USD/JPY Forecast: Bulls retain control and aim to 110.00

USD/JPY Current price: 109.01

- Fresh one-year highs in US government bond yields underpinned the pair.

- Wall Street closed mixed, DJIA and S&P keep pressuring all-time highs.

- USD/JPY is bullish despite its extreme overbought conditions.

The USD/JPY pair posted substantial gains for a fourth consecutive week, settling a few pips above the 109.00 figure. The pair advanced sharply on Friday, underpinned by US government bond yields hitting fresh one-year highs. The yield on the 10-year note peaked at 1.642%, to settle at 1.62%. Stocks were mixed as the DJIA and the S&P advanced, but the Nasdaq closed in the red amid the tech sector underperforming.

Japan published the BSI Large Manufacturing Conditions Index, which advanced a modest 1.6% in the first quarter of the year, down from 21.6 in Q3. This Monday, the country will release January Machinery Orders, previously at 11.8% YoY, and the Tertiary Industry Index for the same month, foreseen at -0.4% MoM.

USD/JPY short-term technical outlook

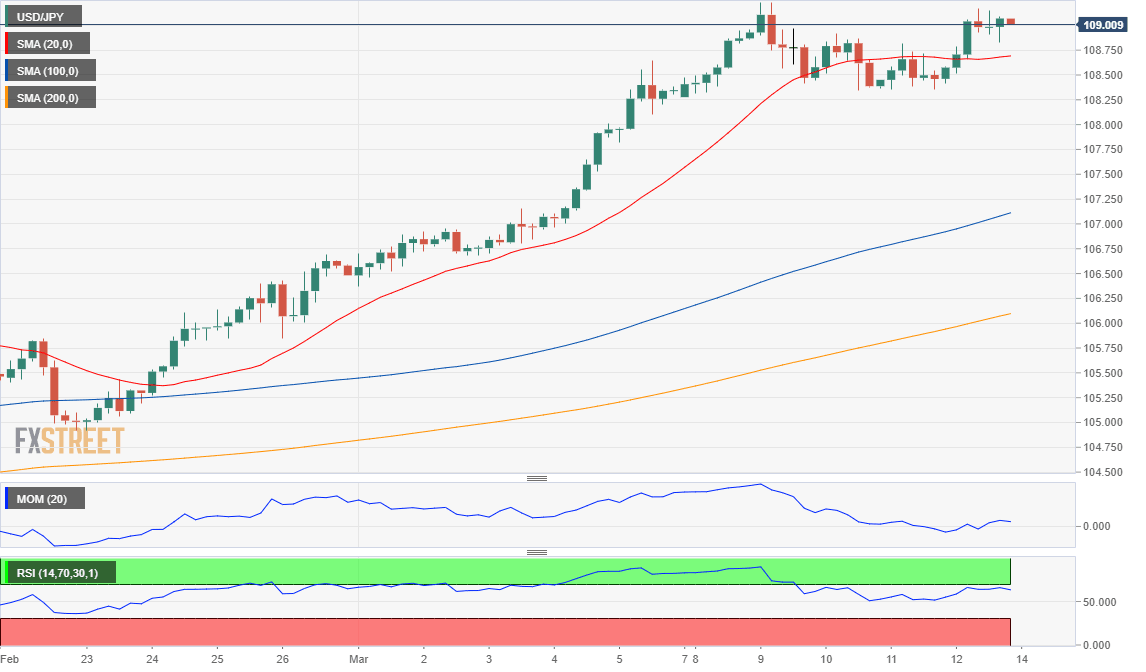

The daily chart for the USD/JPY pair shows that technical indicators advance within overbought readings, with the Momentum heading north almost vertically. Moving averages maintain their bullish slopes, although they develop far below the current level, with the 20 SMA around 106.85. In the 4-hour chart, the risk is skewed to the upside, as the pair develops above a flat 20 SMA, while the longer moving averages maintain their bullish slopes. The Momentum indicator advances above its midline, while the RSI consolidates around 62.

Support levels: 108.70 108.30 107.95

Resistance levels: 109.25 109.60 110.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.