USD/JPY Forecast: Pressuring highs with limited momentum

USD/JPY Current price: 105.63

- Japanese Tokyo inflation came in at 0.2% YoY, missing the market’s expectations.

- The market is cautiously optimistic ahead of Fed’s speakers and the presidential debate.

- USD/JPY is biased higher and needs to break above 105.80.

The USD/JPY pair is up this Tuesday, trading near a daily high of 105.73. The greenback remains under pressure against most major rivals, as investors maintain a cautiously optimistic stance ahead, amid hopes for a US coronavirus aid package and a Brexit trade deal. European indexes opened with gains, but retreated from their intraday highs, now trading with modest losses. US Treasury yields also ticked lower, ahead of a bunch of Fed’s speakers and the first US Presidential debate that will take place later in the day.

Japan published September Tokyo inflation during the past Asian session, which rose 0.2% YoY, below the 0.4% expected. However, the core reading resulted at -0.2%, slightly better than the -0.3% expected. The US session will bring the August Goods Trade Balance and CB Consumer Confidence.

USD/JPY short-term technical outlook

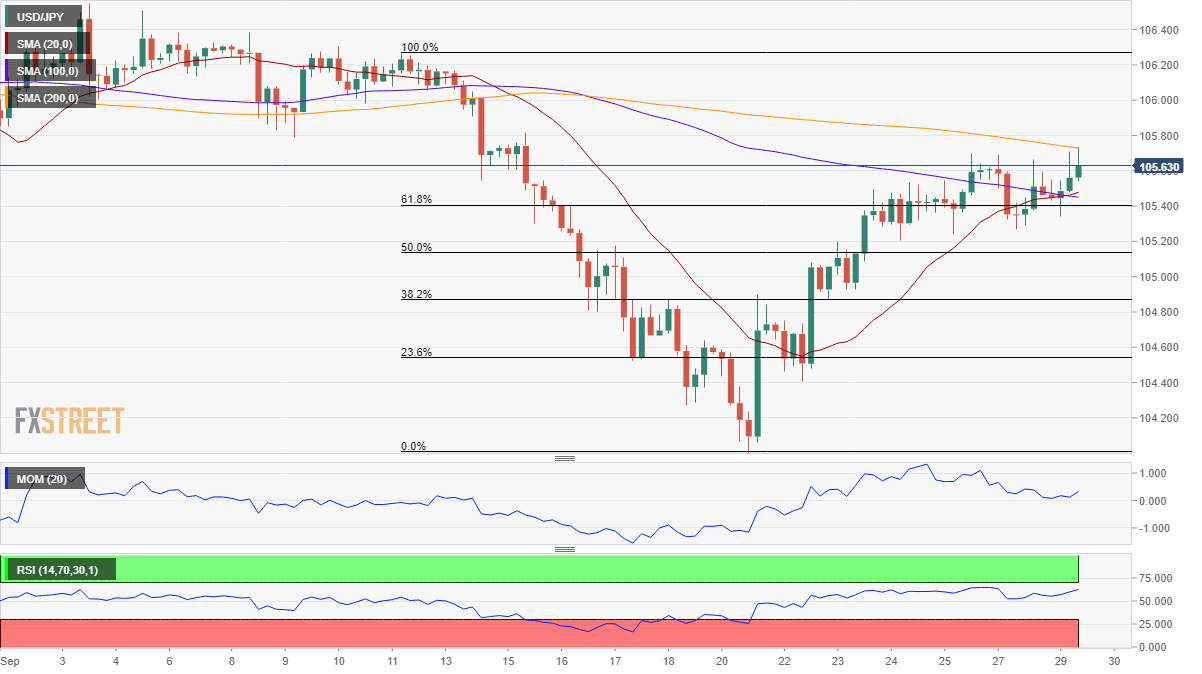

From a technical point of view, the USD/JPY pair is biased higher, although without enough strength. The 4-hour chart shows that technical indicators remain within positive levels, slowly grinding higher. Also, the pair is above its 20 and 100 SMA, which converge in the 105.40 price zone, while a mildly bearish 200 SMA caps advances around 105.80. Beyond this last, the pair has could accelerate north towards 106.25, the next relevant resistance level.

Support levels: 105.40 105.00 104.60

Resistance levels: 105.80 106.25 106.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.