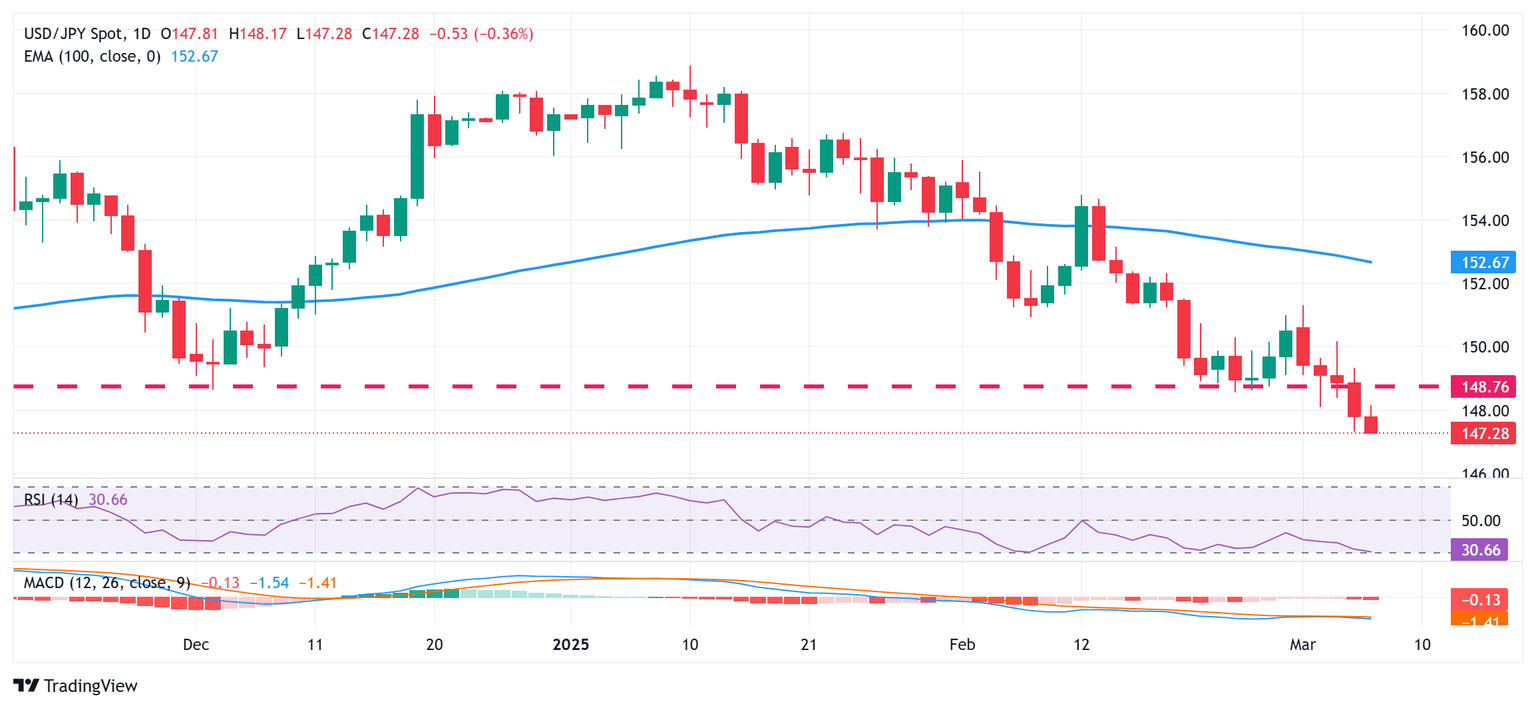

USD/JPY daily chart

Technical Outlook

From a technical perspective, this week's breakdown below the 148.70-148.65 horizontal support was seen as a key trigger for bearish traders. That said, the Relative Strength Index (RSI) on the daily chart is hovering close to the 30 mark, suggesting that spot prices are on the verge of moving into the oversold territory. Hence, it will be prudent to wait for some near-term consolidation or a modest bounce before positioning for an extension of the USD/JPY pair's downtrend witnessed over the past two months or so.

Meanwhile, any attempted recovery back above the 148.00 mark might now confront stiff resistance and remain capped near the aforementioned support breakpoint, around the 148.65-148.70 region. This is closely followed by the 149.00 round figure, which if cleared might trigger a bout of a short-covering move and lift the USD/JPY pair towards the 150.00 psychological mark. The momentum could extend towards the 150.60 intermediate hurdle en route to the 151.00 mark and the weekly swing high, around the 151.30 region.

On the flip side, the 147.00 mark could offer some support, below which the USD/JPY pair could accelerate the downfall toward the next relevant support near the 146.40 region. Some follow-through selling could make spot prices vulnerable to weaken further below the 146.00 round figure, towards the 145.60-145.50 support zone, and eventually drop to the 145.00 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.