USD/JPY forecast: Bulls rejected at 148.00 as Dollar weakens – Is 142.70 next? [Video]

-

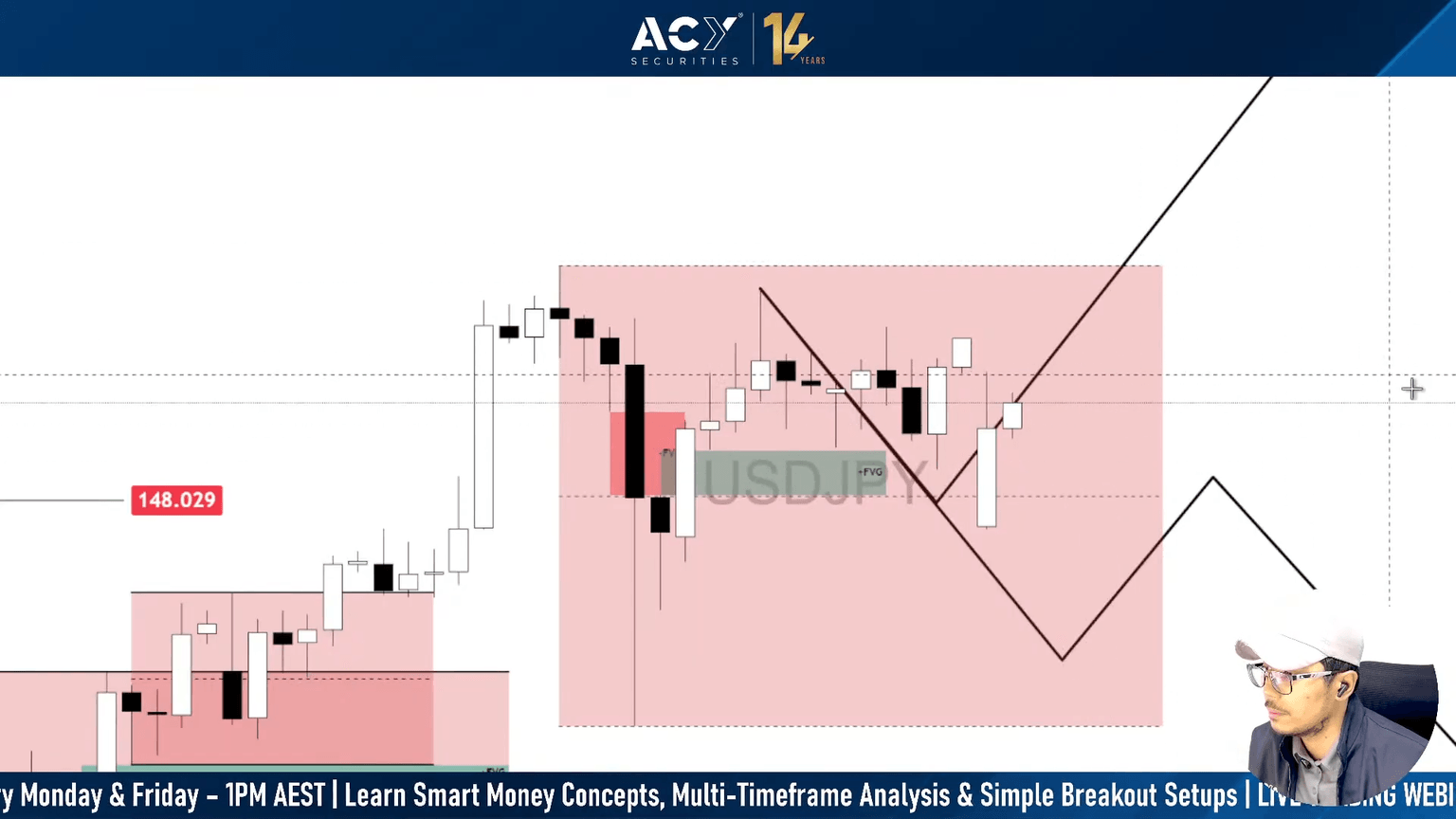

USD/JPY bearish scenario plays out as price rejects the 148.029 key resistance level, confirming a distribution.

-

Dollar weakness confirmed by DXY breakdown, amplifying the bearish momentum across USD/JPY as safe-haven yen flows accelerate.

-

Technical bias remains bearish below 145.75, unless the Fair Value Gap is reclaimed with targets toward 149.80 or further downside toward 142.70.

![USD/JPY forecast: Bulls rejected at 148.00 as Dollar weakens – Is 142.70 next? [Video]](https://editorial.fxsstatic.com/images/i/currency-jpy_XtraLarge.jpg)

Bearish scenario plays out, bullish trap confirmed

USD/JPY opened the week with a clear upside bias, trading above key Fair Value Gaps and appearing poised for a continuation move toward 150.00 and 151.00. The structure favored a bullish move following a retracement sweep and reclaim of the FVG near 148.056–148.277, as mentioned in the previous forecast: Nasdaq and S&P 500 hit all-time highs, XRP leads crypto breakout, Gold eyes $3,400

However, the market instead validated the alternate bearish scenario, reversing precisely from the 148.029 resistance level. This marked a distribution phase, not an accumulation to the upside, and the price has since fallen decisively.

DXY breakdown confirms Dollar weakness – Triggers USD/JPY selloff

As shown in the recent Dollar price action, the DXY has decisively broken down from a key Bearish Fair Value Gap, currently trading below 97.30. This marks a significant structural shift that reinforces the broader USD weakness narrative, which is now dragging USD/JPY lower as the yen regains dominance.

This price action confirms that the entire USD complex is under pressure, not just a reaction to isolated JPY strength. The rejection from the 98 level and the subsequent lower high formation has invalidated any near-term bullish correction, signaling a continuation of the downtrend.

Why the bearish reversal happened

1. Technical rejection from key supply

The 148.029 level acted as a magnet for liquidity, drawing in breakout traders only to reverse sharply. This zone coincided with:

-

A 4H Fair Value Gap

-

An internal liquidity pocket used to trap late buyers

-

Smart Money selling interest that engineered a false breakout, then broke structure aggressively to the downside

2. Safe-haven Yen demand

-

A new U.S.–Japan tariff agreement reduced tensions and opened the door for JPY strength, as markets priced in a stronger Japanese export outlook.

-

Investors also shifted into the yen amid domestic political volatility, with the ruling coalition losing control of the upper house. Though not extreme, it reinforced uncertainty, supporting JPY flows.

3. USD weakness and fading Risk Appetite

-

The DXY rejected 99.00 and dropped below 98.00, erasing USD strength.

-

With US indices hitting all-time highs, investors began rotating into safe-haven currencies as a hedge—pushing down USD/JPY.

Technical outlook

USD/JPY is currently trading around 146 level, navigating a key Bearish Fair Value Gap. The pair has retraced toward a support cluster between 145.75 and 146.00.

Bullish scenario: Short-term base and FVG reclaim

If USD/JPY validates and reacts at the 145.75 support, USD/JPY could be forming a short-term bottom. A retracement into the Bearish FVG may turn into a reclaim, indicating strength and potential reversal back toward previous distribution zones.

This would continue to go bullish if:

-

Price reclaims and closes above 147.50 (top of the FVG)

-

DXY begins to recover from 97.00 lows

Upside Targets:

-

148.00 - next short-term resistance

-

149.80–150.00 → structural retest of prior highs

Bearish scenario: FVG rejection and breakdown toward lower liquidity zones

If price gets rejected from the FVG and fails to hold above 145.75, it would confirm the continuation of the broader bearish structure. This aligns with current DXY weakness and JPY strength driven by macro sentiment.

This would continue to go bearish if:

-

Price is rejected from 146.90–147.60 FVG zone

-

A clear breakdown below 145.75 occurs with a momentum candle

-

DXY continues sliding toward 96.70 or lower

Downside Targets:

-

144.18 - next swing point

-

142.70 - prior swing low and high-timeframe liquidity target

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.