USD/JPY Price Forecast: Bears have the upper hand amid reviving BoJ rate hike bets

- USD/JPY rebounds after touching a two-week low amid the emergence of some JPY selling.

- Domestic political uncertainty, the risk-on mood, and disappointing PMI undermine the JPY.

- A modest USD bounce further supports the pair, though the upside potential seems limited.

The USD/JPY pair stages a goodish intraday recovery of over 50 pips from a two-week low touched earlier this Thursday and moves back closer to mid-146.00s during the first half of the European session. The prevalent risk-on environment, bolstered by the latest trade optimism, is seen undermining demand for traditional safe-haven assets, including the Japanese Yen (JPY). Reports suggest that the US and the European Union (EU) are heading towards a 15% tariff deal, which provides an additional boost to the global risk sentiment against the backdrop of the recently announced Japan-US trade agreement. Apart from this, the domestic political uncertainty and the disappointing data from Japan weigh on the JPY, which, along with a modest US Dollar (USD) recovery, prompts some intraday short-covering around the currency pair.

Japan's ruling coalition – the Liberal Democratic Party (LDP) and its junior partner Komeito – suffered a defeat in the upper house elections last weekend. This adds a layer of uncertainty and fuels concerns about Japan's fiscal health. Furthermore, a private-sector survey showed on Thursday that Japan’s manufacturing activity unexpectedly slipped into contraction during July. In fact, the S&P Global Japan manufacturing Purchasing Managers’ Index (PMI) dropped to 48.8 from June's final reading of 50.1 as businesses assessed the impact from US tariffs. This overshadowed the upbeat Services PMI, which increased to 53.5 in July from 51.7 in the previous month. However, Japan's trade deal with the US has removed economic uncertainty, suggesting that conditions for the Bank of Japan (BoJ) to hike rates further may start to fall in place again.

In fact, BoJ Deputy Governor Shinichi Uchida reiterated on Wednesday that the central bank's course of action is to continue raising interest if the economy and prices move in line with forecasts. Moreover, a Reuters poll showed that a majority of economists expect the BoJ to hike its key interest rate again by the year-end, though most expect the central bank could wait for some time and would stand pat at this month's meeting. Nevertheless, reviving BoJ rate hike bets, which helped offset Thursday mixed data from Japan, could limit JPY losses. The USD, on the other hand, might struggle to attract follow-through buyers amid the uncertainty over the Fed's rate cut path. Furthermore, fears that the US central bank's independence could be under threat, amid mounting political interference, might cap the upside for the Greenback and the USD/JPY pair.

In fact, US President Donald Trump has been personally attacking Fed Chair Jerome Powell for not lowering interest rates and has repeatedly called for his resignation. The markets, however, do not expect an interest rate cut from the Fed in July despite Trump's continuous push for lower borrowing costs. Nevertheless, Trump-Powell standoff warrants some caution for the USD bulls. Traders now look forward to the release of the flash US PMIs for some impetus. Thursday's US economic docket also features the release of the usual Weekly Initial Jobless Claims and New Home Sales data. This, in turn, might influence the USD price dynamics and contribute to producing short-term trading opportunities around the USD/JPY pair.

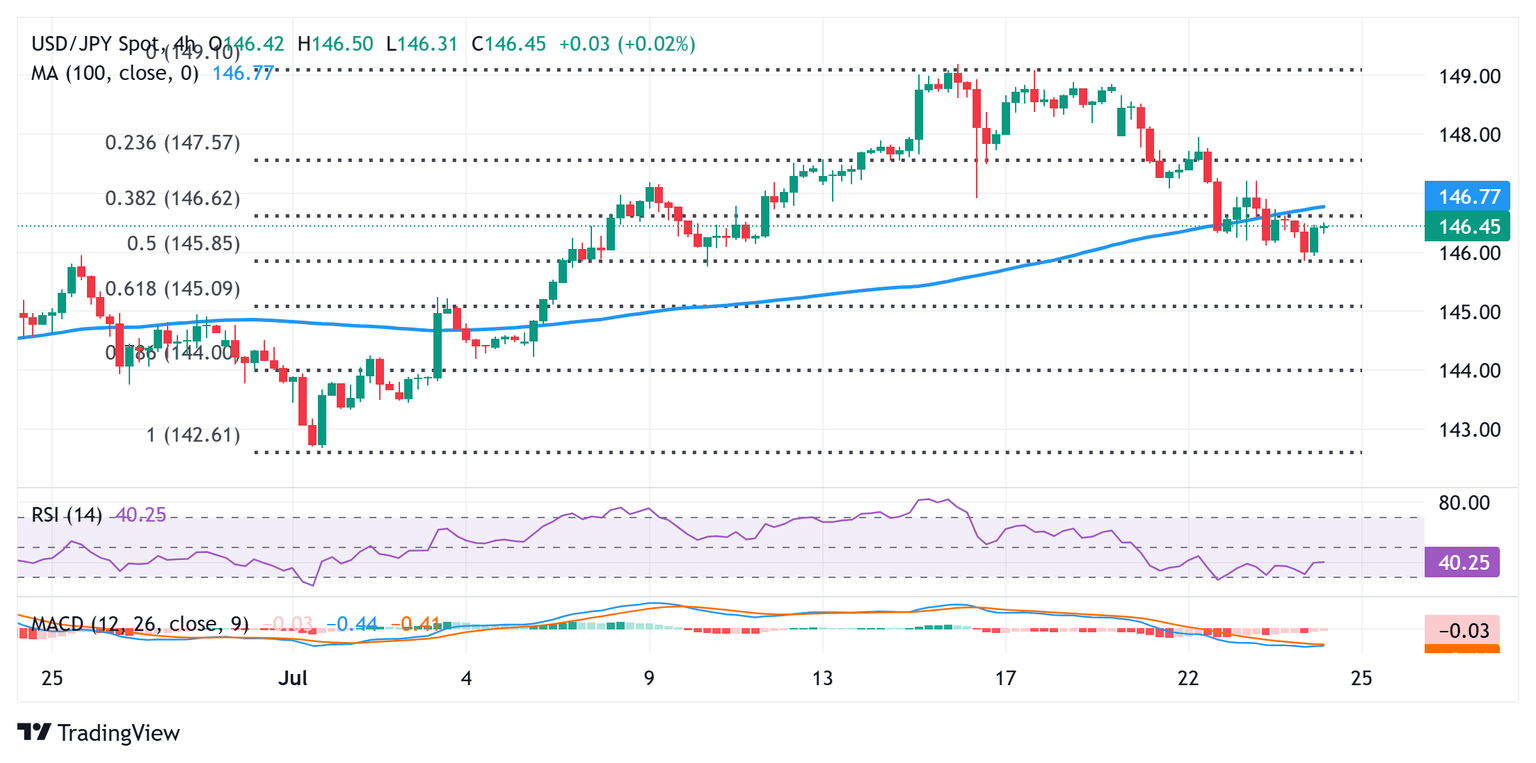

USD/JPY 4-hour chart

Technical Outlook

From a technical perspective, an intraday breakdown below the 100-period Simple Moving Average (SMA) was seen as a fresh trigger for the USD/JPY bears. Moreover, oscillators on the daily chart have just started gaining negative traction. Hence, the recovery momentum is more likely to confront stiff resistance near the said support breakpoint, currently pegged near the 146.60 region. The said area now coincides with the 38.2% Fibonacci retracement level of the upswing in July.

A sustained strength beyond, however, could lift the USD/JPY pair to the 147.00 round figure. This is closely followed by the overnight swing high, around the 147.20 area, which, if cleared, could allow spot prices to accelerate the move up towards the 147.60-147.65 intermediate hurdle en route to the 148.00 round figure.

On the flip side, bearish traders might now wait for some follow-through selling below the 145.85-145.75 region (July 10 low) before placing fresh bets. The subsequent fall could drag the USD/JPY pair to the 145.20-145.15 region, or the 61.8% Fibo. retracement level, en route to the 145.00 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.