USD/JPY forecast: Rate gap narrows as Fed cuts [Video]

- Fed cuts weigh on the dollar as markets price in a 25 bps move, narrowing the U.S.–Japan yield gap.

- BOJ tightening expectations build, with potential hikes later this year reinforcing yen demand.

- Technical outlook turns bearish, with rejection at 147.90 and downside targets at 146.20–145.50 unless buyers reclaim 147.20.

![USD/JPY forecast: Rate gap narrows as Fed cuts [Video]](https://editorial.fxsstatic.com/images/i/USDJPY-bullish-object_XtraLarge.png)

The dollar–yen pair has been hovering in a tight range between ¥147 and ¥149 as traders position for the next round of central bank decisions. Momentum has slowed, but the underlying drivers remain clear: the U.S. Federal Reserve is preparing to cut interest rates while the Bank of Japan is edging toward further tightening.

Fed decision in focus

The Federal Reserve is expected to deliver a 25 basis point rate cut, with the real test lying in Jerome Powell’s forward guidance. Investors want clarity on whether this is the start of a series of cuts or just a cautious adjustment.

A more dovish tone from the Fed could weigh on Treasury yields and deepen dollar weakness, opening the door for yen gains. On the other hand, if Powell stresses that inflation risks remain elevated and signals a slower path of easing, the dollar may hold its ground.

Bank of Japan’s policy path

While the BOJ is not expected to raise rates at its next meeting, markets are increasingly pricing in another hike later this year—potentially lifting short-term rates from 0.50% to 0.75%. Inflation in Japan is running above the BOJ’s 2% target, and the yen’s prolonged weakness has amplified imported price pressures.

Officials face growing pressure to gradually narrow the gap with U.S. policy rates. Any confirmation of further tightening from Tokyo would reinforce demand for the yen.

The interest rate differential

USD/JPY is largely driven by the spread between U.S. and Japanese interest rates. When the U.S. offers higher yields, the dollar benefits as capital flows toward dollar-denominated assets. Now that the Fed is moving toward cuts while the BOJ hints at more hikes, the gap is narrowing. This shift is one of the main reasons why USD/JPY has stalled and is vulnerable to downside pressure if U.S. yields continue to soften.

Technical outlook

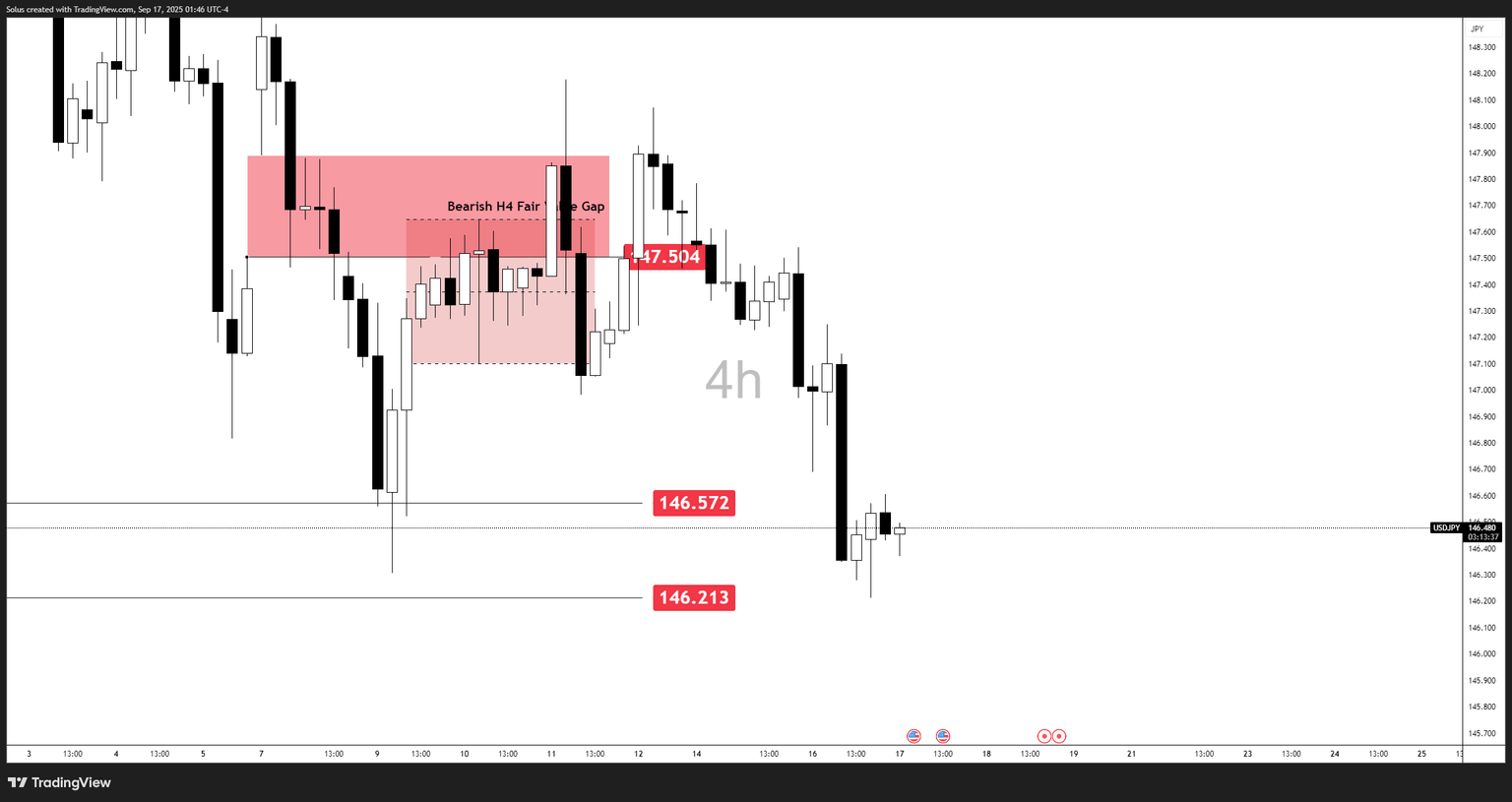

USD/JPY had been consolidating under the 147.50–147.90 resistance zone, which aligned with a bearish H4 Fair Value Gap. Ahead of the Fed decision, the market had already priced in a 25 bps rate cut, limiting upside potential for the dollar. That meant any rally into this supply zone was vulnerable to rejection.

Before

Leading into the event, USD/JPY attempted to reclaim higher ground but repeatedly stalled inside the Fair Value Gap. The inability to break above 147.90 signaled that sellers were defending the zone, anticipating the narrowing interest rate differential as the Fed eases policy and the BOJ leans hawkish.

After

Once the market confirmed dovish positioning, the rejection materialized. Price rolled over sharply from the Fair Value Gap, breaking back below 147.00 and extending toward 146.57 and 146.21. This move validated the bearish setup and showed how expectations of Fed cuts—already embedded into positioning—helped fuel the downside momentum.

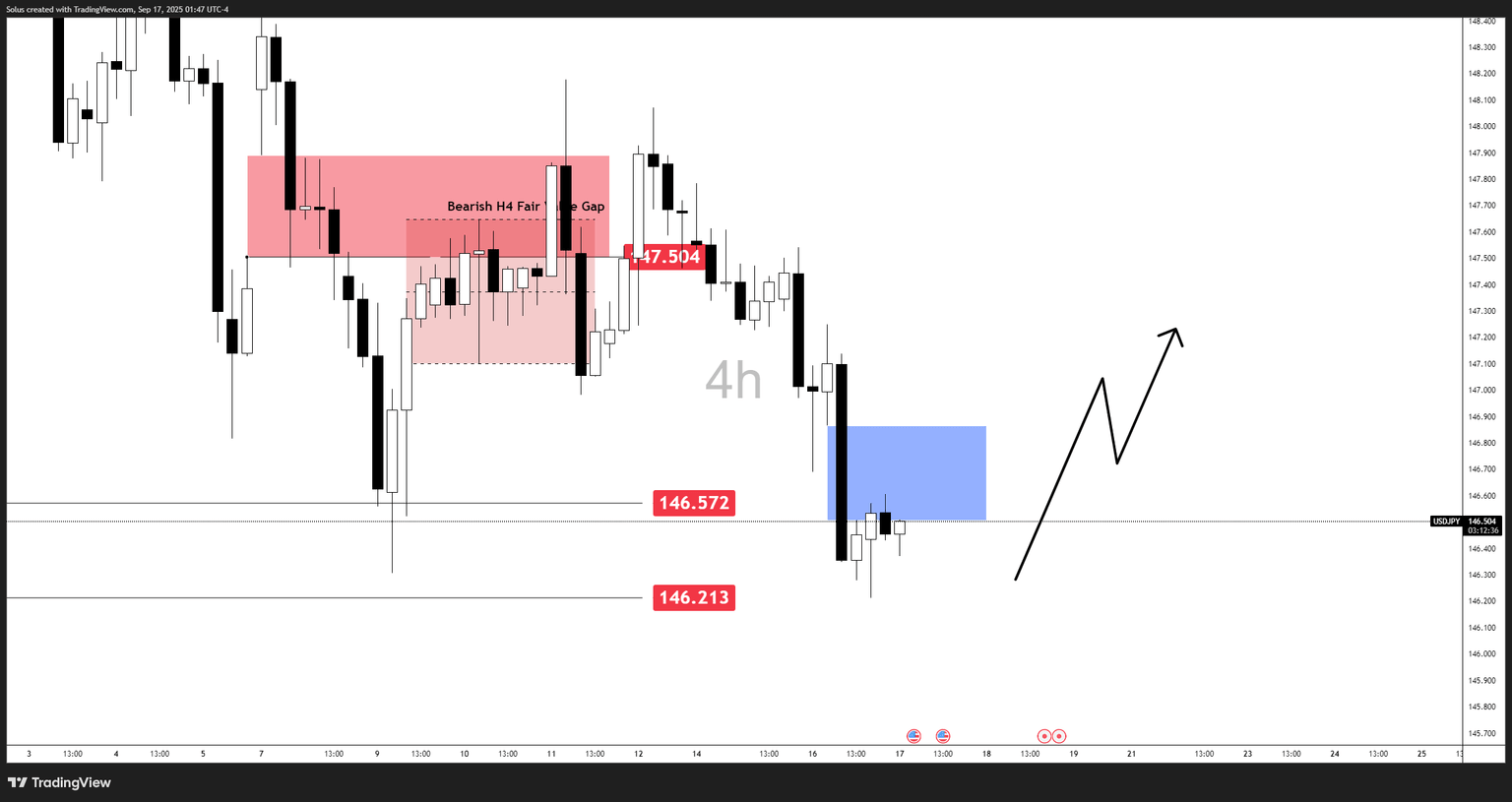

Bullish scenario: Recovery from demand

- Price holds above 146.20–146.57 support and reclaims the blue zone with momentum.

- A clean move through 147.00 shifts structure back to the upside.

- If sustained, upside opens to retest 147.50–147.90 (Fair Value Gap) with extension toward 148.50–149.35 if Fed commentary turns less dovish than expected.

Trigger/invalidation:

- Bullish bias confirmed on reclaim of 147.00 and acceptance above 147.20.

- Invalidation if price closes below 146.00, putting pressure back on the downside.

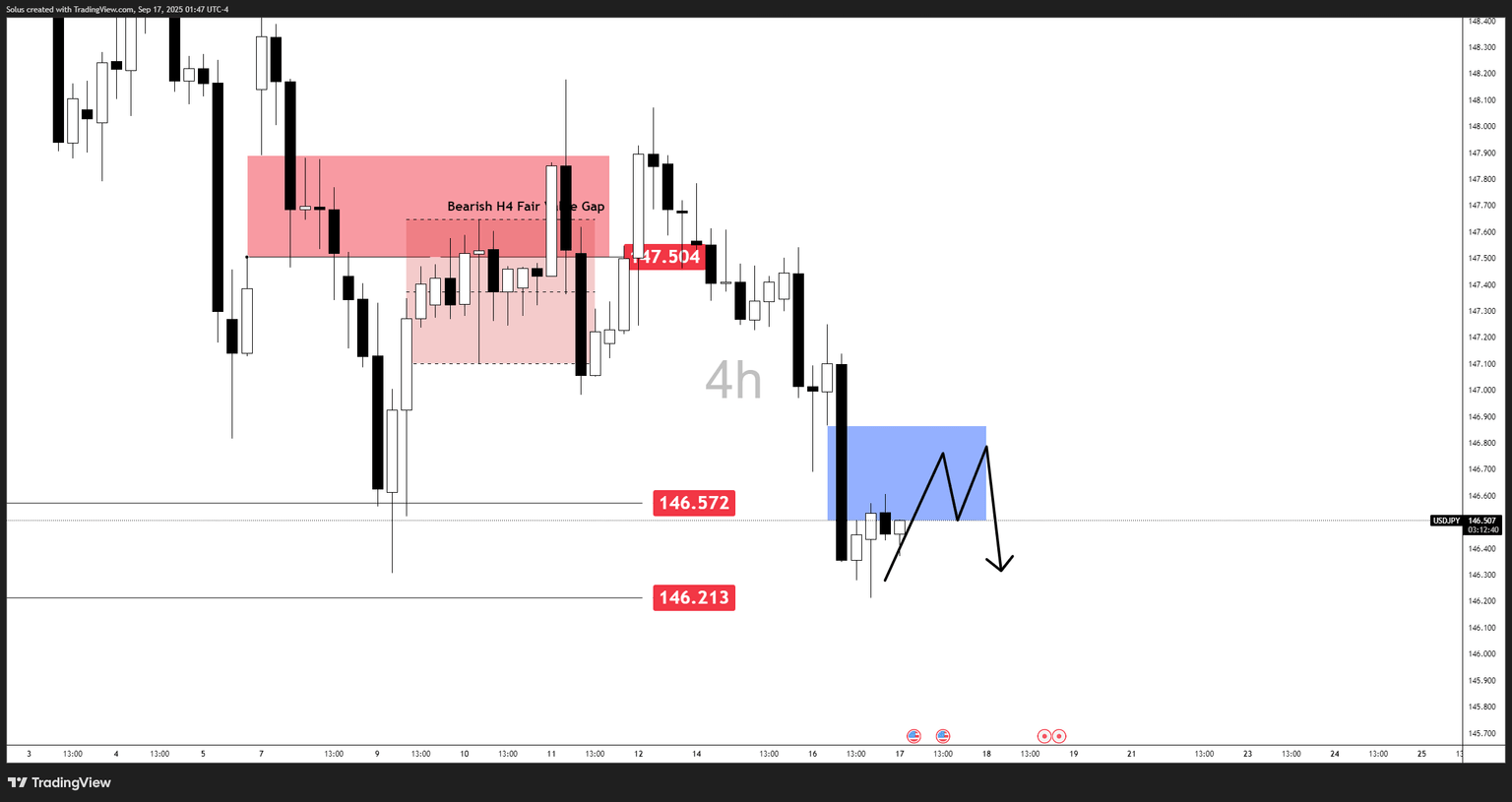

Bearish scenario: Continuation through lows

- Price retests the blue zone supply (~146.80–147.00) but fails to reclaim above it.

- Sellers defend the zone, leading to another leg lower.

- Break below 146.20 confirms continuation, opening targets toward 145.50 and possibly 144.00 if U.S. yields soften further and BOJ tightening expectations remain intact.

Trigger/Invalidation:

- Bearish bias holds below 147.00.

- Invalidation if H4 closes above 147.20, which would suggest buyers are regaining control.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.