USD/JPY Forecast: Imminent bullish breakout

USD/JPY Current price: 109.54

- The yield on the US 10-year Treasury note jumped to 1.69%, a fresh one-month high.

- Higher-than-anticipated US inflation spurred demand for the American currency.

- USD/JPY is trading near its May monthly high and has room to extend its advance.

The USD/JPY pair peaked at 109.63 this Wednesday as higher US inflation sent government bond yields to one-month highs. The yield on the 10-year Treasury note reached 1.69%, just below the critical 1.70% level that spurred substantial dollar gains back in March. The pair trades near the mentioned high, despite Wall Street plummeted, as higher US inflation readings lifted concerns about a sooner than expected tighter monetary policy in the country.

Japan published the preliminary estimate of the March Leading Economic Index, which improved to 103.2 from 98.7 previously. The Coincident Index came in at 93.1 from 89.9 in February. Early on Thursday, the country will report the March Current Account and the April Eco Watchers Survey.

USD/JPY short-term technical outlook

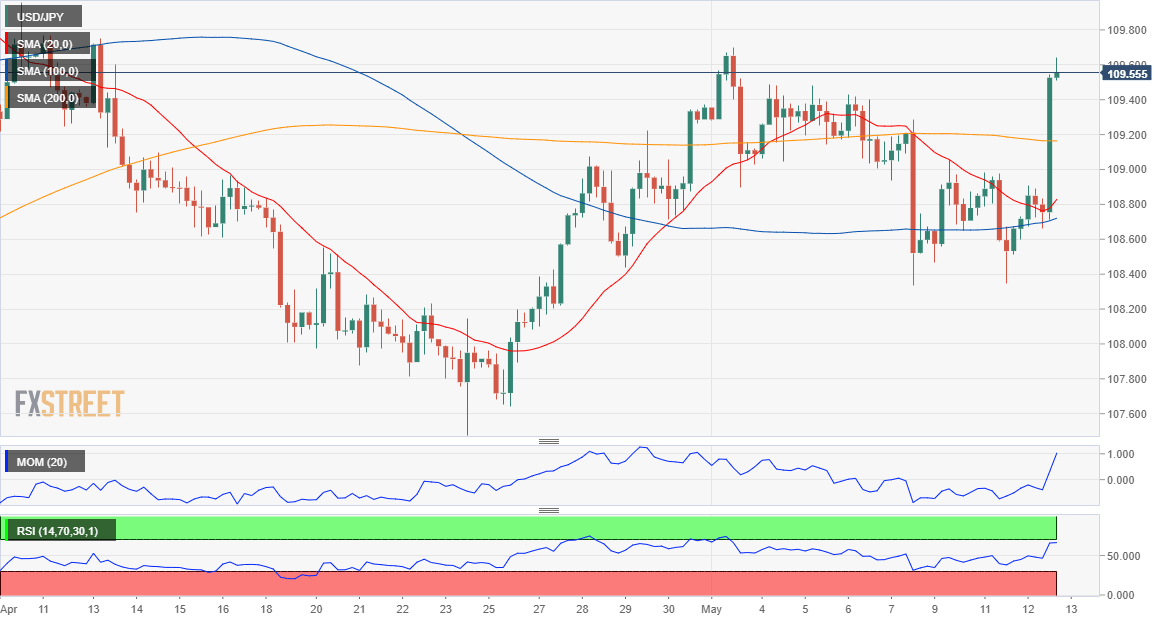

The USD/JPY pair is trading in the 109.50 price zone, consolidating gains. In the 4-hour chart, the pair has advanced above all of its moving averages, which anyway lack directional strength. Technical indicators lost directional strength after reaching overbought readings but lack clear directional strength. The pair topped at 109.69 this month, with a break above the level favoring a bullish continuation.

Support levels: 109.25 108.80 108.30

Resistance levels: 109.70 110.10 110.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.