USD/JPY Forecast: Pressure mounts, about to challenge the weekly low

USD/JPY Current price: 105.64

- Dollar’s broad weakness prevails ahead of several first-tier events later this week.

- Equities underpinned by positive Chinese data released in the Asian session.

- USD/JPY is biased lower and could break below the 105.00 level.

The dollar maintains a low profile across the board, trading near its weekly lows against most major rivals. The USD/JPY pair hovers around 105.60, ignoring gains in European indexes, which are anyway modest. Chinese data released overnight kept the positive sentiment afloat, although as it happened yesterday, a caution stance prevails ahead of first-tier events to take place later in the week.

The Japanese macroeconomic calendar remained empty this Tuesday, while the US will offer minor figures, hardly capable of overshadowing sentiment trading. The country will publish August Industrial Production, foreseen at 1% from 3% in the previous month, and Capacity Utilization for the same month, expected at 71.4% from 70.6% in the previous month.

USD/JPY short-term technical outlook

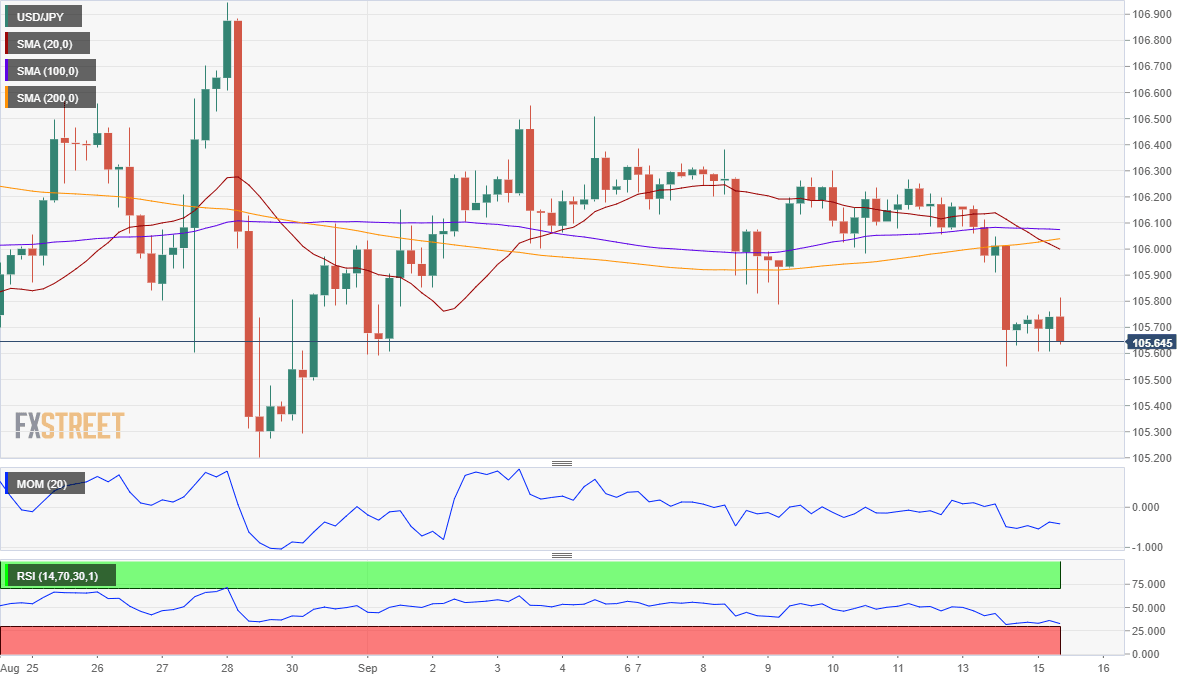

The USD/JPY pair is biased lower according to intraday technical readings. The 4-hour chart shows that it keeps developing below all of its moving averages, with the 20 SMA crossing below the larger ones, and all of them above 106.00. Technical indicators, in the meantime, have turned lower within negative levels, lacking enough momentum but still indicating sellers are in control. A steeper decline is to be expected on a break below 105.50, an immediate support level.

Support levels: 105.50 105.10 104.70

Resistance levels: 106.00 106.35 106.70

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.