USD/JPY: Good near term support is forming at 106.95 [Video]

![USD/JPY: Good near term support is forming at 106.95 [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/usdjpy_XtraLarge.jpg)

USD/JPY

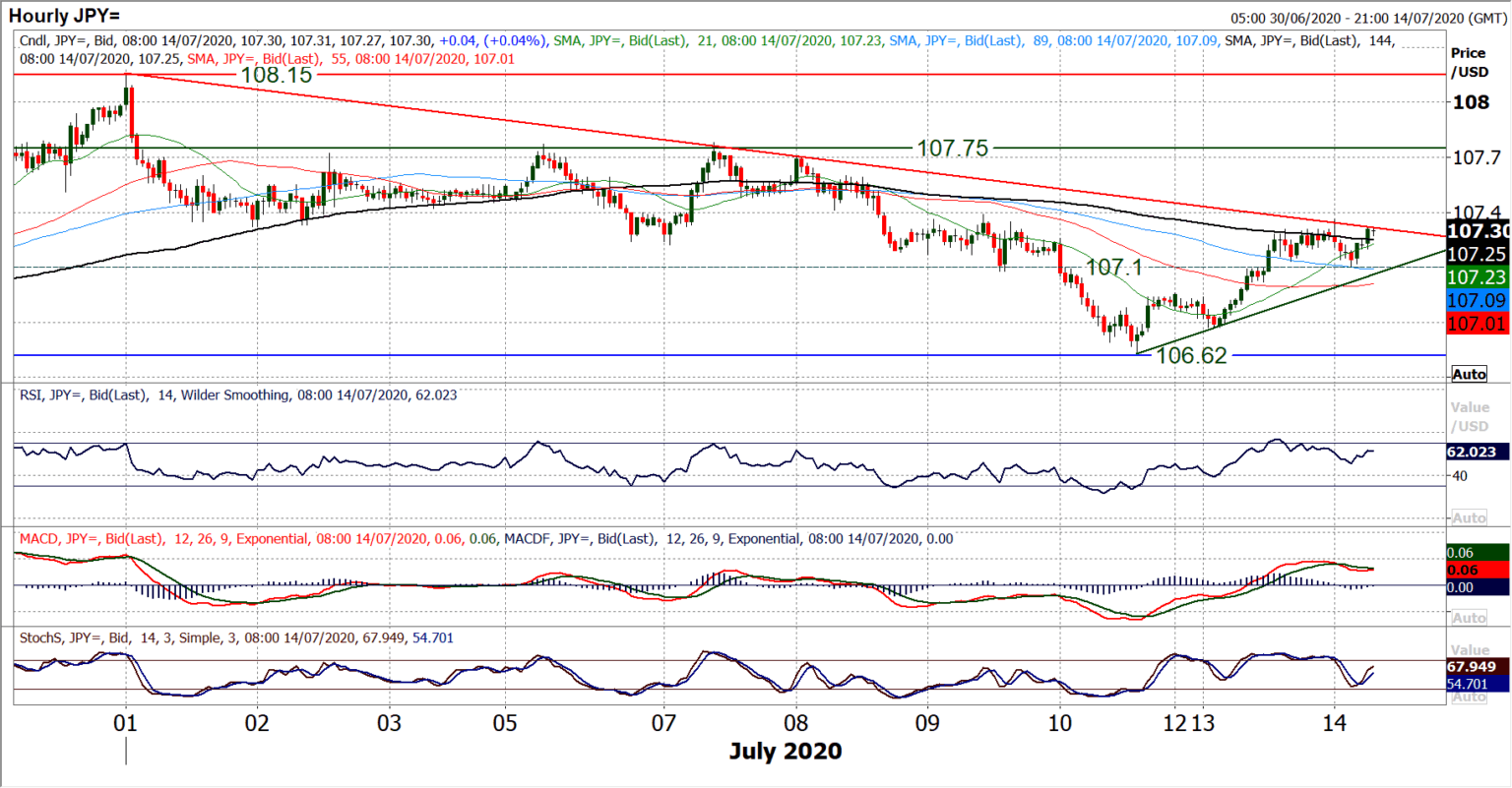

In yesterday’s analysis we discussed the potential for a near term rebound from the medium term support area between 106/107. With so many retreats into this band over recent months, time and again finding willing buyers, it was interesting to see once more this coming through in yesterday’s session. The strong positive candle that built throughout the session has subsequently retraced the negative implications of Friday’s sell-off and builds the potential for a near term recovery now. The first test if a little two week downtrend (today at 107.35) which needs to be broken. In such a tight consolidation, trendlines mean little and will often be broken. However, they can imply subtle shifts in sentiment. Daily momentum is mixed (Stochastics falling, RSI rising and MACD flat), but an improvement is being seen across the hourly indicators. A new run of higher lows and higher highs, whilst the hourly RSI moved above 70 for the first time in two weeks, and good near term support is forming at 106.95/107.10. A move above 107.40 would open the next line of resistance at 107.75 but also swing the market into a confirmed new phase of recovery within the medium term range.

Author

Richard Perry

Independent Analyst