USD/JPY Forecast: More near-term gains at sight

USD/JPY Current price: 103.55

- A steady advance in US Treasury yields backs gains in USD/JPY.

- US to release employment-related figures and services output data.

- USD/JPY flipped to bullish in the near term, next resistance at 103.90.

The greenback continues to recover, and the USD/JPY pair trades at daily highs in the 103.50 price zone. The pair’s strength comes from government debt yields, which surged to multi-month highs on Wednesday, following news that US Democrats took control of Senate. The yield on the benchmark 10-year Treasury note is currently at 1.05% near a daily high of 1.07%.

The Japanese macroeconomic calendar was scarce today, as the country published November Labor Cash Earnings, which were down 2.2% YoY. The country also released foreign investment data that’s usually ignored by markets. The US will publish today the November Trade Balance and employment-related figures. Initial Jobless Claims for the week ended January 1 are foreseen at 833K. Later into the session, the country will release the December ISM Services PMI, foreseen at 54.9.

USD/JPY short-term technical outlook

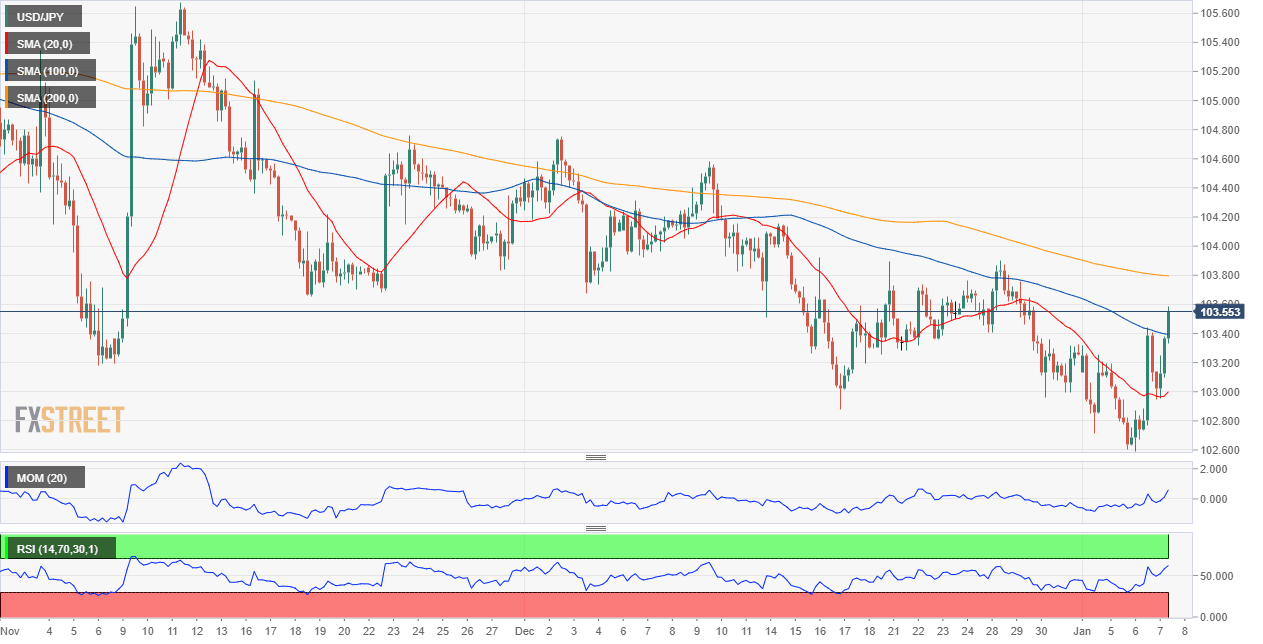

The USD/JPY pair is shrugging off its bearish potential and could extend its advance, according to the near-term technical picture. In the 4-hour chart, the pair is trading above its 20 and 100 SMAs, with the shorter one accelerating north below the longer one. Technical indicators are approaching overbought readings, with moderated bullish strength. The next relevant resistance is 103.90, with gains above the level opening doors for a steeper advance.

Support levels: 103.15 102.70 102.30

Resistance levels: 103.90 104.30 104.75

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.