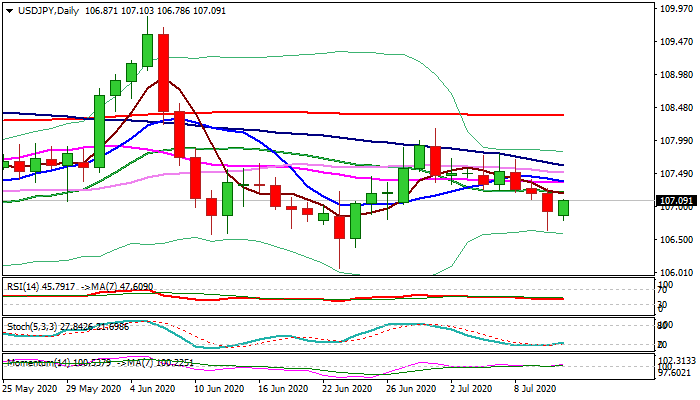

USD/JPY outlook: Recovery is seen as positioning for fresh weakness

USD/JPY

The pair bounces above 107 on Monday after last week's fall was strongly rejected at 106.63 on Friday and failed to close below cracked Fibo support at 106.87 (61.8% of 106.07/108.16). The action is supported by rising bullish momentum and stochastic emerged from oversold territory, but requires more signals on break of initial barriers at 107.20 zone (20DMA / Fibo 38.2% of 108.16/106.63). Larger picture is bearish and sees current move as positioning for fresh weakness, with stronger upticks to be ideally capped at 107.50/60 zone (Fibo 38.2% of 109.85/106.07 / 30 DMA / Fibo 61.8% of 108.16/106.63). Only break above 108 zone would neutralize bears.

Res: 107.20; 107.40; 107.60; 107.80

Sup: 107.00; 106.78; 106.63; 106.38

Interested in USD/JPY technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.