USD/JPY Forecast: Risk slowly skewing to the upside

USD/JPY Current price: 104.42

- Japanese encouraging data further boosted sentiment to the detriment of the yen.

- Equities kept advancing, underpinning by coronavirus vaccine hopes.

- USD/JPY is technically neutral, the downside seems limited as long as it holds above 103.85.

The USD/JPY pair has shown little progress this Tuesday, ending the day in the 104.30 price zone. However, the pair posted a higher high and a higher low for the day, somehow lifting odds of recovery. The persistent dollar’s weakness put a cap to the pair’s advance, despite a generalized optimism. Progress in coronavirus vaccines and increased efforts to begin emergency use as soon as this December boosted investors’ mood.

Japanese data published at the beginning of the day was generally positive. The November Jibun Bank Manufacturing PMI was upwardly revised from 48.3 to 49. The October Unemployment Rate came in at 3.1% as expected, while the Jobs/Applicants Ratio improved to 1.04. The country will publish this Wednesday, November Monetary Base and the Consumer Confidence Index for the same month, this last seen at -4.4% from -6.3% in the previous month.

USD/JPY short-term technical outlook

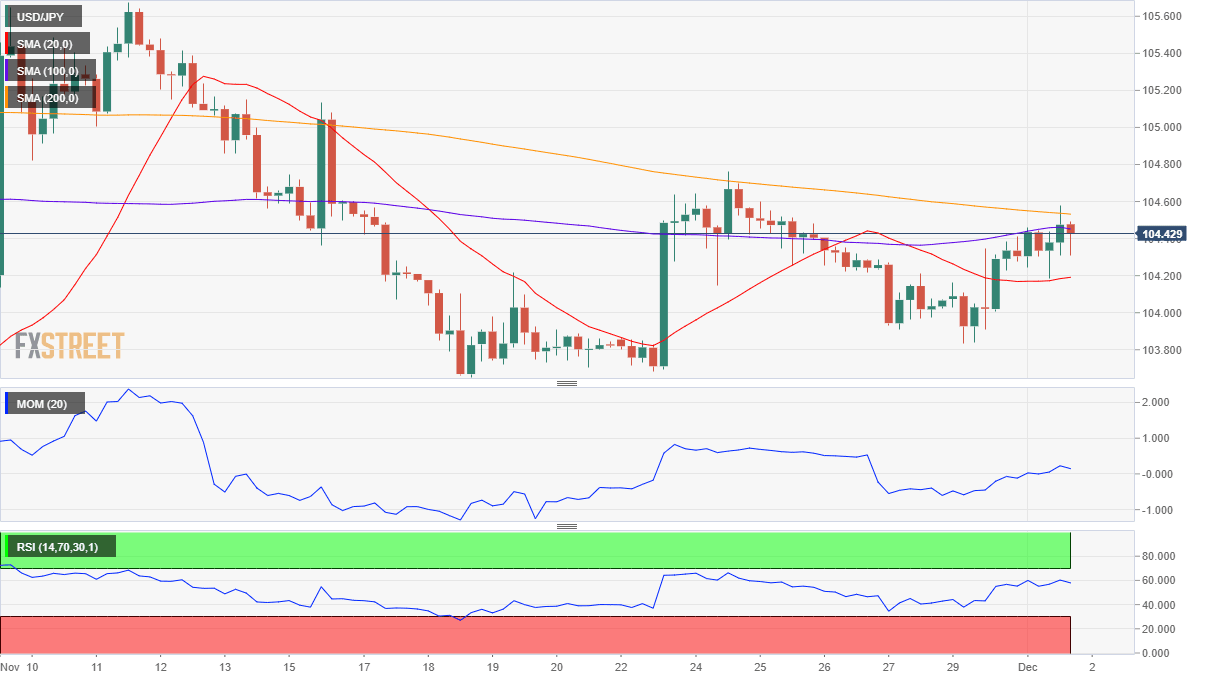

The USD/JPY pair maintains a neutral stance in the near-term, and according to the 4-hour chart. In the mentioned time-frame, the pair is trapped within moving averages, with a mildly bearish 200 SMA providing resistance around 104.55. Technical indicators remain directionless just above their midlines, reflecting the absence of speculative interest.

Support levels: 103.85 103.50 103.15

Resistance levels: 104.55 104.90 105.20

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.