USD/JPY moving in an up trend now by forming higher highs higher lows

Forex GDP USD/JPY Technical analysis

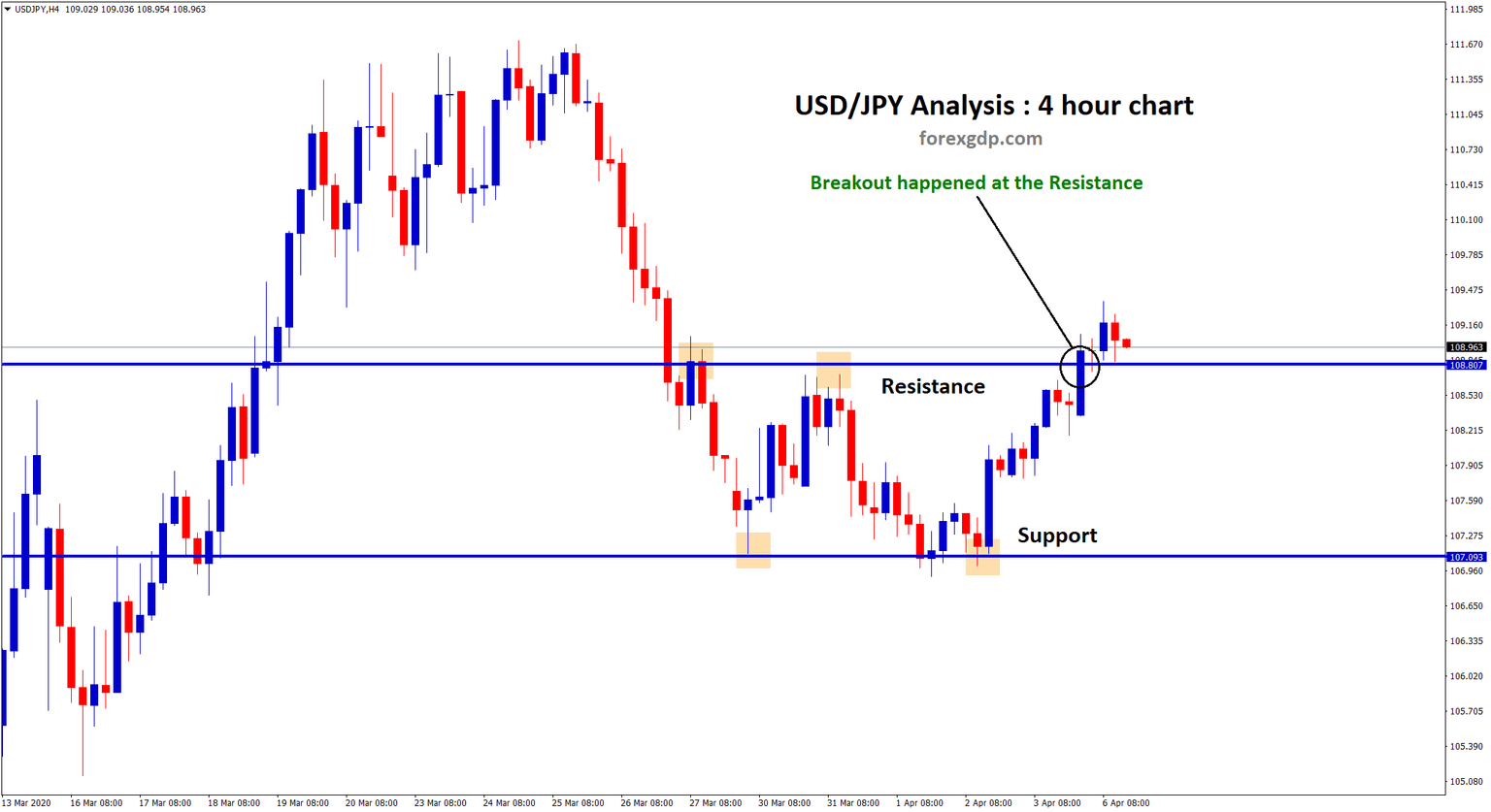

USD/JPY broken the resistance zone in 4 hour chart.

USD/JPY is moving in an Uptrend now by forming higher highs, higher lows in 1 hour chart.

By 9:35 AM ET (1335 GMT), the Dow Jones Industrial Average was up 827 points, or 3.9%, at 21,879 points, while the S&P 500 was up 3.6% and the Nasdaq Composite was up 3.5%

The news followed announcements at the weekend that daily deaths from the Covid-19 virus had fallen in Spain and Italy, the two worst-affected countries in Europe.

While U.S. data are harder to interpret and point mainly to a higher death toll in the next few days, President Donald Trump reiterated his upbeat belief that a turnaround is in sight, tweeting "LIGHT AT THE END OF THE TUNNEL!"

Please Don't trade all the time, trade only at best trade setup.

It is better to do nothing, instead of taking wrong trades.

We are here to help you for taking the trades only at best trade setup.

If you want more best forex signals, Try our free forex signals now at forexgdp.com

Thank you.

Author

Forex GDP Team

Forex GDP

Forexgdp.com provides forex market signals live to your mobile phone and email. Forexgdp team recommend all traders to follow this rule: “Don’t trade all the time, trade only at Good Opportunities available in the market”.