USD/JPY Forecast: Rally continues amid appetite for the greenback

USD/JPY Current price: 105.46

- The Japanese economy is showing signs of a turnaround, according to BOJ’s Kuroda.

- US Treasury yields remained mute amid growth concerns and coronavirus vaccine’s hopes.

- USD/JPY holding on to gains and could rally up to 106.26 during the upcoming sessions.

The USD/JPY has advanced for a third consecutive day, reaching a weekly high of 105.48. As it has been happening since the week started, is all about demand for the greenback. The pair held on to gains by the end of the day, despite the sour tone of Wall Street. US Treasury yields, in the meantime, remained within familiar levels, trapped between concerns about economic growth and optimism related to a coronavirus vaccine, as Johnson & Johnson became the fourth company to start a phase three testing.

In the data front, Japan published at the beginning of the day the preliminary September Jibun Bank Manufacturing PMI, which came in at 47.3 as expected, improving modestly from 47.2 in August. The country also published the July All Industry Activity Index, which was up 1.3%, missing expectations of 3.3%. Also, BOJ’s Kuroda offered a speech and said that the local economy is showing signs of a turnaround, adding that the central bank may extend the deadline for aid to pandemic-hit firms. During the upcoming Asian session, the BOJ will release the Minutes of its latest meeting.

USD/JPY short-term technical outlook

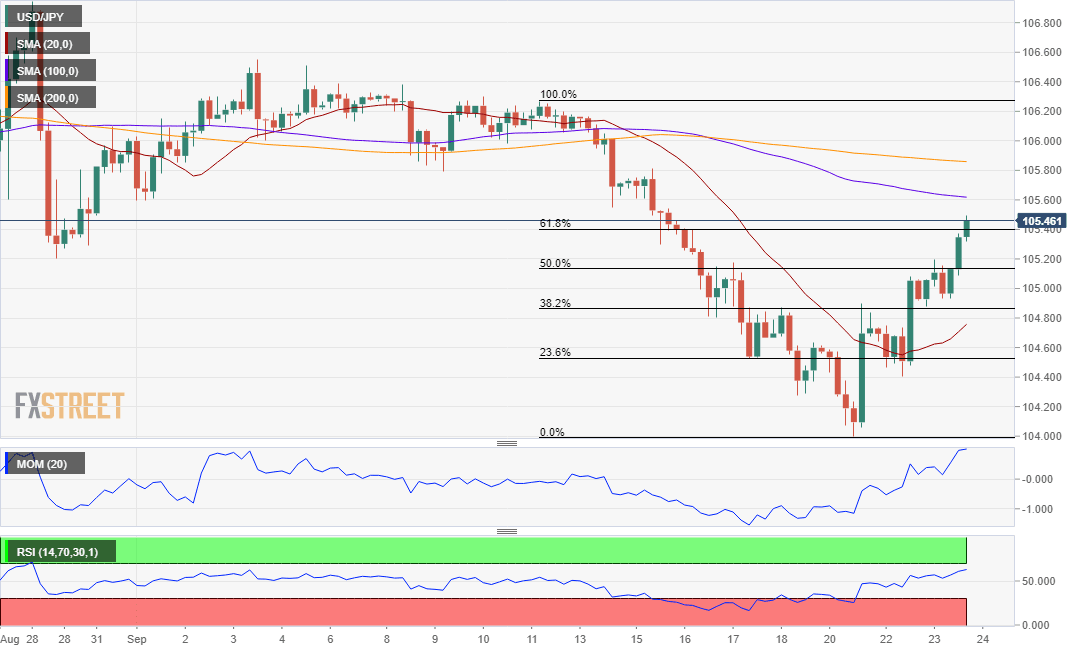

The USD/JPY pair has extended its rally to reach the 61.8% retracement of its latest daily decline around 105.40. The 4-hour chart shows that the pair further advanced above a now bullish 20 SMA, while the larger ones have lost their bearish strength, standing above the current level. Technical indicators, in the meantime, reached overbought readings, retreating just modestly ahead of the close. The rally will likely continue on a break above the mentioned daily high.

Support levels: 104.85 104.50 104.00

Resistance levels: 105.60 105.95 106.25

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.