USD/JPY Forecast: Pressure mounts ahead of US critical data

USD/JPY Current price: 106.70

- Japan’s Tertiary Industry Index recovered to 7.9% in June from -2.9% in the previous month.

- US Retail Sales and the Michigan Consumer Sentiment Index coming up next.

- USD/JPY is retreating from highs, further slides are not yet clear.

Turmoil is pushing the USD/JPY pair lower this Friday, weighed by the negative momentum of equities, with European indexes challenging weekly lows. The slump in stocks seems to be related to mounting fears about a second wave of coronavirus hitting Europe, as travel-related stocks led the way lower. US Treasury yields, in the meantime, ease from Thursday’s highs, as demand for safety increased. USD/JPY eased from 107.04 to the current 106.70 price zone.

Japanese data released at the beginning of the day was encouraging, as the Tertiary Industry Index recovered to 7.9% in June from -2.9% in the previous month. The focus now shifts to the US, as the country will end the week publishing July Retail Sales, seen up monthly basis 1.9%, and the preliminary estimate of the Michigan Consumer Sentiment Index for August, foreseen at 72 from 72.5 in the previous month.

USD/JPY short-term technical outlook

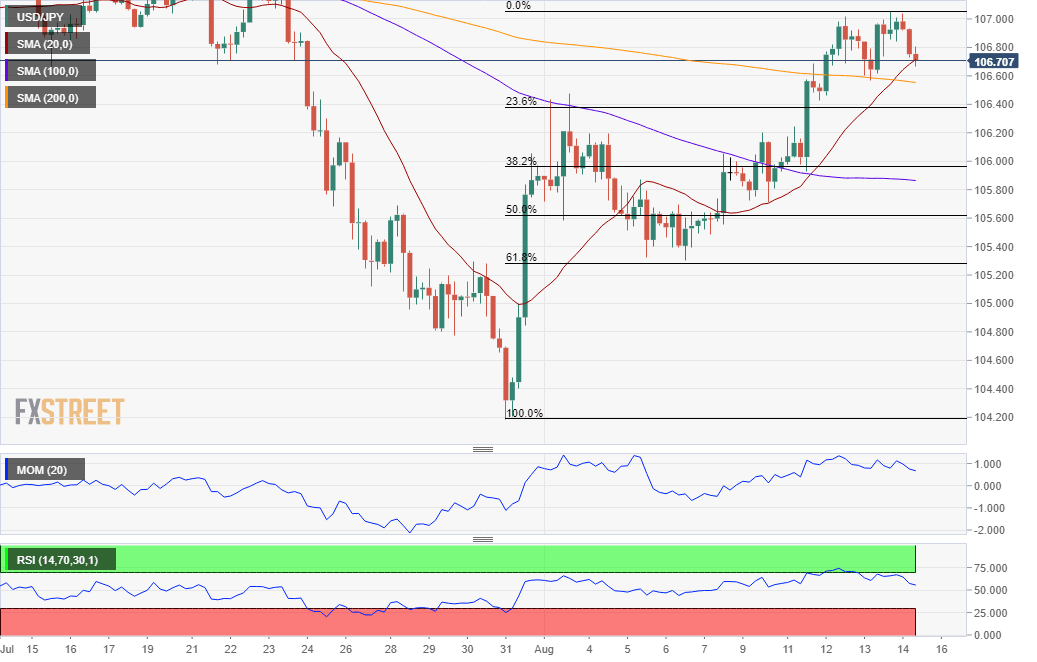

The USD/JPY pair is under pressure, and gaining bearish traction in the short-term, although further declines are not yet confirmed. The 4-hour chart shows that the price is pressuring a bullish 20 SMA, which crossed above the larger ones. The Momentum indicator, in the meantime, is crossing its 100 line into negative ground, as the RSI consolidates at around 56. The 23.6% retracement of the latest bullish run provides immediate support at 106.35, with a break below the level opening the door for a steeper slide.

Support levels: 106.35 105.90 105.50

Resistance levels: 107.05 107.45 107.80

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.