USD/JPY Forecast: Direction depends on yields’ behavior

USD/JPY Current price: 108.95

- BOJ’s Governor Kuroda repeated they will sustain “powerful monetary easing.”

- Several US officials will offer speeches during the American afternoon.

- USD/JPY is technically neutral in the near-term, with buyers aligned around 109.00.

The USD/JPY pair trades just below the 109.00 level, recovering from an early low at 108.69 on the back of weaker government bond yields favoring some modest dollar’s demand. Still, major pair trade near Friday closing levels, waiting for some fresh news. Stocks are up, although gains are modest, also reflecting the absence of a new catalyst and a holiday in Europe and Canada.

Bank of Japan Governor Haruhiko Kuroda was on the wires during Asian trading hours but said nothing new. He said that the central bank “will continue to patiently sustain powerful monetary easing to achieve its mandate of price stability,” adding that the near-term focus is to respond to the impact of a pandemic on the economy. Pressure on the economy remains amid emergency curbs.

The US session will bring the April Chicago Fed National Activity, previously at 1.71, and several speeches from US Federal Reserve officials, which may add some spice to financial markets.

USD/JPY short-term technical outlook

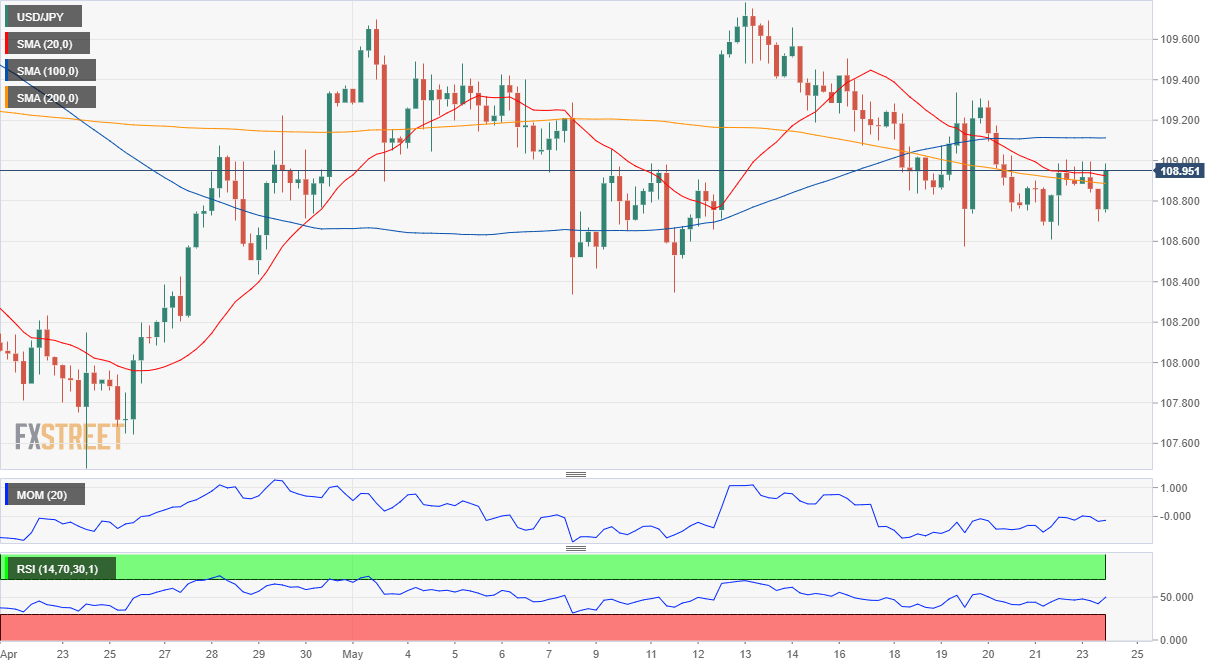

From a technical point of view, the USD/JPY pair is neutral in the near-term. The 4-hour chart shows that the pair struggles with the 20 and 200 SMA, both converging directionless. The 100 SMA is flat above the current level. Technical indicators are seesawing around their midlines, lacking directional strength. Sellers are aligned around 109.00, with a clear break above the level still unlikely.

Support levels: 108.60 108.20 107.80

Resistance levels: 109.00 109.30 109.80

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.