USD/JPY outlook: Rises on dovish BoJ, initial reversal signal looks for confirmation

USD/JPY

USDJPY accelerated higher on Wednesday, as traders collected some profits from steep fall in past few days, fueled by risk aversion which boosted demand for safe haven yen.

Japanese currency made an impressive rally of 8.5% vs US dollar in July and early August, boosted by recent interventions and BOJ rate hike, while the latest strong migration into safety lifted yen to eight-month high.

Today’s comments by BOJ official showed unexpected shift in policy outlook, souring the sentiment and adding pressure on yen.

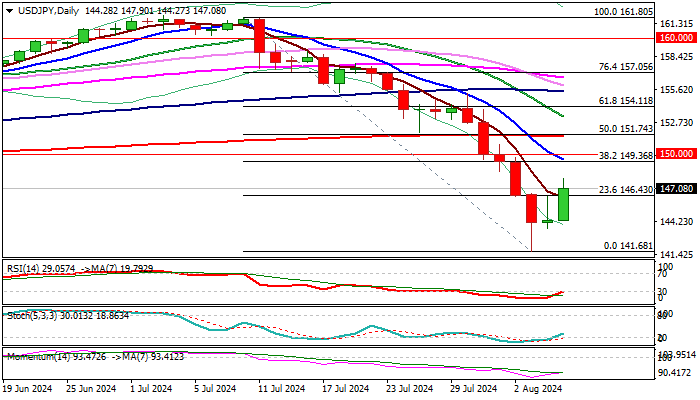

Fresh acceleration after Tuesday’s Doji candle with long upper shadow signaled indecision, adds to recovery signals and the price broke above initial resistance at 146.43 (Fibo 23.6% of 161.80/141.68 fall) with close above this level to reinforce near term structure for extension towards targets at 149.36 and 150.00 (Fibo 38.2% / psychological).

Adding to positive near term signals was a false penetration into weekly cloud, with long tailed weekly Doji and formation of a bear trap.

However, daily studies are predominantly in bearish configuration (MA’s above the price / momentum deeply in negative territory) and require caution.

Lift above daily Tenkan-sen (148.45) will be needed to ease existing downside risk, while break of 149.36/150.00 pivots to signal reversal.

Res: 147.90; 148.45; 149.36; 150.00.

Sup: 146.43; 143.62; 141.68; 140.00.

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.