USD/JPY Price Forecast: Bulls retain control ahead of key central bank event risks

- USD/JPY touched over a one-week top on Tuesday amid sustained USD buying.

- The latest trade optimism undermines the safe-haven JPY and remains supportive.

- Bulls seem reluctant ahead of the crucial Fed/BoJ policy meetings this week.

The USD/JPY pair advances to a one-and-a-half-week top during the early part of the European session on Tuesday, though it lacks follow-through as traders seem reluctant ahead of the key central bank event risks. The Federal Reserve (Fed) is scheduled to announce its monetary policy decision at the end of a two-day policy meeting on Wednesday. This will be followed by the Bank of Japan (BoJ) policy update on Thursday. Both central banks are widely expected to keep interest rates steady. Hence, investors will look for cues about the future policy outlook, which should provide a fresh directional impetus to the currency pair.

In the meantime, investors seem convinced that the Fed will keep borrowing costs higher for longer amid a still resilient US labor market and expectations that higher US tariffs would reignite inflationary pressure during the second half of the year. This assists the US Dollar (USD) to prolong its uptrend for the fourth consecutive day and climb to the highest level since June 23. In contrast, diminishing odds for an immediate interest rate hike by the BoJ contribute to the Japanese Yen's (JPY) relative underperformance against its American counterpart. This turns out to be another factor acting as a tailwind for the USD/JPY pair.

Japan's trade deal with the US has removed economic uncertainty, suggesting that conditions for the BoJ to hike rates further may start to fall in place again. However, data released last Friday showed that consumer inflation in Tokyo – Japan's capital city – eased more than expected in July. Moreover, Japan's ruling coalition – the Liberal Democratic Party (LDP) and its junior partner Komeito – suffered a defeat in the upper house elections, which adds a layer of uncertainty and fuels concerns about Japan's fiscal health. This might complicate the BoJ's policy normalization path, which might continue to weigh on the JPY and support the USD/JPY pair.

Traders now look forward to Tuesday's US economic docket – featuring JOLTS Job Openings and the Conference Board's Consumer Confidence Index – for short-term impetus later during the North American session. Apart from this, investors this week also confront important US macro data, including the Advanced Q2 GDP print, the Personal Consumption Expenditure (PCE) Price Index, and the Nonfarm Payrolls (NFP) report. This could infuse some volatility in the market and influence the UISD/JPY pair during the second half of the week.

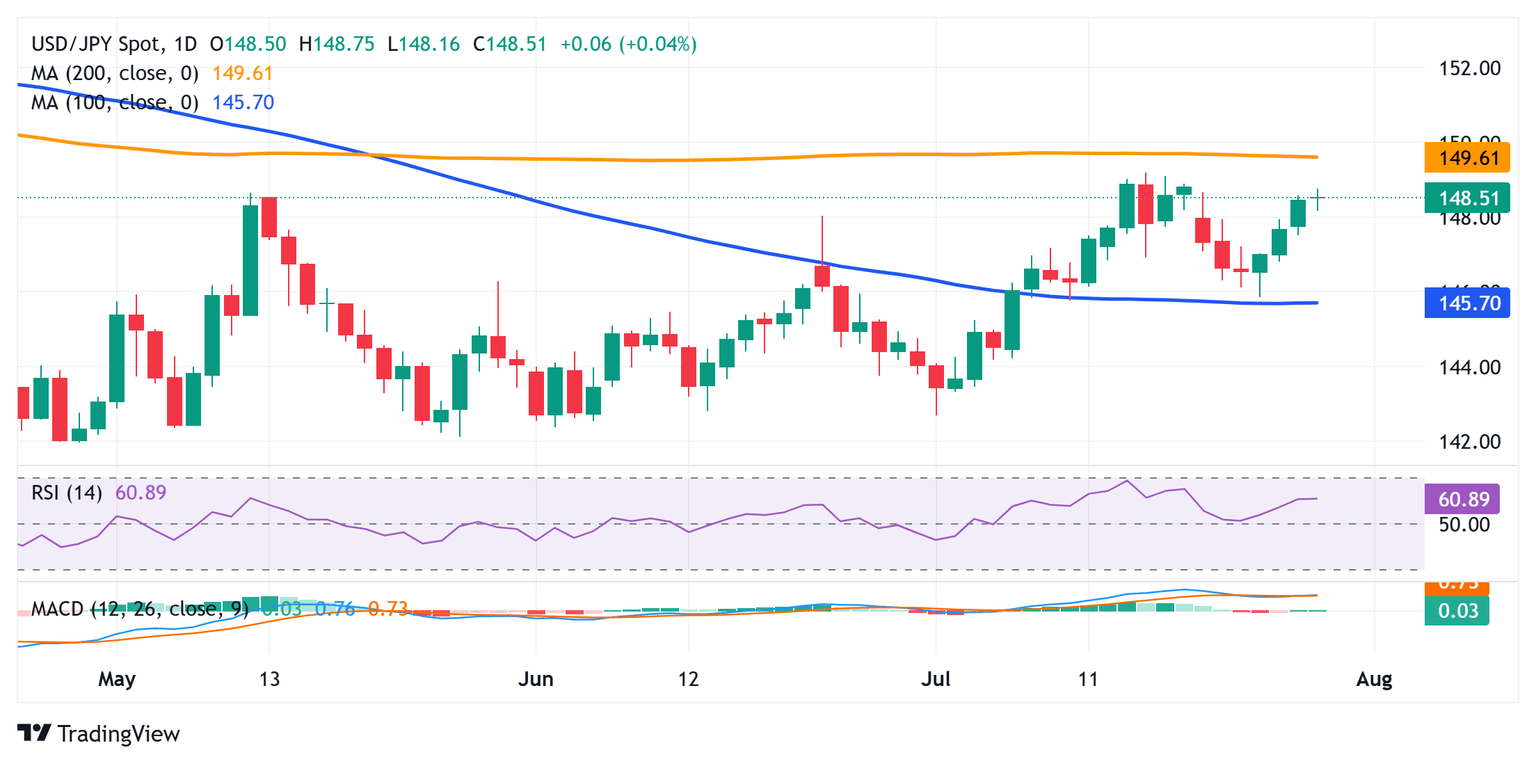

USD/JPY daily chart

Technical Outlook

From a technical perspective, any subsequent move up is likely to confront a hurdle near the 149.00-149.10 region, or the monthly top. This is closely followed by the very important 200-day Simple Moving Average (SMA), around the 149.55 area, which, if cleared decisively, will be seen as a fresh trigger for the USD/JPY pair. The subsequent move up should allow spot prices to reclaim the 150.00 psychological mark and test the next relevant hurdle near the 150.45-150.50 zone.

On the flip side, any corrective pullback below the daily low, around the 148.15 region, could be seen as a buying opportunity and remain limited near the 147.75-147.70 area. A convincing break below, however, might prompt some technical selling and drag the USD/JPY pair to the 147.00 mark en route to the 100-day SMA, currently pegged near the 146.70 area. The latter coincides with last week's swing low, which, if broken decisively, might shift the near-term bias in favor of bearish traders and make spot prices vulnerable to retest sub-146.00 levels. This is closely followed by the 145.75 area (July 10 low), below which the pair could slide to the 145.00 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.