USD/JPY Outlook: Move beyond 200-day SMA will set the stage for additional near-term gains

- USD/JPY climbs to its highest level since March 10 and draws support from a combination of factors.

- The BoJ’s dovish outlook weighs heavily on the JPY and acts as a tailwind amid a modest USD strength.

- Investors now look to the US ISM Manufacturing PMI for some impetus ahead of the FOMC meeting.

The USD/JPY pair builds on Friday's dovish Bank of Japan (BoJ)-inspired blowout rally and gains strong follow-through traction on the first day of a new week. The momentum lifts spot prices to the highest level since March 10 during the Asian session, with bulls now awaiting a sustained strength beyond a technically significant 200-day Simple Moving Average (SMA) before placing fresh bets. It is worth recalling that the Japanese central bank on Friday left its ultra-loose monetary policy settings unchanged and also made no tweaks to its yield curve control (YCC) by a unanimous vote. Adding to this, the new BoJ Governor Kazuo Ueda said that the risk from tightening too hastily is larger than monetary policy falling behind the curve and added that it will be appropriate to continue monetary easing to achieve the 2% inflation target. Apart from this, data released earlier this Monday showed that factory activity in Japan - the world's third-biggest economy - contracted for the sixth straight month in April. This, in turn, continues to weigh heavily on the JPY, which, along with a modest US Dollar (USD) strength, acts as a tailwind for the major.

The prospects of the Federal Reserve (Fed) raising interest rates by another 25 basis points (bps) at the end of a two-day meeting on Wednesday allows the Greenback to gain some positive traction for the third successive day. The markets, however, seem convinced that the US central bank will then hold rates steady for the rest of the year. This might hold back the USD bulls from placing aggressive bets ahead of the highly-anticipated FOMC policy meeting, starting on Tuesday. Furthermore, worries about economic headwinds stemming from rising borrowing costs could lend some support to the safe-haven JPY and contribute to keeping a lid on the USD/JPY pair, at least for the time being. In fact, the Advance US GDP report released last week showed that growth in the world's largest economy slowed more than expected in the first quarter. Moreover, the official Chinese Manufacturing PMI declined to 49.2 in April from 51.9 in March, pointing to a contraction in activity on a monthly basis and fueling recession fears. This tempers investors' appetite for riskier assets, which could drive some haven flows to the JPY and cap the major.

Market participants now look forward to the release of the US ISM Manufacturing PMI, due later during the early North American session, for some impetus. Apart from this, the US bond yields and the broader risk sentiment might contribute to producing short-term opportunities around the USD/JPY pair. The focus, meanwhile, will remain glued to the outcome of the FOMC meeting on Wednesday and the closely-watched US monthly employment details, popularly known as the NFP report on Friday. This will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the major.

Technical Outlook

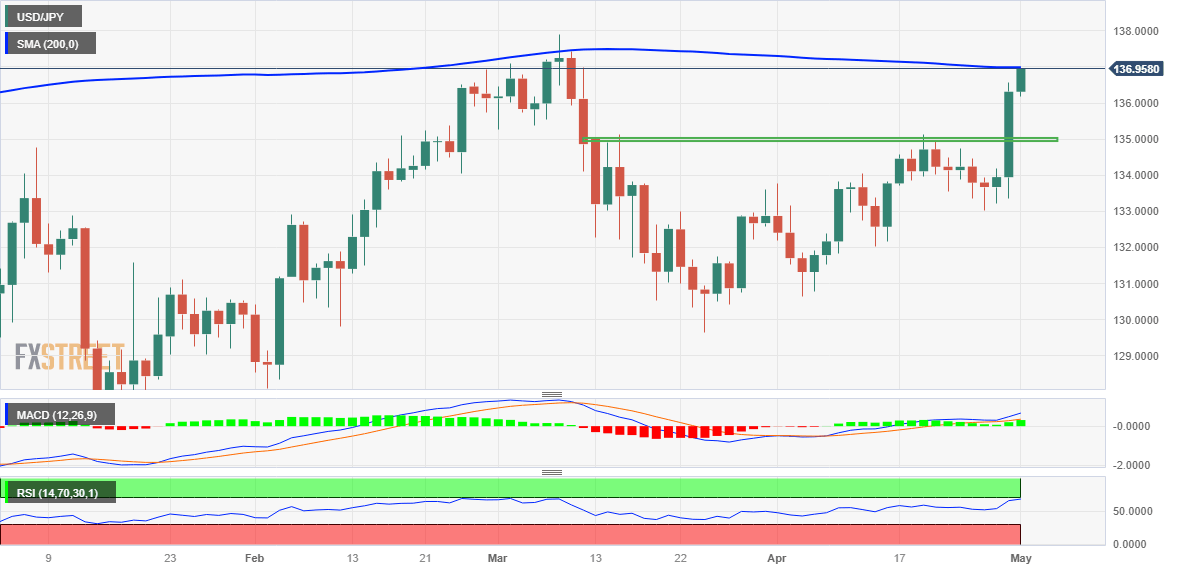

From a technical perspective, some follow-through buying beyond the 200-day SMA will set the stage for a move towards the YTD peak, around the 137.90 region touched in March. A subsequent strength beyond the 138.00 mark will be seen as a fresh trigger for bulls and pave the way for a further near-term appreciating move. That said, the Relative Strength Index (RSI) on the daily chart is on the verge of breaking into the overbought territory and makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for a fresh leg up.

On the flip side, any meaningful pullback now seems to find decent support near the 136.00 round figure. Any subsequent decline is more likely to attract fresh buyers and remain limited near the 135.00 psychological mark. The latter should now act as a strong base for the USD/JPY pair, which if broken decisively might shift the near-term base in favour of bearish traders and prompt aggressive technical selling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.