USD/JPY Forecast: Holding ground, risk skewed to the upside

USD/JPY Current price: 107.74

- The market’s sentiment is upbeat amid EU Commission’s announcement of a recovery fund.

- USD/JPY gaining bullish strength, but still below the 108.00/10 resistance area.

The USD/JPY pair continues to trade within familiar levels, now hovering around 107.70. The market sentiment stabilized throughout the Asian session but picked up in Europe, as the EU Commission is proposing a 750 million euro recovery fund, to be presented by President Ursula von de Leyen in the European Parliament. Appetite for riskier assets persists in detriment of USD/JPY.

It’s a quiet day in the data front, and Japan didn’t release macroeconomic data, while the US one will only include minor figures, including the Richmond Fed Manufacturing Index for May, foreseen at -47 from -53 in the previous month.

USD/JPY short-term technical outlook

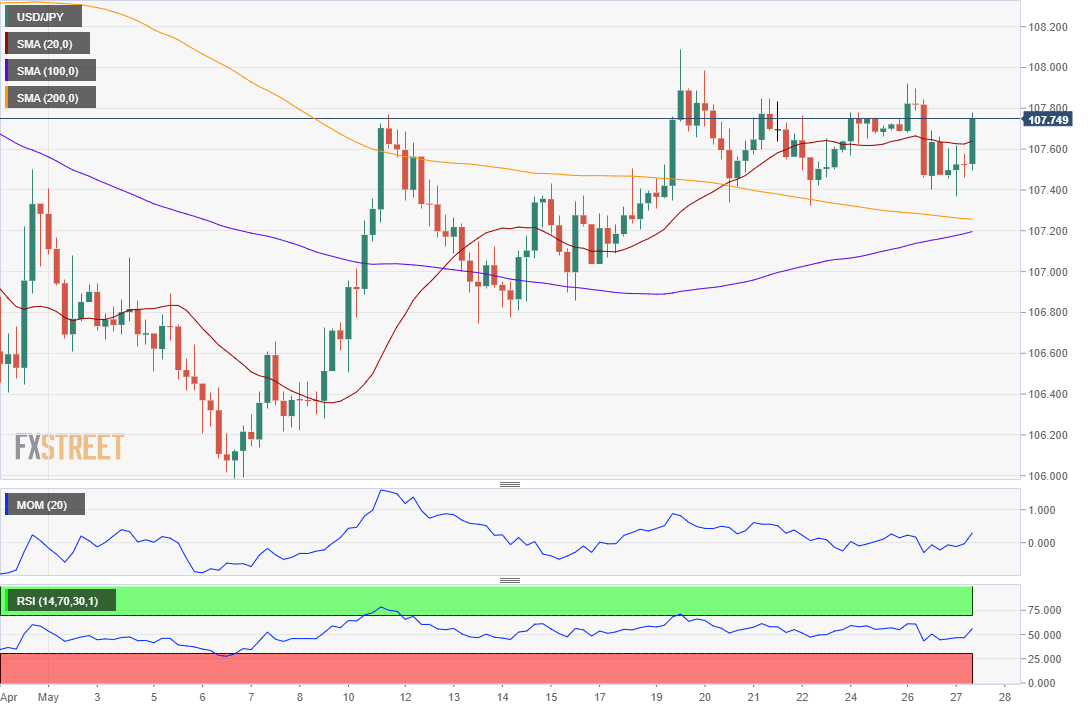

The USD/JPY pair retains its neutral stance with a mildly bullish bias, as, in the 4-hour chart, the pair is developing above all of its moving averages, crossing above the 20 SMA. Technical indicators, in the meantime, turned marginally higher around their mid-lines, although lacking sufficient strength to confirm a new leg north. The main resistance continues to be the 108.10 area, with bulls becoming more confident on a break above it.

Support levels: 107.30 106.90 106.65

Resistance levels: 108.10 108.45 108.80

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.