USD/JPY momentum indicators on the daily chart have reacted positively to yesterday’s [Video]

![USD/JPY momentum indicators on the daily chart have reacted positively to yesterday’s [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen-bills-money-from-japan-63035511_XtraLarge.jpg)

USD/JPY

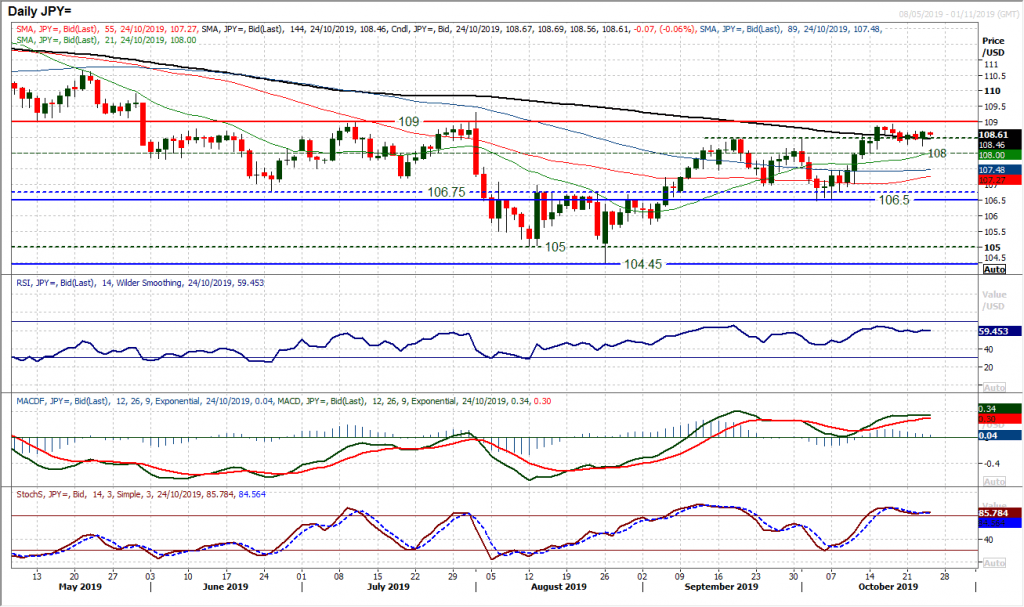

An intraday swing higher in to the close has seen a corrective slip just nipped in the bud on Dollar/Yen. A negative bias was threatening to take hold as the market traded at a one week low, but the bulls have fought back well. Although there is still significant resistance around 109.00 the bulls will be feeling that the current moves are part of a consolidation rather than the prospective correction as part of a range play (between 106.50/109.00). This leaves the current outlook uncertain, but not corrective. This is reflected by the early moves today where, once more the market lacks conviction. Momentum indicators on the daily chart have reacted positively to yesterday’s move and again reflect consolidation. They are all flattening, with RSI back around 60, MACD lines stabilising and Stochastics holding above 80. However, the market needs to push above 108.70 which has been a lower high in the past week, whilst 109.00 is clearly a key barrier. A market in desperate need of a catalyst.

Author

Richard Perry

Independent Analyst