USD/JPY Forecast: holding above the critical 110.00 threshold

USD/JPY Current price: 110.09

- Japan published April Tertiary Industry Index, which fell by 0.7% in the month.

- Stocks were choppy as investors brace for the US Federal Reserve decision.

- USD/JPY is consolidating its recent gains, partially losing its bullish strength.

The USD/JPY pair spent the day consolidating just above the 110.00 level, yet at the same time, it held below the monthly high set at 110.32. US Treasury yields hovered within familiar levels, with the yield on the 10-year note stuck around 1.50%, exacerbating USD/JPY range trading. Meanwhile, European equities managed to post some gains, but American indexes edged lower, as trading was choppy ahead of the US Federal Reserve monetary policy decision.

Japan published the April Tertiary Industry Index, which printed at -0.7% MoM, down from the previous 1.1%. On Tuesday, the country will publish the May Merchandise Trade Balance, expected to post a deficit of ¥91.2 billion and April Machinery Orders.

USD/JPY short-term technical outlook

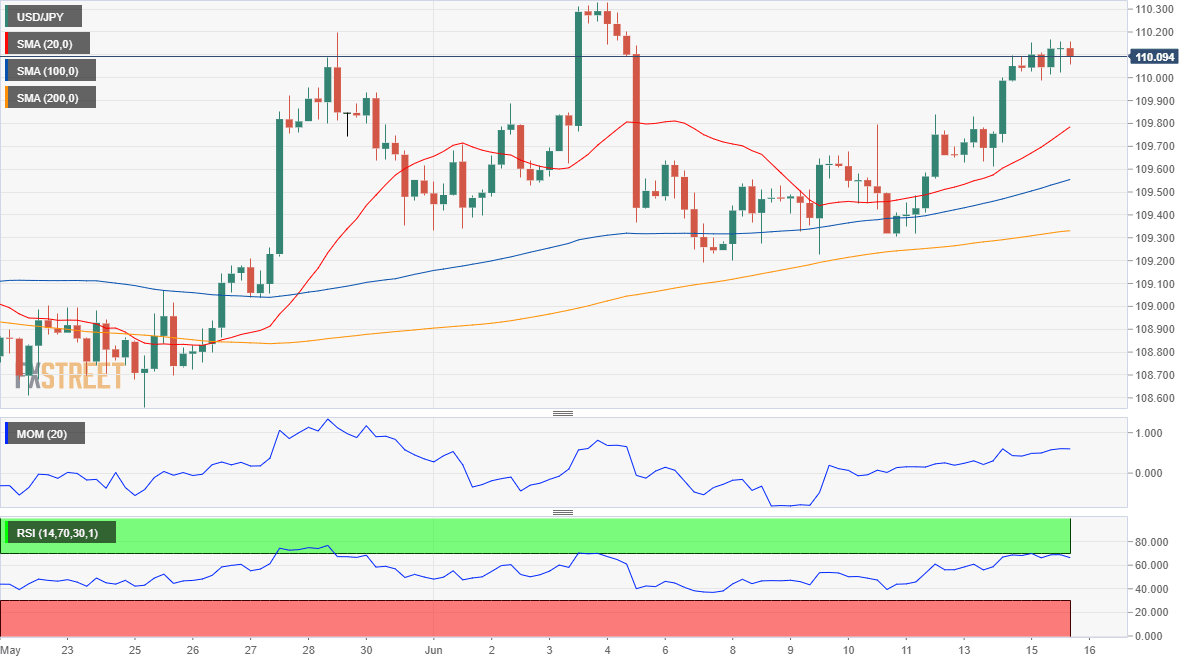

The USD/JPY pair is neutral-to-bullish according to intraday technical readings. The 4-hour chart shows that the pair is well above bullish moving averages, while technical indicators retreated from their recent highs, although they hold well above their midlines, without bearish strength. The pair could correct further lower on a break below 109.80, while bulls could take over on an advance beyond the monthly high at 110.32.

Support levels: 109.80 109.35 108.90

Resistance levels: 110.30 110.75 111.05

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.